Peter Berdusco, CEO, President and Director of Guyana Goldstrike (GYA.V) and formerly boss of Nexus Gold (NXS.V) has a habit of making insider trades, as an executive of public companies, and not filing the paperwork with regulators until later.

Much, much later.

So much later that any shareholder would rightly wonder why he’s still in a job at a pubco, or allowed to be associated with a regulated market.

If you think I’ve already written this story once before, you’re mostly right. On October 5 of last year, I published this piece, which pissed a lot of the right kind of people off.

https://equity.guru/2018/10/05/guyana-goldstrike-gya-v-ceo-took-year-file-insider-docs-relating-stock-dumping-previous-firm/

Here’s the cliff’s notes of that story:

On June 29 2017, as his company had drifted in share price from $0.24 down to $0.18 over the previous few weeks, the company put out this news release, in his name:

Nexus Gold Corp. wishes to confirm that the Company’s management is unaware of any material change in the Company’s operations which would account for the recent increase in market activity.

24 hours later, on June 30 2017, Berdusco sold 100,000 shares of his company at $0.18, good for a haul of $18,000.

This is not a crime – CEO stock sales happen all the time. Sometimes a guy wants to buy warrants and sells some stock to finance that, sometimes he has stock options he wants to make use of, sometimes his girlfriend wants a diamond to make up for that thing she saw on his text messages, and cash must be had – stat.

A CEO generally wouldn’t sell his own stock the day after sending out a regulatory shrug, because the optics of that would be fucking horrible, and probably contribute to more investors selling their own stake.

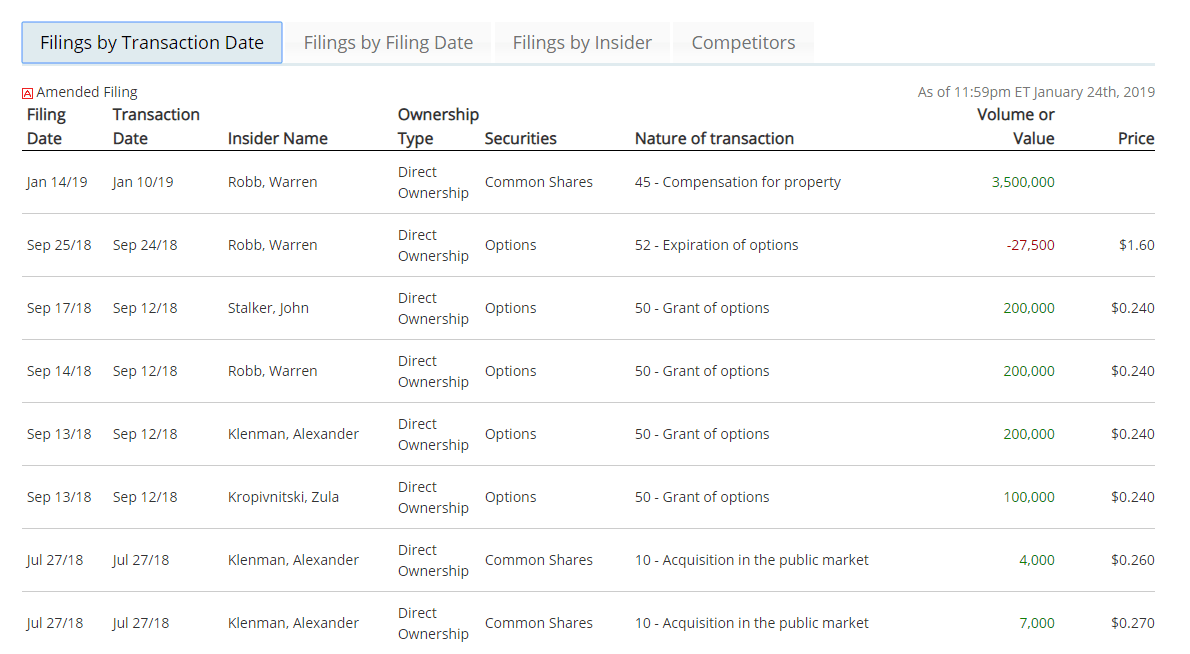

The proper thing to do in any instance – the LEGAL thing to do – is to file insider documentation that shows a trade happened. This is what that information looks like.

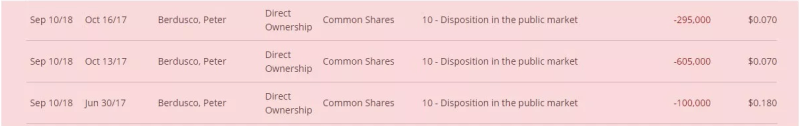

Maybe Berdusco didn’t want to see his company suffer, maybe he just forgot, or maybe he was getting out and didn’t want anyone to know, but in any event, Berdusco didn’t file his insider paperwork until September 10, 2018 – over a year after his first trade, and two days before he left the company.

Investigators at the BCSC took note of that one, and that may have forced Berdusco’s hand to go file further. And earlier.

Today, Equity.Guru researchers noticed Berdusco has filed more late stock dumping transactions, with some of them filed almost two years later than the days he was selling his own company stock.

They weren’t immediately apparent to the casual observer because, if you look at NXS insider charts, it shows the most recent ten trades made, by default.

Nothing to see there. Just the current crop of Nexus insiders buying their own stock and picking up options. All fair and normal as they go about undoing the legacy left behind by previous management.

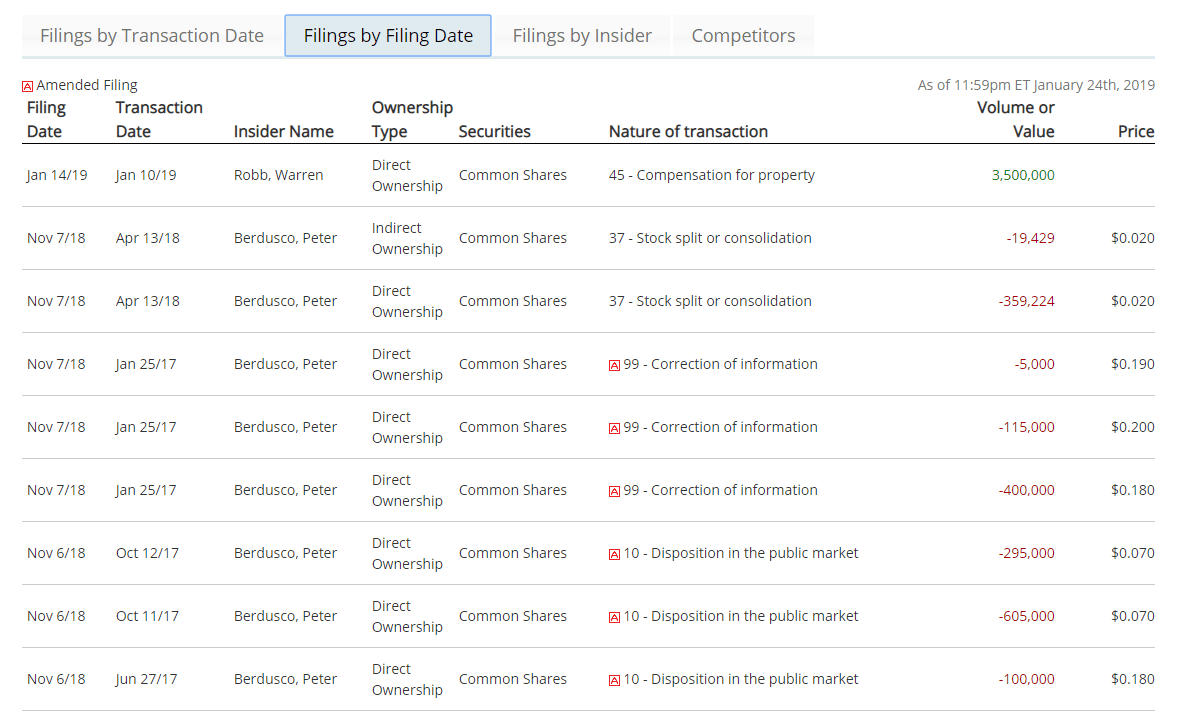

But if you look at that page by ‘filing date’ instead of ‘transaction date’, you’ll find something VERY different, and frankly quite disgusting.

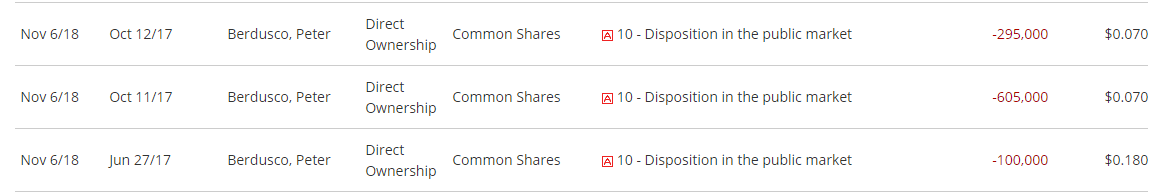

That’s Peter Berdusco filing NEW documentation in November of 2017, a month after our story broke, and going back as much as 23 months in doing so, showing he was selling the shit out of his company stock while not only serving as CEO, but also sending out news releases saying he had no idea why the share price was falling dramatically.

The timelines on the most recent filings show some of his previous (late) filings were erroneous. Others appear to be new.

In September 2017, he filed insider sell documentation for Jun 30, October 13, and October 16 of that year.

The new filings add new filings or, more likely, replace the earlier filings – with June 27, October 11 and October 12.

It’s gross that he was selling stock on the sly, while it was sliding in price, and while telling shareholders he had no idea why it was falling.

But, judging by the amounts noted, we’re likely seeing him here correcting earlier incorrect filings with more accurate info. Dumb that he didn’t bother to get it right the first time, and shitty that he never bothered to file at the time he was selling, but we’ve already expressed our outrage at that.

But those filings are posted in addition to what appears to be new amounts going back almost two years, showing the NXS boss has been dishonest with shareholders for a long time.

On January 24 2017, NXS put out news of results from their Niangouela gold concession in Burkina Faso. Those results saw the stock rise markedly, from the $0.16 range to as high as $0.27 in just a few days.

During that time, Berdusco sold nearly $100,000 of his company’s stock, but chose not to file correct and required insider trade docs for nearly two years – and only after he’d left the company (and left it nearly broke) and after our expose on his trading was published, which led to a BCSC investigator looking into details.

The news, back on January 24 2017, also announced this:

The Company also announces that it will grant 1,800,000 incentive stock options to directors, officers and consultants of the Company. The options will be exercisable at a price of $0.16 for a period of five years. The grant remains subject to the approval of the TSX Venture Exchange.

So Berdusco’s filings now show, the day after he granted himself and others $288,000 in stock options at a price that was nearly half what the market was paying a day later, he sold around $95,950 of his personal stock into the open market.

Gross.

Now, you may wonder how an executive at a public company can get away with this sort of behaviour and still be allowed to do business at another one (currently, Guyana Goldstrike), and the answer to that is, he’s been tacitly encouraged to file in this way.

In talking to staffers at the BCSC in relation to this story back in September of last year, we were told explicitly that the commission is unlikely to charge someone filing late, even years late, with anything more than a nominal fine and a slap on the wrist. because, “If they don’t file at all, we have no way of knowing that, but when they file late, we do, so we want to encourage lateness over an executive not filing at all.”

Yes, we’re outraged too.

You may feel like the exchange would step in and monitor this, but here’s what the TSX says about insider filings:

Insider Trade Summary Corrections will be posted on this website as they are available. Insider Trade Summary Corrections may occur at any time following the applicable Insider Trade Summaries. Insider Trade Summaries information and Insider Trade Summary Corrections information is provided by third parties without verification by us, and is provided on an “as is” basis without warranties or representations of any kind. Insider Trade Summaries and Insider Trade Summary Corrections are provided with the express condition, to which everyone using these products assents, that no obligation, responsibility or liability shall be incurred by TSX Inc., its affiliated companies, or their information providers, for any loss or damage whatsoever arising from or relating to any use of or reliance on the Insider Trade Summaries or Insider Trade Summary Corrections.

At Canadian Insider, we paid for a full insider report on Nexus Gold, but Berdusco’s late filings were not included in that report because, though he filed them recently, their ‘date of trade’ goes too far back to be included, and the fact that he’s no longer an executive takes him off the insider list their system pulls from.

So those late filings are allowed to slip by almost in total secret.

You’d be right to wonder how many other executives are pulling this fast one, and buying and selling the stocks they represent without ever fessing up to it. We caught Berdusco here because we, as marketing partners of Nexus, were looking deeper at them than most investors would.

But you almost have to think that he’s just unlucky, that he’s the cockroach we caught when we flicked the kitchen light on, while hundreds of others sit under the fridge watching him get stomped.

If nobody is willing to actually police executives as they trade their stock, replete as they are in insider information that can grant them an advantage in trades, what chance toes anyone have in engaging in a clean marketplace?

To encapsulate:

- We have a pubco CEO trading hundreds of thousands of dollars of his stock while the company is actively disseminating news, and has more coming, including a rollback

- Said CEO doesn’t file for 18 months and continues to sell, while the share price is tanking and he’s telling people he has no idea why

- Said CEO is rewarding himself and others with stock options at the same time

- Said CEO re-files over a year later, correcting incorrect information and adding older trades to the mix, after he is terminated by the company

- BCSC takes a look, but says nothing publicly, other than to tell us they prefer this over total secrecy, and can do little else – by design

- Canadian Insider essentially (and likely unknowingly) buries the information, unless you look hard for it, by virtue of their system design and user interface

- TSX disavows itself of the information and doesn’t want to be held liable for its inaccuracy

- Shareholders get fucked while nobody looks out for their best interests

You’re on your own people. Assume the worst, because who knows how many executives at companies we own as individuals are trading against your interests and not filing at all – ever.

All we know is, if they do so, you’ll never know, and no regulator is watching for you.

PS Guyana Goldstrike shareholders: You may want to inquire as to how many shares are held by Peter Berdusco’s brother, and how he got them, and whether they’re being traded by proxy, because a load of stock was sold off last week, with no news out and no explanation as to why, and we hear family financial connections are strong between those two.

And if you’re really keen, ask about that blockchain deal the company announced last year, that saw a $3 million financing and a massive stock price rise, but has never been mentioned again.

— Chris Parry

FULL DISCLOSURE: Nexus Gold has been an Equity.Guru marketing client.

Someone had to facilitate the trades. Maybe time for some disclosure on a broker level ?

Unless there are more trades to disclose here, the riddle to the dark pool chicanery sept/17 just got answered…..Someone knew and got out period.can you blame them ?

I wonder- would this be considered inside information?

What a mess

I can verify the current Nexus Gold CEO doesn’t participate in any practices like this. I’ve known him for years and never has he given me a cause for concern when investing. Don’t write off Nexus Gold just yet.

Branden, rest assured, our beef is with the trading practices of a former executive, we are all in on Nexus Gold – the current management – and Burkina Faso.

I disagree Nexus’s Board of Directors knew very well what was going on with the company, all the insiders did, as they all read all news releases before dissemination occurs, they ALL sold imo when the stock was tanking, only the CEO was caught for late filing and roasted by Equity Guru

BTW this happens regularly on Howe St & TSX Ventures & CSE juniors !

Concerned Investor, your opinion is registered. Yes, of course this type of thing occurs regularly. We don’t have evidence to support your assertion of wider selling by insiders, based on non-public information.

“We don’t have evidence to support your assertion of wider selling by insiders, based on non-public information.” That is correct because the other directors hid behind numbered companies they controlled, which then sold anonymously into the markets, a common practice. They never did file insider reports because the companies are not insiders.

Yes, we are painfully familiar with the off-shore numbered company anonymous-selling ruse, but we can’t throw mud blindly into a fog.

May want to look closely at GYA these days…..I hear that their deal in Guyana is either done or close to it. The CEO seems reluctant to share that information with shareholders.

I have recently heard that GYA is completely finished in Guyana and has no further involvement with the Marudi project.