Nexus Gold (NXS.C) made considerable progress on both domestic and international fronts this week.

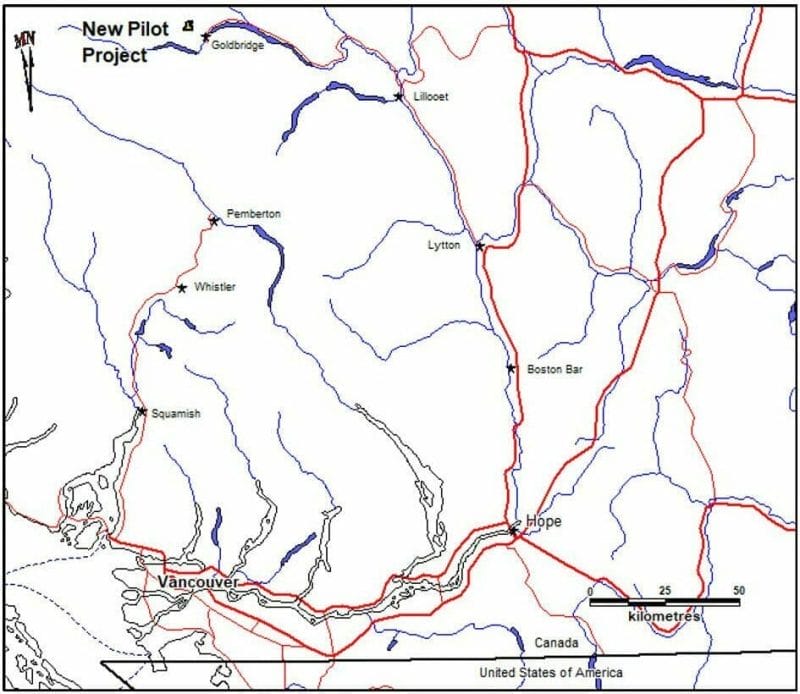

On Monday, the Vancouver-based junior announced the completion of its New Pilot project acquisition in British Columbia. This morning, the company released more sample results from its recently acquired Dakouli 2 gold project in the African nation of Burkina Faso.

New Pilot – the deal

The transaction for New Pilot, a gold-copper exploration property located in the storied Bridge River mining camp, was carried out with the issuance of 3.5 million common shares at a deemed price of $0.0825 each to the current owner of the project, Warren Robb.

Since Robb also serves as a director and the senior VP of exploration at Nexus, the company has ensured the deal complies with TSX Venture Exchange policies regarding related party transactions.

All common shares issued pursuant to the transaction are subject to the customary four-month hold period.

The property

The 509-hectare exploration-stage gold-copper property, roughly 1.33 times the size of New York’s Central Park, sits approximately 180 kilometres north of Vancouver, B.C.

In the early 90s, Cogema Canada worked the New Pilot property with a detailed prospecting and sampling program, grabbing 99 samples in three zones.

Three of those grab sample results came back with more than 100 grams per tonne (g/mt) gold (Au), while another three samples tested above 10 g/mt Au and 14 others in excess of one g/mt Au.

Cogema also carried out a 108-metre diamond drill program which produced chip samples of 4.03 g/t Au.

Not bad, considering the cut off for a respectable gold mine ranges between two and four grams per ton. Possibly pretty great considering the following were the highest-grade underground mines producing in 2017.

New Pilot is situated 18 kilometres southeast of the producing Bralorne mine operated by Avino Silver and Gold Mines (ASM.T).

The region has a rich mining history. From 1928 to 1971, the Bralorne mine with the help of nearby Pioneer and King mines, pulled 4.15 million ounces of gold out of the ground.

Bralorne gold camp continues to be a place of interest as evidenced by Australia-based Blackstone Minerals (BSX.ASX) and its 2017 acquisition of the Little Gem project, a high-grade cobalt and gold project approximately 900 metres from New Pilot.

The New Pilot acquisition is a strong complement to Nexus Gold’s Burkina Faso assets in West Africa.

Speaking of which…

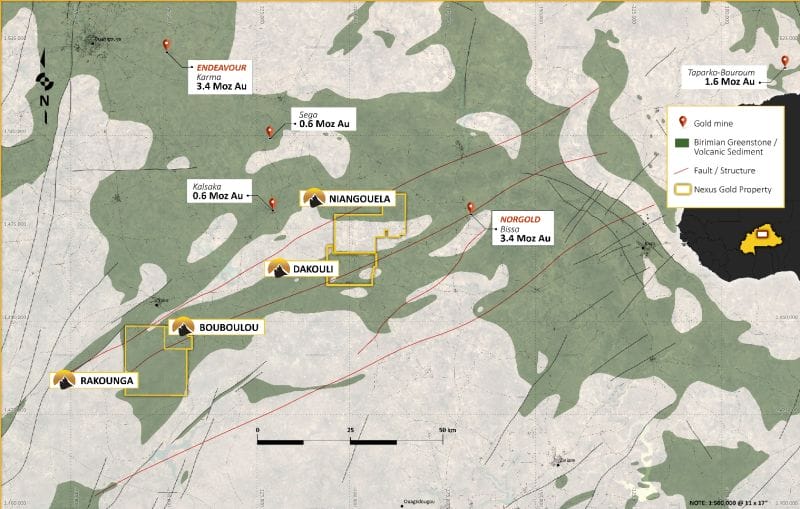

More gold in Burkina Faso

Nexus reported additional sample results from the recently acquired Dakouli 2 Gold Project in central Burkina Faso.

The wholly-owned, 98-square kilometre project located on the Goren Greenstone Belt, went through a second round of prospecting where a total of 13 samples were taken.

Five of those samples came back with values between 1.74 g/t Au and 17.6 g/t Au. Samples were taken from small-scale mining dumps from depths of 15 to 40 metres below surface within active artisanal pits and shafts.

Nexus has collected 25 samples to date on the Dakouli 2 property. Eleven of those samples came back at greater than 1 g/t Au and five returned assay values north of 11 g/t Au.

See the coarse, nuggety, visible gold for yourself:

Since Dakouli’s acquisition it’s been nothing but good news as all 25 samples taken to date at the project have tested positive.

Recent ground reconnaissance also produced smiles as Nexus was also able to identify two new mineralized zones and a secondary vein south of the primary Northeast Zone.

Three samples from this area were taken 17 to 40 meters below depth and came back with gold values of 1.74 g/t Au, 3.68 g/t Au and 17.6 g/t Au, respectively.

It should be noted the workings of the Northeast Zone on the Dakouli 2 property now stretch 400 meters along strike surrounding two 150-metre-wide gold bearing structures.

Nexus took further advantage of this phenomenon when it extracted samples from a second orpaillage or artisanal mine structure in the Boken Vein Zone located on the western boundary of the Dakouli 2 permit.

Two of those samples, taken at 25-metre depths from workings located there, were measured at 2.72 g/t Au and 11.1 g/t Au.

Warren Robb commented on the importance of the Boken Vein results:

“The secondary structure identified in the north east and the Boken Vein showings are revealing just how robust the Sabce fault zone is. The amount of coarse visible gold we have seen thus far makes this a very exciting exploration program.”

Alex Klenman, president and CEO, was quick to affirm Robb’s excitement:

“These are positive early indicators at Dakouli. We have already confirmed multiple mineralized zones on the property and are currently mapping out these zones to determine their relationship to known structural faults and trends. It is a prolific area in terms of gold mineralization and we are encouraged by both the abundance of visible gold at Dakouli and the sample grades so far. We have lots of similar ground to cover, I’m looking forward to a deeper and more extensive exploration program, including a maiden drill program, in the coming months.”

So far, 2019 has kept Nexus busy. These preliminary exploration wins are important and provide a solid stepping stone for more detailed programs like the planned maiden drill campaign.

Yes, there are risks for miners in Burkina Faso, but with a new three-year IMF program approved in 2018, the government will be able to pay down an onerous deficit and save money to put into social services and important infrastructure projects.

If Burkina Faso’s government can keep the wheels turning and give its population the peaceful stability it deserves, the country will continue on its journey to become the next big gold producer in Africa, making Nexus Gold a solid player in a significant mining region.

Nexus Gold share price dropped 13.33 percent in afternoon trading to settle at $0.13 per share. Currently the company has 37,985,432 million issued and outstanding shares with a market cap of CAD$4.9 million.

–Gaalen Engen

FULL DISCLOSURE: Nexus Gold is an Equity.Guru marketing client.