As Canadian-based marijuana companies pivot from selling sizzle to selling steak – there has been a macro weed-sector stock-price slump.

The Canadian Marijuana Index – flying high at 858 on October 15, 2018 – is now at 557 – a 35% haircut.

In the same time frame, Canopy Growth (WEED.T) lost 40% of its value while Namaste (N.V) and MedMen (MMEN.C) both shed 50% of their market caps.

iAnthus Capital (IAN.C) is down a (relatively) modest 19% during this period.

Why has iAnthus escaped the worst of the carnage?

Because IAN is a U.S.-focused business run by consummate pros that is already generating solid cash flow.

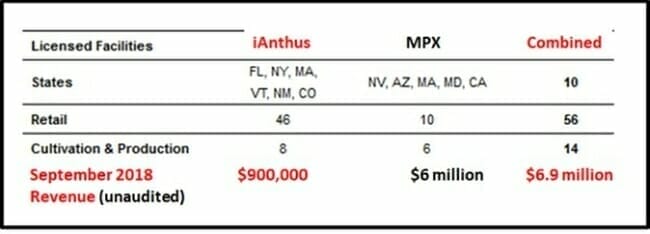

The day after Canadian legalisation iAnthus announced a deal to “combine with MPX” in an all-stock transaction valued at $835 million.

MPX is a vertically integrated cannabis operation providing “management, staffing, procurement, advisory, financial, real estate rental, logistics, and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative services to medicinal cannabis enterprises across its holdings in five states.”

Arizona, Maryland, Nevada, California and Massachusetts are now added to New York, Florida, Massachusetts, Vermont, Colorado, and New Mexico, forming “super-regional footprints in both the eastern and western United States.”

The merger is accretive to iAnthus.

“This is a watershed moment for iAnthus, as we nearly double the size of our national footprint in the U.S,” stated Hadley Ford, CEO of IAN, “iAnthus has been strategically focused on building scale, and this announcement crystallizes our position as one of the largest multi-state operators in North America.”

When one smart company merges with another smart company in the same sector, it’s usually a good thing.

But iAnthus is also riding a political tail-wind.

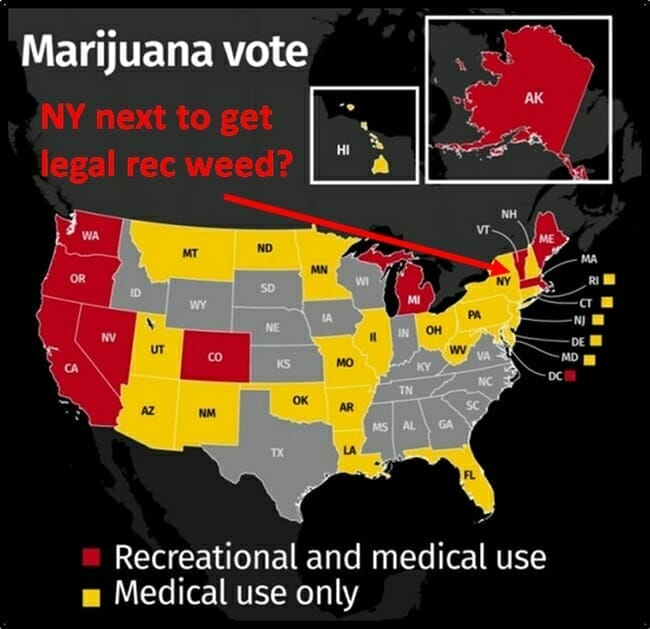

Wednesday, November 6, 2018 U.S. voters in three states voted to legalize weed, while the resignation of U.S. Attorney General Jeff Sessions, “one of the most virulently anti-cannabis politicians in the country” – was viewed as a positive for marijuana investors in the U.S. space.

Ballot initiatives to legalize recreational marijuana in Michigan and North Dakota succeeded, while allowing the drug for medical use in Utah and Missouri.

33 U.S. states plus the District of Columbia currently allow for legal marijuana use either medically or recreationally.

“Momentum for marijuana reform continues to build across the country and in New York,” states The Daily Chronic, “In September Governor Cuomo endorsed legalization and established a workgroup to draft legislation to legalize, tax, and regulate adult-use marijuana in New York.”

With the Democrats regaining control of the New York Senate and Assembly for the first time since 2010, New York is on the cusp of legalizing marijuana. The question is no longer should New York legalize marijuana, but what legalization needs to look like.

iAnthus owns Citiva Medical – one of the ten vertically integrated medical marijuana “Registered Organization” licenses in New York State.

Citiva’s license includes a cultivation and processing facility and four dispensary locations, which will be located in Brooklyn, Staten Island, Dutchess County, and Chemung County.

New York State Operational highlights:

- Finalizing design phase 39,500 square-foot modular cultivation and processing facility

- 2.2 million grams targeted annual production.

- Flagship dispensary located in high traffic area across from Barclays Center in Brooklyn

- Negotiating and finalizing leasing agreements for dispensaries in Staten Island, Dutchess County and Chemung County.

“Governor Cuomo and the legislature must build an adult-use program that ensures equity and diversity and reinvests in the communities that were the hardest hit by marijuana enforcement,” said Kassandra Frederique, New York State Director of the Drug Policy Alliance.

The wheels are turning so quickly here, that no-one has a firm handle on exactly how this new legal environment will play out for weed companies operating in the U.S.

Here, CNBC news gives it go – and does a pretty good job – with lots of user-friendly visual aids.

Brooklyn District Attorney Eric Gonzalez has now stopped prosecuting misdemeanor pot possession cases.

Over 3,000 low-level marijuana cases were recently thrown out after Manhattan District Attorney Cyrus R. Vance Jr. asked a court to delete 3,042 warrants for people who missed court dates or had cases pending.

More than 4,300 people got arrested for weed in NYC in September 2010. Eight years later (September 2018) arrest numbers are down 97% – to 151 arrests.

But it won’t all be smooth sailing for U.S. – focused weed companies.

According to US News, “Regulations and paperwork are driving up costs for financial institutions that serve marijuana companies.

One Colorado credit union was made to file more than 7,000 reports with regulators on behalf of 220 cannabis-related member companies – compared to 226 reports required for 33,000 regular members of her Partner Colorado Credit Union.

“When you ask me why banking is expensive,” stated the banker, “what you are really paying for are all the bodies it takes to file 7,000 reports.”

The iAnthus/MPX deal is the first public-to-public merger transaction in U.S. cannabis history.

It expands iAnthus’ business activities to 56 retail locations and 14 cultivation/processing facilities in 10 U.S. states.

Full disclosure: iAnthus Capital is an Equity Guru marketing client and we own stock.