TransCanna Holdings (TCAN.C) closed a deal for a land, building and asset package in Northern California for USD$15 million today.

The facility will give TransCanna complete control over all aspects of their production rather than being forced to outsource some aspects of their operation.

“Acquiring arguably the largest vertically integrated cannabis centric three-storey multipurpose facility in California reinforces our strategy to be fully self-contained in our ecosystem. We also have an additional five acres in the green zone adjacent to the facility to build up to 600,000-square-foot three-storey grow facility to supply our own biomass for the brands we acquire or create,” said Jim Pakulis, chief executive officer of TransCanna.

TrasCanna expects to lease space to a third party laboratory testing company, and estimates the facility will employ approximately 500 staff members working over two eight-hour shifts.

The former owner, a specialist in developing USDA-grade, commercial heating, ventilation and air conditioning (HVAC) facilities, is responsible for all of the facilities upgrades prior to the sale.

The facility has undergone a USD$8 million renovation over the past 24 months, creating specific divisions for everything from cultivation and manufacturing to distribution.

“Inside it right now we have the capability of having logistics, all transportation and distribution. We can do remediation of the cannabis. We’re going to go ahead and do high and low volatility extraction, manufacturing, bottling, grow and nursery all inside the facility. We’ve architecturally drawn out the other six acres for two-storey grow,” Pakulis said in the below YouTube clip.

TransCanna paid the sellers a USD$250,000 deposit, and will now pay a USD$8 million down payment out of net proceeds from the company’s brokered private placement.

The seller has agreed to a carry-back note of USD$6.75 million at 7% per year interest only up to 13 months, with a maturity date of Oct. 15, 2019.

Each warrant paid to the seller will be the equivalent of a common share of TransCanna at the price of $2.60 per share for five years. If the company decides to exercise their option to extend the maturity date to April 15, 2020, the company will issue another 500,000 common shares. The warrants will be issued when the acquisition closes.

Here’s Jim Pakulis discussing what TransCanna’s been doing in California:

TransCanna’s blowing up

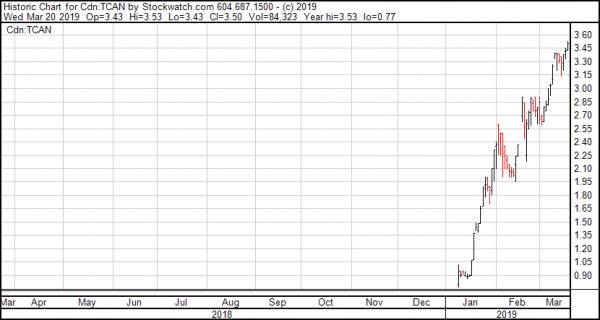

TransCanna started the year with a bang when its non-profit entity, TCM Distribution received its temporary distributor license in California, a cannabis market estimated to be worth $5.1 billion by the end of 2019. As a result, share price has more than tripled since January.

The temporary licensing will allow the company to execute on three conditional agreements it has in place with unnamed licensed operators to distribute their cannabis-related products pending full state licensing.

The company expects to close the deal as soon as possible after closing its private placement.

Share price on the CSE rose $0.08 to $3.51 by market close.

Currently the company has 16,995,654 issued and outstanding shares with a market cap of $59.6 million

–Joseph Morton

Full disclosure: TransCanna Holdings is an Equity.Guru marketing client.

Nice strategical move TCAN. California has a population of roughly forty million people and on January 1, 2018, the state began issuing licenses for commercial cannabis activity. During the first six months of 2018, the number of granted licenses jumped from 1,272 licenses on January 17th to 6,421 licenses on June 30th. And in 2018, California retail stores sold $2.5 billion worth of cannabis products, compared to $1.5 billion in Colorado’s robust cannabis marketplace, $1.0 billion in Washington, and $0.6 billion in Oregon.