C21 Investments (CXXI.C) is shaking things up in Oregon.

The company announced Dec. 29 it is reorganizing its management structure in the Pacific Northwest state and terminating its discussions with two Salem-based dispensaries called 7 Leaf. The company also says it’s restructuring its Eco Firma Farms real estate setup.

Oregon management

C21 says it’s “integrating management of its Oregon operations to better align the organization’s strategic focus and maximize operational efficiencies.”

The company named Eric Shoemaker the new head of operations for its Oregon holdings. Shoemaker was also named president of Eco Firma Farms. He heads up a team that includes Skyler Pinnick. Pinnick stays on as the C21 board member responsible for operations in Oregon.

7 Leaf dispensaries in Oregon

C21 previously announced in June it was expanding in Oregon by acquiring three new dispensaries, with one location in Portland and two in Salem. Now we know two of those outlets, the 7 Leaf locations in Salem, will never open under the C21 banner.

“C21 also announced that it is terminating further discussions with 7 Leaf dispensaries in Oregon.”

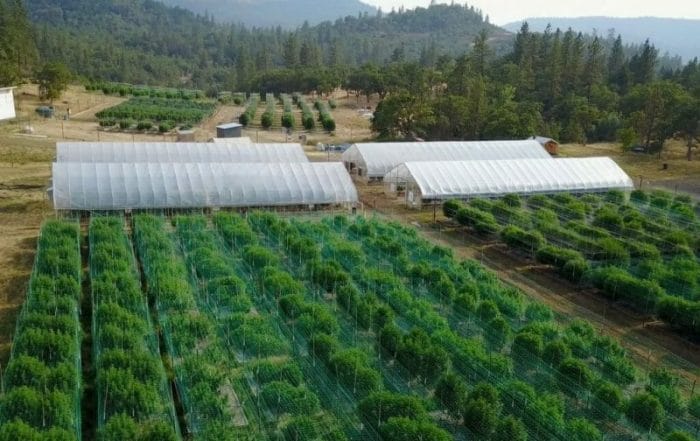

Restructuring at Oregon’s Eco Firma Farms

C21 Investments also announced they are restructuring some real estate rights with Eco Firma Farms.

Under the new arrangement, C21 will obtain Eco Firma Farms’ real estate assets. This will be done under something called a ‘vendor finance arrangement.’

Basically, rental payments will be converted into mortgage interest payments. This will be done as a “straight-line amortization of the USD$3.8-million purchase price in cash or shares over two years,” the company wrote in their press release. They added they retain the right to accelerate the payments in the future.

The changes announced today will enhance C21’s ability as a top competitor in the Oregon market, driving true vertical integration of our Oregon assets into a single strategic unit. Under Eric and Sky’s leadership, we are well positioned to profitably deliver premium brands and products to the Oregon marketplace.

— Rob Cheney, C21 Investments president and CEO

Private placement

C21 also announced it closed the first tranche of its private placement finance offering.

The company closes the first tranche after raising $5.06 million. The total offering amounted to 10,000 units, or $10 million.

Industrial Alliance Securities (IAG.T) led the offering along with syndicate members Canaccord Genuity (CF.T) and Sprott Capital Partners (SII.T).

Despite turbulent conditions, the market was receptive to our offering. Our agents were able to target investors who understand our strategy to build a vertically integrated cannabis company that cultivates, processes, and distributes quality cannabis and hemp-derived consumer products in the United States.

— Rob Cheney, C21 Investments president and CEO

Each unit contains: 1.) One, $1,000 principal amount 10 per cent unsecured convertible debenture, and 2.) One-half of one non-transferable debenture warrant. (Each warrant allows the warrant holder to buy—over a two-year period from the issue date—one additional $1,000 principal amount 10 per cent unsecured convertible debenture, at $1,000 per warrant debenture.)

The debentures can be converted into C21 common shares at $0.80. The warrant debentures can be converted into C21 common shares at $0.90.

The company said the proceeds from the offering will be used “primarily to complete previously announced acquisitions in the United States, and to upgrade and expand the acquired businesses.”

Some of those acquisitions C21 hopes to complete before its year-end Jan. 31, 2019, include: Silver State, Phantom Farms, Pure Green, and Swell.

Outlook

So some restructuring, some debentures, and some changes. But with the news, questions remain.

The 7 Leaf deal collapsed, but not a word of why in C21’s press release—just a one-liner: “terminating further discussions.” I think investors expect more than that. If you couldn’t agree on something, tell us that. If you can’t discuss anything because of legal matters, tell us that.

And there are other questions.

C21 announced in September they applied for a U.S. listing. But there have been no updates. When will the listing arrive?

The company also announced in August they planned to acquire Grön Chocolate. Later, the deal collapsed and a scant sentence was inserted into the bottom of a Nov. 1 press release. Deals collapse all the time, but, again, I would expect some kind of communication: “this happened and now we’re backing out—etc., etc.”

The dive in stock price over the last six months is also troubling to investors. After peaking at nearly $3 a share in July, the stock continued to decline to about $1 in August, then rallied in September to nearly $1.75, before dropping down again after legalization, this time to a low of $0.64 in mid-December.

Chris Parry wrote a couple of days ago about some weed companies that are undervalued. C21 was one of them:

C21 Investments (CXXI.C), for example, with a $35m valuation as they buy a company in the U.S. that has $25m in 12-month trailing revenue.

I’ve put few calls into C21, but I’ve yet to receive a call back. I expect to hear from them sooner or later. I see C21 as a company that has a great story to tell, but doesn’t yet know how to tell it. However, that’s not a reason to hold anything against C21.

If C21 Investments closes half the deals they hope to close by Jan. 31, their stock price could very well rise again. And with the current valuation, they still seem like a bargain. In the meantime, C21 just needs to tell us what is happening.

Full Disclosure: C21 Investments is an Equity Guru marketing client.