The Green Organic Dutchman (TGOD.T) has signed a multi-year extraction services agreement with Valens Groworks (VGW.C).

This partnership will help get The Green Organic Dutchman’s hemp strategy off the ground and into the hemp-derived CBD market when edibles are legalized later this year.

Kelowna-based Valens Groworks is a vertically integrated cannabis company focused on extraction, distillation, cannabinoid isolation and purification.

They have three wholly-owned subsidiaries doing extraction, testing and cultivation with a 400 square foot greenhouse presently under construction.

“The ability to partner with skilled and specialized extraction operators such as Valens will add significant bench strength to TGOD’s already robust extraction capabilities in Canada, Poland and Jamaica. We believe the importance of high-quality cannabis oils will continue to greatly increase as patients and consumers look for safer and healthier delivery methods.”

–Brian Athaide, director and CEO of The Green Organic Dutchman

In exchange for helping Valens get their processing certification, TGOD will enjoy exclusive access to all of Valens’ extraction services for the first year of their two year deal.

The agreement includes the extraction and purification of TGOD’s cannabis and hemp biomass, and the conversion of the proceeds into resins and distillates the company can use in the infused product line they intend to launch into the expanded cannabis market next October.

Ladies and gents start your engines

Edibles go live in only seven months away and the race is on.

Cannabis companies are busy building out their distribution and supply chains in time to capitalize on the enhanced profit prospects offered by edibles, and CBD and THC infused beverages.

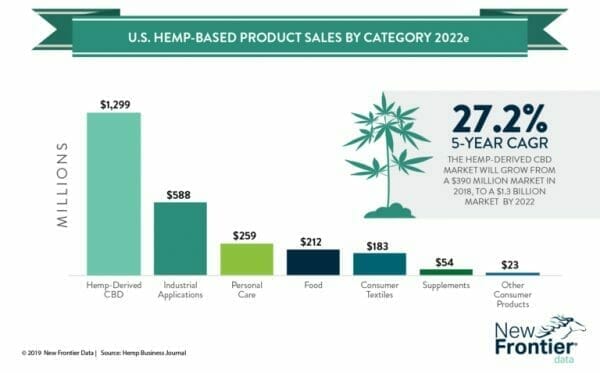

According to the Hemp Business Journal, sales of hemp-CBD products will grow from $390 million in 2018 to approximately $1.3 billion by 2022.

The CBD market owes most of its growth trajectory to its use in medical applications, but as cannabis companies in the United States languish under federal prohibition and Canadian companies wait for the starting gun, recreational hemp-CBD remains a well of opportunities.

Here are four opportunities that TGOD could capitalize on in the future.

Cannabis beauty and skin care products

Products containing CBD have gained enough mainstream acceptance that they’re now being sold on Sephora’s website.

Cannabis edibles

Gummies, chocolate and beverages are the three most obvious choices for CBD and THC infusion in October as six out of 10 likely pot consumers would choose edibles over smoking cannabis, according to a Deloitte survey of 1,500 Canadians.

Cannabis-infused beverages

The Coca Cola Company (KO.NYSE) has been talking with Aurora Cannabis (ACB.T) about developing its own line of CBD-infused beverages, and Molson-Coors Brewing Company (TAP.NYSE) has a partial stake on a 500,000 square foot cultivation space in Belleville, Ontario.

Cannabis pet treats

CBD-infused pet treats have garnered support from holistic veterinarians.

Being the first across the finish line with its organic CBD products would help TGOD capture enough market share to grow before the big guys swallow it all up.

–Joseph Morton

Full disclosure: The Green Organic Dutchman is an Equity.Guru marketing client.