{Please see disclosures at bottom of page}

How many times have you heard of a company that’s in the midst of a paradigm shift? A sea change? A leader in a disruptive industry? Those companies are quite rare and when the rubber hits the road (for instance, the achievement of meaningful revenues & profitability), most touted companies fail to reach sky-high expectations.

We are currently seeing this unfold in the cannabis/hemp (and closely related) sectors. There are over 300 names in these sectors, and that’s just stocks listed in Canada and the U.S. Expectations are running rampant, but of the 300, how many will be good investments in 2019/2020? I’m talking about investment here, not day trading…. How many will be great investments? My guess is that most will not be good or great!

Is CUV Ventures on the Verge of Greatness?

One company that sailed through 2018, albeit with a lot of volatility, is entering 2019 in a very promising position. That company is CUV Ventures (TSX-v: CUV). Led by Steve Marshall and a wide range of experienced executives and advisors, the Company could be on the verge of greatness, on the verge of harnessing technology to disrupt banking and several online industries. It has not made it yet, but recent events suggest that the Company is on the right track. Note: {embedded links in blue are also found at the end of the article}

Most recently the news that its deal with Expedia & Booking Holdings has begun to bear fruit in the form of revenues. Approximately 3 million small hotel establishments, bed & breakfasts and private accommodations currently feature on Expedia, Booking Holdings branded websites. To be clear, this is not CUV taking business away from Expedia & Booking Holdings, CUV is simply taking over the payment mechanism through which these B&Bs are paid and earning a lucrative 3% fee.

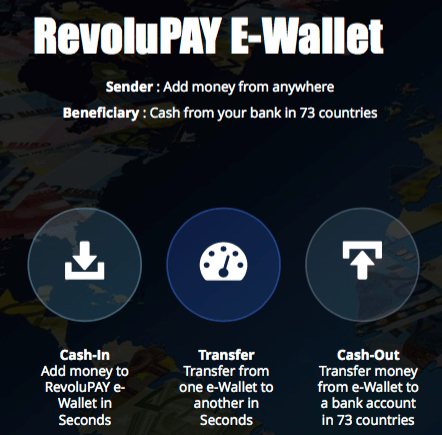

Through CUV Ventures, property owners or their agents are able to instantly convert Virtual Credit Card (“VCC“) funds into RevoluPAY® e-Wallet funds and transfer the balance to bank accounts worldwide. This is important because the property owners’ alternative is often a wire transfer which can take up to 30 days and comes with a fee attached.

“In 2017, Booking Holdings reported revenue of USD $12.7 billion (brands include Booking.com, Priceline.com, Kayak.com, Agoda.com) and Expedia reported USD $10.6 billion (brands include Expedia.com, Hotels.com, Hotwire.com, Trivago.com, Venere.com, Travelocity.com, Orbitz.com and HomeAway.com).”

CUV’s Deal With Expedia & Booking Holdings Looks Promising

RevoluPAY® processed its first US$25,000 of VCC Cards on the very first day the system was live, receiving a 3% fee = US$750 of revenue. Is this what all the excitement is about, US$750??? Even if one annualizes it — US$750 x 365 = US$273,750 — that’s nothing to write home about. But, it’s early days, this was day 1 of launch. With over 3 million B&Bs worldwide that could use CUVs RevoluPAY®, the numbers can grow quickly. AND, the profit margin embedded in the 3% fee is stellar.

According to CUV’s December 20th press release, the Company “expects daily volumes to increase exponentially, once the VCC clearance mechanism is deployed to B&B and small hotel owners worldwide.“

A key point not explicitly stated in the press release is all the hard work that has gone on behind the scenes for months to get to this stage. The Company has built a mobile banking app approved on iOS and Android, obtained a banking license, and begun mobile financial transactions, all in less than a year. And, if Steve Marshall and his expert team can get this important deal over the finish line, think about what that says about the prospects for other business segments.

CEO Marshall & Team are Executing on Key Initiatives

For example, again from the December 20th press release, “CUV CEO meets with 5 separate [meetings with] major retail consortiums for RevoluPAY® apppayment acceptance across: Uruguay, Colombia, Guatemala, El Salvador and Mexico.” Note the words “major consortiums.” Marshall executed with major travel sites Expedia & Booking Holdings, he can point to that success when speaking with major retail consortiums and banks.

“…it is the intent of the company that RevoluPAY® app users benefit from a multi-use scenario when using the app. On one hand, simple remittance cash collection for a minimal fee and, on the other hand, the ability to be able to transact directly using RevoluPAY® in select retail stores, supermarkets and, businesses, with no fee, essentially 1:1 currency wallet balance value in collaborating retail stores. Retailers will be allowed to permit direct payment with RevoluPAY®, with B2B processing fees that are lower than those offered currently by other payment systems or, Visa/Mastercard fees, in their respective countries.“

The users, customers, would be able to use RevoluPAY® for free like a credit card and retailers would be charged a transaction fee that’s less than that currently charged by Visa or Mastercard. This is truly a win-win for retailers, in addition to a lower transaction fee, retailers gain new customers; patrons entering the store to use RevoluPAY®, who might otherwise have gone elsewhere. New customer acquisition costs are carefully tracked by major retailers, getting new customers via RevoluPAY® at low cost (no advertising, discounting, etc.) is compelling.

The same holds true for advisor Emilio Morales’ talks with a major restaurant chain, present in 11 countries with over 800 restaurants in 280 cities. The parties are discussing an initial Letter of Intent (“LOI”), which would include a pilot trial in Florida, USA. Success in one business segment enhances the probability of success in other related segments.

Success Breeds Success, a Recipe for Explosive Growth?

Across multiple segments all roads lead to Rome, individuals, banks, landlords, merchants have to download the RevoluPAY® app for great deals on travel, to send and receive remittances, or to pay the phone, electricity and water bills of friends & family abroad. The suite of vertical revenue streams CUV is linking to its proprietary banking app RevoluPAY® is impressive, RevoluCHARGE, RevoluVIP, RevolUTILITY, RevoluFIN and others, cover a large user base, with plenty of cross platform potential.

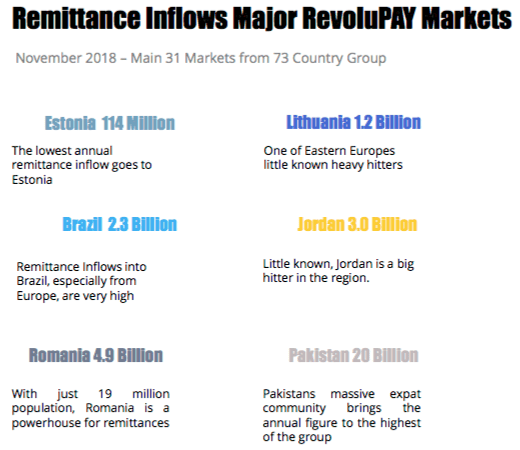

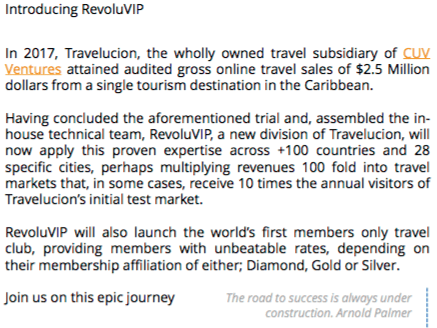

CUV has already managed to forge relationships for remittance deliveries in 43 countries and, is on the verge of signing with a major Top 40 world bank for 16 more in Central/South America and the Caribbean. There are other segments for the Company’s proprietary App, but perhaps the best example of RevoluPAY®’s growing value proposition is the RevoluVIP segment that launches this month.

RevoluVIP is a Potential Game Changer in the Travel Industry

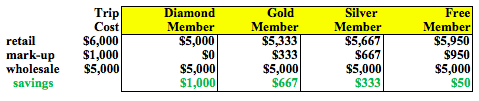

The exclusive RevoluVIP club will allow Diamond-level members to travel at wholesale prices, the same prices that wholesalers like Expedia or Priceline pay. This club membership will cost US$249 per year. Given that mark-ups from wholesale to retail are routinely 10%-30%, it doesn’t take much math to figure out how much travel one needs to do to make up for the US$249 annual fee.

At 15% savings, if one were to spend US$2,000 on a trip the annual fee would be more than paid for. This program is a no-brainer for families that make multiple trips per year, especially if the trips include flights. There are also Gold & Silver-level memberships which cost less, but do not offer wholesale pricing.

A Gold-level membership (US$199/yr.) offers up to a 2/3’s discount on the mark-up between wholesale and retail. So, one would be paying just 33% above wholesale. A Silver-level membership ($99/yr.) offers up to a 1/3 discount on the mark-up between wholesale and retail. Finally, there’s a free membership that offers a 5% discount to the retail price. When comparing the plans it quickly becomes apparent that the Diamond membership is superior.

Management hopes to enroll up to 1 million global members over the next 24 months as the program is rolled out to 130 countries in coming months. Most of the memberships are expected to be Diamond. As is the case with all CUV verticals, members must use RevoluPAY® for all travel payments, so CUV will generate earnings from booked travel as well.

For RevoluPAY® to be born, CUV has spent over a year forging relationships with the world’s largest and most prestigious travel conglomerates, obtaining a requisite wholesale IATA License, signing with publicly quoted companies Amadeus and, Constellation Software subsidiary, Juniper. These are real results happening rapidly. CEO Marshall believes the story is just beginning.

CUV Ventures (TSX-v: CUV) will be generating multiple revenue streams in 2019. The question is how large those streams will be. There’s certainly blue-sky potential for really big numbers, but it all depends on the pieces of the puzzle falling into place. As mentioned, success in one segment leads directly to success in other segments. Predicting the timing of the ramp up of RevoluPAY® and affiliated verticals is difficult at best, but the Company has proven it can execute on key corporate initiatives and it has a tremendous team of execs and advisors.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CUV Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of CUV Ventures are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares in CUV Ventures and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic. [ER] may buy or sell shares in CUV Ventures and other advertising companies at any time.