By Guy Bennett

Walking on Kitsilano Beach, I recently ran into an old friend who started his career producing low budget horror films, and is now a veteran TV & Film producer with over 80 international imdb credits.

After exchanging pleasantries, I inquired about his business.

There was a pause.

A hint of a smile.

“It’s a very good time to be a content creator,” he said.

Thunderbird Entertainment (TBRD.V) is a Vancouver-based company – looking to exploit the opportunities arising from the content demands of new streaming platforms.

In November 2018, Thunderbird went public and is now producing and distributing animated, factual and scripted content. Last quarter, TBRD booked revenue of $14.3 million.

The digital entertainment landscape is under-going a seismic shift, creating opportunities for nimble production companies and investors.

What has triggered this shift?

“Cord-cutting” – the process of severing expensive cable connections in favor of lower-cost (and ad-free) streaming services.

In decades past, the Big 3 networks ABC, CBS and NBC controlled the pipes into which entertainment content flowed. The popularity of Netflix, Apple and Amazon Prime made has diminished the importance of those traditional pipelines.

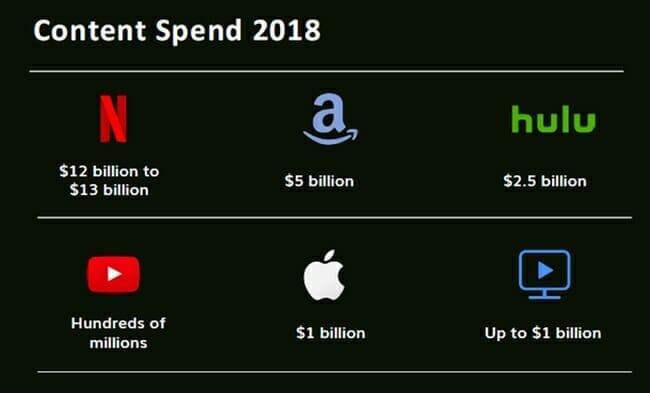

The combined production spending of Netflix, Apple and Amazon Prime was about $19 billion last year, with Hulu spending about $2.5 billion. The 2019 spend is expected to be significantly higher.

In 2018, in North America there were an astonishingly 498 original series in production.

Thunderbird was founded in 2003 by a savvy producer Tim Gamble who grew it organically and through acquisitions.

Production Summary:

Thunderbird’s factual division premiered Season 7 of its Highway Thru Hell television series on Discovery Canada, also producing “Worst to First” and “Save My Reno” for HGTV Canada and shooting Arctic Haulers.

Thunderbird’s scripted division completed production of the 3rd season of its award-winning comedy series Kim’s Convenience – which is now available on Netflix.

Thunderbird’s Kids division, Atomic Cartoons, has 12 animated television series in various stages of production “reflecting a blend of both service-based and proprietary series”.

Being a “service producer” means that you run the logistics (crew, locations, transportation, post-production, union disputes etc.) without taking an equity position in the project.

Atomic Cartoons’ service-based work is typically for global companies like Marvel or Disney. With shows that Thunderbird owns the IP on, the financial risk is hedged because the content is pre-sold to OTT platforms like Netflix.

Before we get more into Thunderbird – let’s look at some of the data supporting the theory that content creation is in a state of transition.

Netflix and YouTube now combine for about 70% percent of teenagers’ video viewing time, while traditional cable has fallen to 16 %.

The Hollywood Reporter states that 41% of consumers aged 22- 37 spend more time watching streaming services than cable or satellite TV.

When network TV does have a hit, the audience tends to skew old – like last season’s top-rated network TV show, “Roseanne,” which had a median viewer age of 53.

Although 53-year-olds have more money than 23-year-olds, advertisers don’t like them.

Why?

Because if a 53-year-old brushes her teeth with Colgate – she’ll probably keep doing that no matter how many Crest commercials you put in front of her.

If I’m an advertiser, dishing out $180,000 for a 30-second ad on “Roseanne” – I’m paying for the privilege of shouting at the deaf.

Thunderbird’s CEO, Jennifer Twiner McCarron was recently named Playback Magazine’s 2018 “Exec of the Year” – acknowledging her as “the most innovative, interesting and successful executive of 2018.”

Twiner McCarron joined Atomic Cartoons as head of production in 2011 – catalysing the corporate shift from being a powerful service hub, to become a full-fledged, independent content creator, launching hits like Beat Bugs and developing bestseller books series such as The Last Kids on Earth for Netflix.

“Jenn is a leader well-known for her creativity, accessibility and a strong desire to produce quality content,“ stated Ivan Fecan, TBRD Chairman, “Our entire Board feels very fortunate to have Jenn as our CEO.”

TBRD’s board is eye-popping.

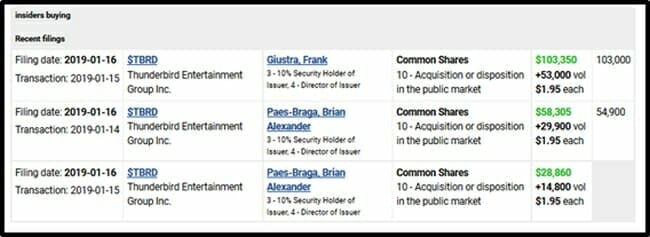

As well as Mr. Fecan – former VP of Creative Affairs at NBC, Head of English TV at CBC, TBRD board boasts investing and philanthropy legend Frank Giustra – the founder of Lions Gate (LGF.NYSE), and wunderkind millennial merchant banker Brian Paes-Braga is who just sold Lithium X for $265 million.

Giustra and Paes-Braga aren’t just around for the free cinnamon buns at the board meetings. Giustra has his hands in so many operations, he’s usually an invisible behind-the-scenes capital markets’ guru. He’s out front here, and both Giustra and Paes-Braga are buying shares in the open market:

But in the video below, starting at 3:08, you can hear Giustra – interviewed by Paes-Braga talk about his background in the entertainment industry – and why he’s involved with Thunderbird.

“We believe that independent producers are benefitting from the fact that major studios are pulling content from SVOD (Subscription Video On Demand) platforms in favour of their own” stated Canaccord Genuity (CF.T) in its November, 2018 initial coverage on Thunderbird. “This leaves the independents better positioned than ever to achieve a larger slice of SVOD programme budgets” on platforms like Netflix.

“Thunderbird has punched well above its weight in producing high-profile shows (Beat Bugs, Kim’s Convenience, Highway thru Hell),” stated Canaccord, “and in parallel gained traction with many of the major platforms including Netflix and Amazon. It also has a solid financial track record growing EBITDA over 4x through F2016-F2018.”

An independent film and TV production company will sink or swim based on its ability to attract talent. In particular there is a premium on the so-called “Show Runners” – usually veteran Head-Writers, who can wrangle the story-arcs of a show over multiple seasons.

“The major challenge for smaller producers is attracting and retaining top talent, in particular amidst the current bidding frenzy for accomplished showrunners,” confirms Canaccord, “Presently, they are competing with deep-pocketed SVOD platforms like Netflix who are prepared to lock down top players.”

However, Canaccord continues, “Netflix and Amazon may not be a fit for a lot of creative talent.” While the pay is usually good, the collaborative environment at a large SVOD may not be optimal.

Multi-hit showrunners are few and far between: Empirical evidence suggests there are very few showrunners who can have multiple premium hit shows. Hence, a business model that is better tuned to identifying and attracting exciting new producers, rather than buying out already established heavyweights, may be more valuable.

Thunderbird intends to target “compelling intellectual property for exploitation and to expand its production capacity” to meet building demand. At the same time, TBRD will continue to assess strategic M&A opportunities.

When I parted with my producer friend on Kitsilano Beach, he invited me over for drinks.

We ended up watching something on Netflix.

There is a swelling tsunami of content demand.

Thunderbird is strategically designed to fill it.

Canaccord issued TBRD a BUY rating with a share price target of $3.00.

Thunderbird is currently trading at $1.80 with a market cap of $83 million.

Full Disclosure: Equity Guru has no current financial relationship with Thunderbird Entertainment.