Transcanna Holdings (TCAN.C) has hired Vancouver-based Purple Crown Communications to handle its investor relations.

Purple Crown Communications is an IR and communications firm with over 25 years in the industry.

The partnership’s primary purpose is to broaden Transcanna’s shareholder base and to create communication strategies to bridge the gap between the company, its shareholders and investors.

One such strategy on offer from Purple Crown includes arranging one-on-one meetings with retail investors, analysts and fund managers.

“Our goal was to align ourselves with a firm that puts shareholder communication first and can build a strong shareholder base as management focuses on building the business. We’re extremely pleased to have retained Purple Crown, and we look forward to working with them and growing Transcanna together,” states Jim Pakulis, chief executive officer of Transcanna.

Purple Crown offers services individually tailored to meet each client’s needs.

The company offers advice on how to navigate the social media world and assists clients with news releases and the regular dissemination of information to brokers, analysts and investors.

Purple Crown says it pays special attention to timing, positioning, accuracy and fair disclosure policies.

Purple Crown Offers:

- Investor relations

- Corporate Communications

- Property brokering

- Regional and International Road Shows

- Financing

- Public and media relations

The contract is for 12 months, after which it will become renewable on a month-to-month basis. Purple Crown will be paid $7,000 monthly, and admits they do not have any interest, either directly or indirectly, in the company or its securities.

Purple Crown’s appointment as investor relations consultant to Transcanna is contingent on the approval of the Canadian Securities Exchange.

Transcanna made their debut on the CSE earlier this month as a provider of transportation and distribution services to a multitude of industries, including cannabis.

The legal American cannabis industry is expected to be valued at over $20 billion by 2020.

Two weeks post IPO, Transcanna is presently valued at a smidge north of $25 million and closed at $1.65.

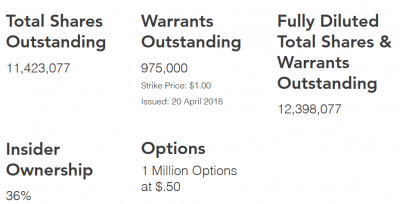

Transcanna’s share structure looks like this:

The company has a number of different subsidiaries navigating the tightly-regulated California market, including TCM Distribution which has recently received its temporary distributor license to operate in the state.

Transcanna’s application for a permanent license to operate in California was submitted on Dec. 31, 2018 and is presently under review.

Once Transcanna clears their upcoming licensing hurdles in California, they intend on expanding with five distribution centres, allowing them to compete on more even-footing with the existing LPs operating in California’s cannabis space.

They have also recently been welcomed onto the Frankfurt stock exchange, widening their investor base and giving them opportunities to bring more value to their shareholders.

–Joseph Morton

Full disclosure: Transcanna is an Equity.Guru marketing client.

The legal cannabis sector is still in its infancy. Marijuana is projected to be a $150 billion Industry by 2025, Legal adult-use marijuana consumption has acquired serious momentum for the past 20 years and has gained considerable traction on the worldwide market due to a high demand among consumers. A trend that’s likely to continue, the popularity of recreation marijuana legalization and acceptance of medical marijuana has increased dramatically around the globe.

Furthermore, as public and private funds are used for scientific research into the plant’s many terpenes and cannabinoids for development of safer forms of cannabis consumption, the legal marijuana sector is anticipated to grow exponentially.

I missed out on the dot com opportunity … I won’t miss this one.