On March 14, 2019 LiveWell (LVWL.C) announced that it has finalized a CBD supply agreement with Tilray (TLRY.NASDAQ).

LiveWell will supply Tilray with 150 kg of CBD oil per month. In August, 2019 that will ramp up to 300 kilograms of hemp-derived CBD isolate per month, or an equivalent amount of full-spectrum CBD extract – with an an option to increase to 500 kilograms per month.

The supply deal is in effect until January 31, 2020, at which time it will renew for successive 12-month terms unless either party opts out.

CBD – a non-psychoactive cannabis compound – is gaining traction in the health and wellness sector.

“CBD makes us sleep better,” explains Equity Guru’s Chris Parry, “It helps us deal with blood sugar. It lowers stress and triggers bodily systems that we want triggered.”

But you’ll have to wait to buy LiveWell shares.

On December 3, 2018 LiveWell announced that it has signed a binding L.O.I to acquire 100% of Vitality CBD Natural Health Products and its U.S. subsidiary, Vitality.

A few hours later, the LVWL stock was halted.

It’s still halted.

Because the deal is structured as a reverse takeover by Vitality – the stock exchange is reviewing Vitality’s documents in detail.

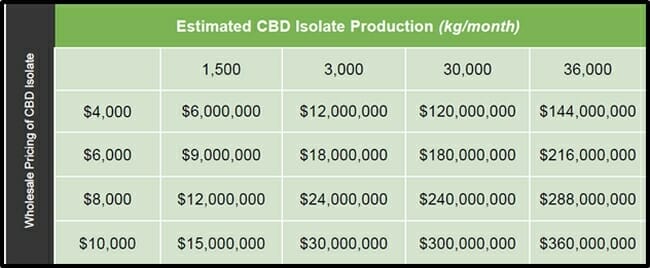

Wholesale prices of CBD isolate vary wildly – dependent on hemp quality, location, tax jurisdiction and a volatile sellers’ market.

Current wholesale market data reveals CBD isolate pricing ranging between CND $8,600 and CND $13,200 per kilogram, based on the quality and purchase volume.

Last summer, LiveWell Canada signed a CBD isolate agreement at a price of CAD $9,300 per kilogram.

At $9,300 (x 300 kg/month) the deal with Tilray would be worth $2.7 million/month or $33 million per year.

Too bullish?

Tuck’s Best Retail Customer Experience is Populum, an Arizona-based CBD brand that sells for .24 per mg – which extrapolates to $240,000 a kilogram.

Objects in the mirror may be larger or smaller than they appear. The actual price to be paid by Tilray for LiveWell’s CBD isolate is unknown. LiveWell’s corporate literature anticipates a price range of $4,000-$10,000.

As part of its diligence process, Tilray conducted lab testing on the LiveWell’s product and conducted a site visit to the Eureka Montana manufacturing facility.

“Tilray is one of the best known and most stringent companies in the cannabis and cannabinoid space,” stated David Rendimonti, President and CEO of LiveWell Canada. “One of our key priorities is capturing greater market share in wholesale.”

“This merger with Vitality is about meeting and satisfying patient and consumer needs,” stated Rendimonti, “North American markets are the primary focus initially, European and South American markets are also on the horizon for the new merged company.”

“We’ll have the resources to rapidly scale to meet the anticipated explosive demand in newly legalized CBD markets worldwide,” confirmed Robert Leaker, President and CEO of Vitality.

Merger Summary:

- 20,000 acres of CBD hemp harvested in 2018.

- Two extraction facilities

- 3,000 kg/day CBD isolate by the second half of 2019.

- Footprint in Canada and the United States.

- Personalized diagnostics and patented therapeutics R&D capabilities.

- 36,000-square-foot nutraceuticals development and manufacturing facility.

- Researchers and scientists specializing in CBD and other cannabinoids.

- 540,000-square-foot greenhouse facility on 100 acres of land.

On February 13, 2019 LiveWell and Vitality gave a joint update on the Eureka, Montana facility, announcing production of more than 200 kilograms of CBD equivalent in the first week of February 2019.

“We’re very pleased with the ramp up in production during the last month,” stated Leaker. “Demand for CBD extract continues to grow. I expect that we will increase our production of CBD isolate to 50kg/day imminently at Eureka, with a goal of producing 200kg/day before the end of the first half of 2019.”

LiveWell has scheduled a special meeting of shareholders on April 11, 2019, to approve the merger. The company will distribute related materials, including the Vitality’s audited financial statements on or about March 20, 2019.

We anticipate the Livewell will begin trading shortly after the April, 2019 special meeting.

Full Disclosure: LiveWell is an Equity Guru marketing client, and we own the stock.