On December 3, 2018 LiveWell (LVWL.V) announced that it has signed a binding L.O.I to acquire 100% of Vitality CBD Natural Health Products and its U.S. subsidiary, Vitality.

10:45 a.m. update: since the announcement, LVWL stock has been halted.

The deal is structured as a reverse takeover by Vitality.

The Transaction will enable the combined companies to become a new leader in the health and wellness market for CBD products from hemp and cannabis.

CBD – a non-psychoactive cannabis compound – is gaining traction in the health and wellness sector.

“CBD makes us sleep better,” explains Equity Guru’s Chris Parry, “It helps us deal with blood sugar. It lowers stress and triggers bodily systems that we want triggered.”

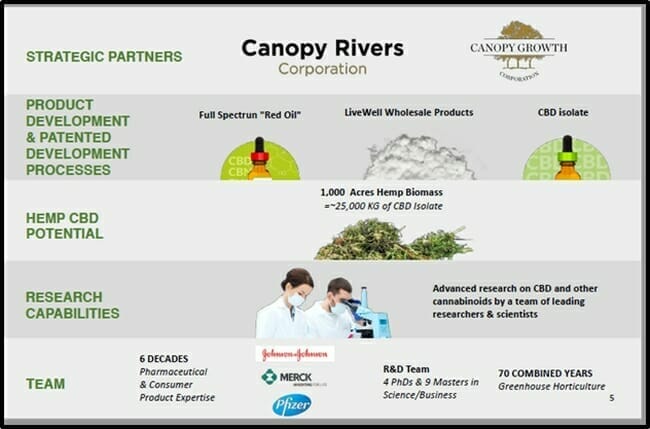

LiveWell is focused on advanced research on CBD and other cannabinoids – developing and distributing prescription, consumer health and wellness products.

The company is also building greenhouses in Ontario and Québec and is supported by business partners such as Canopy Growth (WEED.T) and Canopy Rivers (TSXV: RIV.V).

Vitality is a fully integrated, hemp processing and CBD isolation and wholesaling company, with operations in Eureka, Montana – operating under the State Farm Act.

Its demonstration plant is scaling to full manufacturing – pushing production capacity to over 3,000 kilograms per day of CBD isolate.

News of the merger is not a complete surprise, as the two companies recently signed a 15-month term sheet which ensured their fortunes would be intertwined.

Global Wellness will:

- distribute CBD isolate

- distribute distillate

- distribute full spectrum CBD oil

- pay a $3 million US dollar deposit to the new partnership for initial CBD supply

Beginning January 2019, Global Wellness will distribute at least 1,000 kilograms per month.

“Starting April 2019 to March 2020, the minimum quantity increases to 3,000 kilograms per month, for a total minimum quantity of 39,000 kilograms over the 15-month contract period.”

Current wholesale market data reveals CBD isolate pricing ranging between CND $8,600 and CND $13,200 per kilogram, based on the quality and purchase volume.

The 15-month supply agreement with Global Wellness Distributors is worth about $335 million CND.

We noted that Global Wellness and the new partnership will “co-share net profits” – but that “the mathematical formula for divvying up that pie is not yet known.”

Now it is known.

LiveWell and Global Wellness are merging.

Shared goals, shared risk, shared profits.

The new merged company will be headquartered in Ottawa, Ontario, with locations in New Mexico, Montana and Quebec, Canada.

“The World Health Organization (WHO) has recommended that CBD be de-scheduled across its 194 nation members,” states LiveWell.

According to The Economist Intelligence Unit global annual health spending reached $7 trillion dollars in 2015, and is expected to reach to $8.7 trillion dollars by 2020.

The “health and nutrition industry” is riding the mother of all of demographic waves.

Between 2016 and 2021, worldwide life expectancy is expected to rise from 73 years to 74.1 years. By 2021, the number of people older than 65 years will jump to 656 million (about 11% of the total population).

These health-conscious older folks want non-addictive organic medicines to treat the aches and pains.

“Nearly Half Of People Who Use Cannabidiol Products Stop Taking Traditional Medicines” – FORBES, AUGUST 2017, Dr. Perry Solomon, the Chief Medical Officer of HelloMD

Last week, the U.S. Senate announced a preliminary agreement that would legalize hemp under the U.S. 2018 Farm Bill.

The anticipated passage of the final Farm Bill is expected to dramatically impact the demand for hemp products in the United States — and possibly beyond

Hemp production is currently legal in the U.S., but the 2018 Farm Bill would grant industrial hemp the same unrestricted legal status federally as any other agricultural commodity.

“This transaction is about meeting and satisfying patient and consumer needs,” stated David Rendimonti, President and CEO of LiveWell, “North American markets are the primary focus initially, European and South American markets are also on the horizon for the new merged company.”

“We’ll have the resources to rapidly scale to meet the anticipated explosive demand in newly legalized CBD markets worldwide,” stated Robert Leaker, President and CEO of Vitality.

Merger Summary:

- 20,000 acres of CBD hemp harvested in 2018.

- Two extraction facilities

- 3,000 kg/day CBD isolate by the second half of 2019.

- Footprint in Canada and the United States.

- Personalized diagnostics and patented therapeutics R&D capabilities.

- 36,000-square-foot nutraceuticals development and manufacturing facility.

- Researchers and scientists specializing in CBD and other cannabinoids.

- 540,000-square-foot greenhouse facility on 100 acres of land.

According to New Frontier Data, U.S. CBD sales are predicted to grow about 400% in the next four years, from $535 million this year to over $1.9 billion by 2022.

The Brightfield Group of Chicago is even more bullish, estimating the North American market for CBD could reach US$22 billion by 2022.

Full Disclosure: LiveWell is an Equity Guru marketing client, and we own the stock.