C21 Investments (CXXI.V) has received regulatory approval to acquire Phantom Farms in Oregon, and closed the deal on Silver State Relief and Silver State Cultivation in Nevada.

Both the Phantom Farms and Silver State licenses are part of C21’s master plan to dominate the cannabis market through significant expansions in cultivation, processing and wholesale and retail distribution of their branded products.

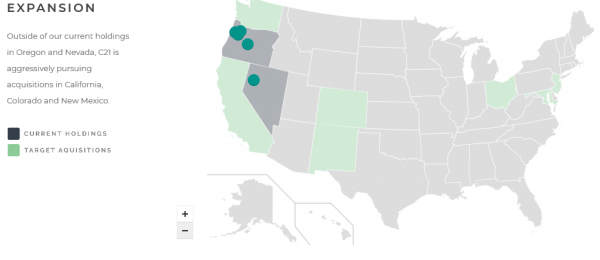

The strategy is simple: the company wants to acquire existing and successful cannabis operations that already have experienced management teams in place. C21 is looking to expand where it can buy up both indoor and outdoor cultivation operations. They’re also looking for processing and extraction facilities, bakeries, other branded products and dispensaries sporting large distribution networks.

The Silver State Relief and Silver State Cultivation acquisitions follow this model. These businesses are an established, virtually integrated cannabis cultivation, processing and retailing operation, with a healthy revenue of $24.5 million over 12-months, according to C21.

“The Silver State brands and products are a strong complement to C21’s existing business. With C21 Investments, we look forward to expanding our reach within Nevada and nationwide,” said Sonny Newman, founder and owner of Silver State.

Silver State is an 8,000 square foot retail dispensary. The dispensary is a cannabis superstore offering 21 points of sale and serving over 36,000 customers a month, and has been consistently one of the top-three revenue producing dispensaries every month for the past three years.

On the other hand, Phantom Farms offers 80,000 square feet outdoor cannabis cultivation facilities, with an addition 40,000 square feet in southern Oregon. They also operate a 5,600 square foot facility, including a wholesale distribution warehouse and an extraction laboratory, along with a 7,700 square foot indoor grow facility in central Oregon.

C21’s next acquisition is in Fernley, Nevada. This opportunity offers a 6,000 square foot dispensary in an area that’s been enjoying some rapid economic growth as well as an uptick in housing and business development. This dispensary offers a boost to the revenue and earnings growth potential of the existing business, and should be operational in the next four weeks.

“Completion next week will represent C21’s largest acquisition and is aligned with our long-term growth objectives. The Silver State businesses will immediately contribute solid revenue and earnings, and we anticipate two more announced acquisitions to close before the end of the month. The Silver State operations are a very well-managed business led by well-known Nevada entrepreneur Sonny Newman. And it has strong potential for significant expansion on all levels,” said Robert Cheney, president and chief executive officer of C21 Investments.

The rest of C21’s master plan for expansion includes restructuring its real estate rights with Eco Firma Farms through a “vendor finance agreement.” This agreement converts rental payments into mortgage interest payments, which will be done according to the company as a “straight-line amortization of the $3.8 million purchase price in cash or shares over two years.”

Despite this recent development, the company endured some setbacks in 2018.

A proposed acquisition of Grön Chocolate fell through, slowing down their proposed entry into the edibles market. Then another collapsed partnership with 7Leaf dispensaries in Oregon.

A quick glance at the one-year chart shows that this company has likely endured more misses than hits, so for their sake they had best hope that their master plan pans out over next few months, and they start coming up aces.

The official transfer and closing procedures for Silver State Relief and Cultivation happened today, but the Oregon expansion should be completed on Jan. 30, 2019.

Full Disclosure: C21 Investments is an Equity.Guru marketing client.