Developing hardware is a bitch.

According to data from a recent hardware symposium, 85% of polled companies stated that they had missed their product development schedule.

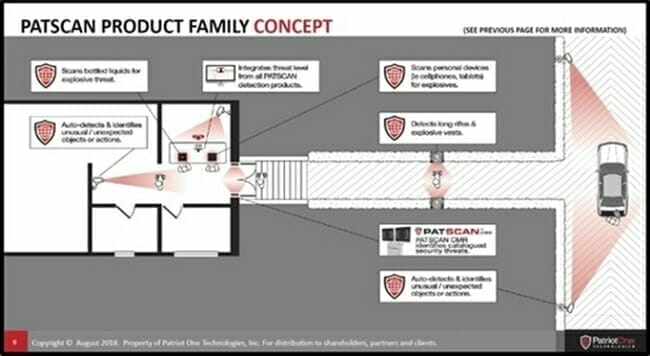

Patriot One (PAT.V) developed a piece of hardware called “Cognitive Microwave Radar” which detects concealed weapons from parking lots to buildings.

With an Amnesty International Report calling “gun violence in the United States a human rights crisis” – and about 40,000 American shot dead every year, PAT’s hardware is riding the mother of all demand waves.

We’re not talking about consumer demand for a ride-sharing app, or glossier lipstick, or sunglasses-for-dogs – we’re talking about saving lives.

It is not fair to say that PAT has “missed its development schedule” because – among the many things I admire about this company – the CEO Martin Cronin is no spin doctor.

Cronin has never maintained the journey to commercialization would be quick or easy.

It is true, that in the last six weeks, some retail investors have grown impatient.

After rising about 400% in the previous 2 years, the stock has recently shed 35% of its market cap and is now trading at $1.71.

On December 20, 2018 – Patriot One provided a Q4 2018 update.

It’s a doozy.

After recently announcing paid trial programs with several partners including Smart CT Solutions and Canada’s Department of Defense, PAT announced that “we will now begin shipping PATSCAN products to several other global security integrators to support paid product trials in their respective markets.”

PAT has embraced a “paid trial” model enabling it to scale efficiently and cost-effectively through its reseller network. This effort meets Phase 4 of its previously described Lab-to-Market strategy.

The objective is that paid trials will serve as a bridge into commercial deployment and product rollout. PAT is now finalizing policies, procedures, terms and PATSCAN installation training with its resellers “in preparation for ongoing commercial activity in Q2, 2019.”

No other company has ever mass-deployed these types of integrated threat detection technologies before. Therefore, advancement into full-scale mass production is, by necessity, constrained until completion and review of the technical trial results.”

Key Q4, 2018 Highlights:

- Beginning of revenues

- Successful deployment of PATSCAN products

- Successful deployment of key security system integrators

- Advanced live tests and trials of PATSCAN solutions

Additional Q4, 2018 milestones:

- The close of a $46M CAD bought deal from Canaccord Genuity and GMP.

- Completed the strategic acquisition of EhEye, video analytics and object recognition technology.

- University Of North Dakota’s Centre of Excellence in Threat Detection invested USD$100,000 for trial deployment of PATSCAN systems in four separate facilities across campus.

- Patriot One joined Cisco’s sales team in presenting PATSCAN solutions to key clients.

- Met with members of Congress, the Department of Homeland Security, Secret Service and Pentagon officials – also met with the ACLU to discuss PATSCAN deployment in a civil liberties and privacy context.

- Recently, ABC affiliate KTNV Channel 13 Las Vegas, did a feature news piece on PAT’s weapons-detection technology.

- “After months of testing and development inside the Westgate Hotel and Casino, employees from Patriot One Technologies were busy Tuesday demonstrating several products aimed at helping police and security identify potential threats,” stated KTNV.

PAT is exploring expanding their technology application to provide weapons detection protection for private home owners.

PAT’s “family concept” explodes the market for their technology from commercial – to retail.

According to Fidelity Money, “it is important to make financial decisions without letting emotions get in the way.”

Agreed.

So I’ll put this on the table: I believe in PAT the way Pandas believe in bamboo.

I own the stock, I’ve never sold a single share – and if the stock price dropped to .85 – I still wouldn’t sell it.

Here’s why: PAT’s technology is a cost-effective insurance policy for casinos, churches, universities, stadiums etc. It is the leader in this space. For that reason, I believe the stock is going many multiples higher than its current price.

FULL DISCLOSURE: Patriot One is an Equity Guru marketing client, and we own the stock.