This morning, Chicago-based Cresco Labs (CL.C) announced it would be acquiring Origin House (OH.C) (formerly CannaRoyalty) in an all-stock deal worth CAN$1.1 billion.

The offer comes in at CAN$12.68 per Origin House share.

Origin House closed Friday at $12.05, which leaves the premium on the deal being less than amazing.

In fact, the stock has fallen 5.8% since the announcement, which is more than the premium announced on the deal. Shareholders like the offer so little they’ve reversed its effect on their way out of the stock.

Here’s how Cresco sells the union to shareholders:

KEY TRANSACTION HIGHLIGHTS & BENEFITS:

- Combination of Cresco Labs and Origin House will result in the premier distribution company serving California, the largest cannabis market in the world

- Accelerates Cresco Labs’ entrance into the California market with the addition of Origin House’s vast distribution platform;

- Establishes the cannabis industry’s first national “house of brands” with a growing multi-state footprint that includes leading distribution market share in some of the largest states in the country including California, Pennsylvania and Illinois;

- Combines the expertise of two industry leaders in branded product development and distribution;

- Positions Cresco Labs as the preferred partner for additional premier cannabis brands seeking distribution on the industry’s most expansive platform;

- Enhances Cresco Labs’ capital markets presence by significantly increasing its scale and the liquidity in the Company’s stock, resulting in improved ability to attract institutional investment and lower its cost of capital;

- Continued participation by Origin House shareholders who will hold approximately 20% of the issued and outstanding Cresco Labs Shares on a pro forma, fully-diluted and as converted basis, enabling Origin House Shareholders the opportunity to participate in the expected value created through the Transaction; and

- Immediate premium to Origin House shareholders of approximately 26% over the 30-day volume weighted average price (“VWAP”) of the Origin House Shares on the Canadian Stock Exchange (“CSE”) ending March 29, 2019 (based on the Exchange Ratio and the closing price of Cresco Labs Shares on March 29, 2019).

You can pretty much ignore the VWAP, because both companies have seen their stocks roar over the past year, and especially over the last month, so the most recent share price is way above the VWAP either way.

So why even do the deal?

Well it’s not an exit for the Origin House founders: they’ll simply be moving their stock in the existing company to the acquiring company, so nobody is heading for Rio on this.

And it’s not because anyone is desperate; both companies are firing on all cylinders right now.

No, this is about like minds moving in together.

The Origin House model of holding multiple verticals, licenses, and immense distribution in California, where they feed 450 dispensaries, is only enhanced when plugging their own brands into Cresco’s distribution across 10 other states.

Cresco, on the other hands, has 5000 SKUs and 350 products in those other states, which they’d love to bombard the California market with, using Origin House’s network.

So a partnership makes sense, in that it makes both greater than the sum of their parts.

And there’s connective tissue here: Origin House boss Marc Lustig, who took that company from $30 million to a $1 billion deal in just a few years, was a major stake holder in the shell company that Cresco took over in going public, so he’s already not just familiar with the team but intimately so, and also a large stakeholder in them.

Heck, if you’re going to get into bed with anyone, it should be someone who already knows which side you like to sleep on.

Here’s the tale of the tape:

CRESCO LABS: 11 US states, 15 production facilities, 21 retail dispensaries, 51 retail licenses.

ORIGIN HOUSE: California and Canada, 130 products being distributed to 450 dispensaries, five licensed facilities.

Longtime readers will wonder why Origin House is mainly a California play when its old model was similar to what Cresco is doing, in going after a multi-state play.

Fact is, Origin House began flipping assets a few months back in a bid to realize profits on what it had bought into, and to clean up their business model to prep it for this kind of deal.

It’s a lot easier to plug in a company with one core mission – dominating California – than it is to plug in 50 assets across a half dozen states. Aggregation was a great way to build value over the early years of cannabis legalization, but now they’re focused on being the biggest guys in the biggest state, and that’s a beautiful thing in the eyes of a potential acquirer.

BUT IS THIS ENOUGH CASH TO WARRANT AN ACQUISITION?

This is less an acquisition than it is a convergence. Realistically, why run these two entities as separate companies when they’re so much more effective as one combined juggernaut?

The folks involved know each other well and understand each other’s businesses. The price is fair, but is less about an exit than it is about a step up. Sure, no investor is going to look at this deal and say, “I can retire”, but that ain’t it.

What you can do is see this thing continue its Matterhorn like climb for a while longer, which might have been tougher as individual entities when the cannabis space is starting to level off.

Frankly, these past few weeks have been the first in years where I’ve stopped recommending Origin House/CannaaRoyalty, because it looked like their valuation had hit a good return. California was maturing and they had their strong foothold already, and a big valuation already. To move it higher, they’d have needed to, oh, I dunno, EXPANDED TO OTHER STATES.

WHAT I DON’T LIKE

Cresco Labs isn’t a democracy. Five guys hold all the voting shares, so you’re not about to get your own way if you decide you don’t like how they’re doing things at AGM time. This is a common thing in companies that are hell bent on acquiring stuff on an ongoing basis and don’t want to be tied down with shareholder approvals, but can end up, as it is with MedMen, being a way to run the company in any way the bros up top see fit with accountability being an after-thought.

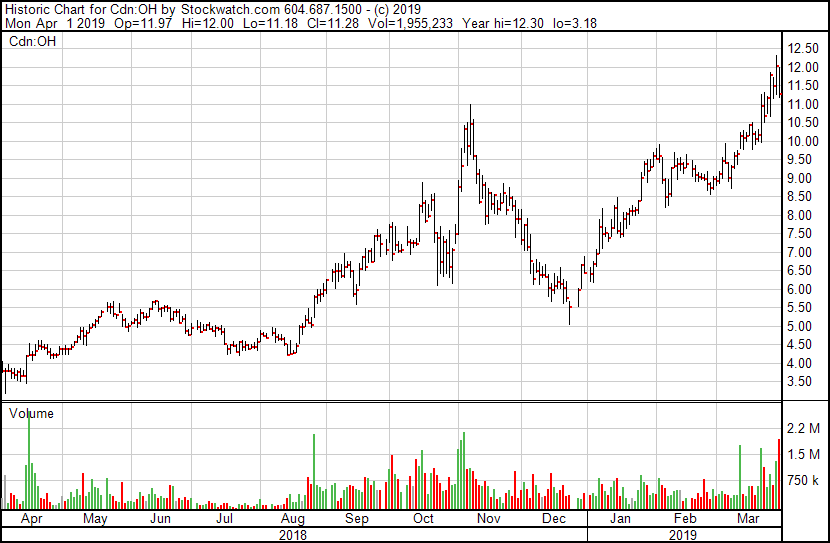

I’m less scared about that, however, when it comes to Marc Lustig. If anyone on the Canadian weed scene has shown himself to understand how to build an asset base, and shareholder value, he’s the guy. If I have to cede my right to object, I’d rather cede it to him than just about any other cannabis exec. I mean, again, the Origin House share chart FFS:

So, okay, you didn’t get a $15 premium today, shareholders. But you did get a bigger sail as harder winds loom. You’re not exiting, you’re leveling up.

And that’s alright.

— Chris Parry

FULL DISCLOSURE: Not commercially connected to anyone in this story, though we have held CannaRoyalty stock previously and have, for years, been pointing readers to that stock because it’s been an all-star from the start.