CROP Infrastructure’s (CROP.C) Nevada farm underwent final inspection this week and is one step closer to medical and recreational licensing.

The company’s 1000-acre Nevada farm supports THC cultivation and production and houses a commercial kitchen and extraction facility.

With said licensing expected to arrive by the end of the month, CROP continues construction on the 40-acre perimeter wall for outdoor and greenhouse production.

CROP’s outdoor project, budgeted at $500,000, is 50% funded and expected to yield 80,000 pounds of high quality, organic outdoor cannabis, the company said.

The resulting product will be mostly marketed to extractors and to fill the company’s tenant extraction quotas.

CROP is awaiting requests for offtake and supply agreements for the 2019 harvest and they shouldn’t be waiting long.

Demand for cannabis in Nevada is strong, state tax officials reported legal marijuana and its downstream products brought in USD$529.9 million during the fiscal year 2018, surpassing projections by 60%.

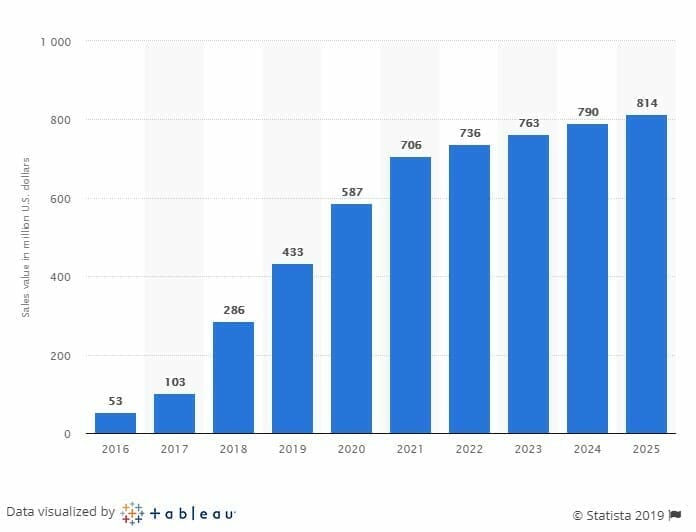

In fact, Statista predicts the legal cannabis market in Nevada will continue growing to eventually hit $814 million by 2024. CROP intends to leverage its Nevada operation to take full advantage of this trend, according to Michael Yorke, CROP’s CEO:

CROP intends to leverage its Nevada operation to take full advantage of this trend, according to Michael Yorke, CROP’s CEO:

“With our ultra low cost, organic outdoor focus in Nevada, our tenant farms will provide extractors with cost effective extraction materials giving both CROP and our tenants a significant competitive advantage in Nevada for the 2019 season and beyond.”

CROP is all about branding and real estate assets, taking a page out McDonald’s (MCD.NYSE) handbook.

The fast food giant is actually a $30 billion dollar real estate king that only operates about 15% of its stores, but owns all the property.

This landlord relationship allows McDonald’s to come away with 85% of the revenue generated at a franchisee shop instead of the measly 16% of revenues at its company-run outlets.

The land itself, appreciates over time and acts as hard collateral when it comes time to finance, as well as generating over $4 billion in revenue from leasing to franchisees.

CROP is turning this paradigm from burgers to bud.

Besides the Nevada farm, the company’s portfolio has grown from cultivation–with properties in California, Washington State, Jamaica and Italy–to extraction at its Nevada Lab.

It’s been an active year already for CROP, securing two expert plant scientists to head up its newly-minted Nevada lab and announcing a CAD$2 million private placement to fund near-term growth.

The Nevada farm will add significantly more revenue to CROP’s bottom line and show jaded investors real movement in a space that, up until now, has fueled itself on promises and letters of intent.

CROP Infrastructure shares dipped slightly to end the day at $0.34 per share.

Currently the company has 132,985,453 issued and outstanding shares with a market cap of $46.5 million.

–Gaalen Engen

Full Disclosure: CROP Infrastructure is an Equity.Guru marketing client.