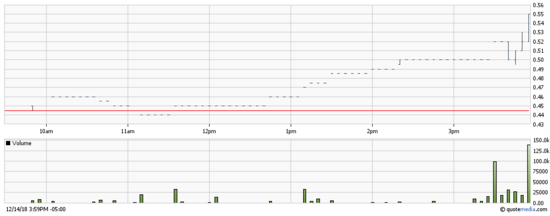

Canada Cobalt Works (CCW.V) dropped significant news on November 2nd. With barely 45 minutes remaining in the trading day, the stock broke out of its short-term holding pattern and went on a late session tear.

Before we peer into the fine details of Friday’s news, a brief refresher of some of CCW’s components (warning: this is NOT your ordinary junior exploration company):

- The company operates in a region which produced in excess of five-hundred million ounces of silver and over thirty million pounds of cobalt historically.

- The Castle Mine produced 9,410,095 ounces of silver and 376,053 lbs of cobalt in its day.

- The company boasts fully permitted underground access to eleven levels covering some eighteen kilometers.

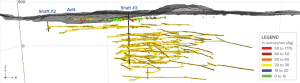

- High-grade cobalt veins, with significant nickel and silver credits, fan out across the property (the exploration blue sky potential is excellent).

- The company began a campaign of underground drilling back in June of this year.

- Underground bulk samples of high-grade ore are being collected and processed.

- Permitting the construction of an onsite six-hundred ton per day mill is well underway.

- A five-hundred kilogram per day pilot plant has recently been constructed to produce gravity concentrates.

- Gravity concentrates are now being processed using the company’s proprietary Re-2OX metallurgical process resulting in excellent recoveries of pay metals – 99% cobalt, 81% nickel, 84% manganese (significantly, 99% of the arsenic in the host rock is removed during this process).

- Re-2OX bypasses the expensive smelting process – a premium-grade cobalt sulphate has been produced in lab tests, one which exceeds the technical specifications of cathode producers in Asia.

- The company, working in ‘real time’, appears well on its way to becoming a vertically integrated cobalt company.

I’d be derelict in my duty not to remind readers that CCW’s cobalt is conflict-free – a consideration that cannot be overemphasized…

Dangerous Cobalt Mines in Congo Pose Challenges for Big Tech

The November 2nd news…

Canada Cobalt Drills 2.28% Cobalt Over 7 Meters at Castle

CCW began drill testing a network of high-grade vein structures underground at their Castle Mine project back in June of this year. The market has been anticipating these underground assays – eagerly anticipating them.

The market was expecting high-grade cobalt values. Expectations were met. Exceeded. We also have high-grade silver and nickel to boot.

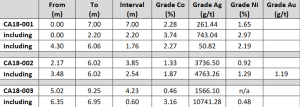

Highlights from the first three drill holes are as follows:

- 2.28% cobalt, 261 g/t silver and 1.65% nickel over 7.00 meters in hole CA18-001.

- 1.87% cobalt, 4,763 g/t silver, 1.29% nickel and 1.19 g/t gold over 2.54 m in CA18-002.

- 3.16% cobalt and 10,741 g/t silver (345 ounces per tonne) over 0.60 meter in hole CA18-003.

The maximum hole length for these first three holes was 30 meters. There is potential for additional high-grade mineralization at depth.

The table below gives you a nice breakdown of the ‘included’ values within the broader intercepts. Note that true widths are unknown at this time:

These are solid hits. Bar none.

The 2.28% cobalt over 7 meters encountered in hole CA18-001 towers over anything I’ve seen coming out of the junior Co exploration arena this year or last. Included within this impressive intercept are significant silver and nickel values.

The silver values encountered in holes CA18-002 and CA18-003 actually trump the cobalt, which is extraordinary, considering the Co grades. It’s conceivable that the silver, nickel and gold credits alone will cover the cost of production. I’m sure this is what CEO Frank Basa is aiming at.

Adding depth to the significance of this November 2nd news drop, CEO Basa stated:

“These cobalt grades are very high in a global context and demonstrate the unique opportunity at the Castle mine, from which we have already created battery grade cobalt sulphate through our proprietary Re-2OX process for evaluation by clients in Asia and Europe.”

“The purpose of this initial and continuing underground drill program is to confirm that the Castle vein structures do contain impressive cobalt values. Previous operators focused exclusively on mining high-grade silver through the 11 levels, ignoring cobalt and other metals such as nickel and gold.”

“We have a lot of room on the first level while pump testing continues to the second level, beginning at a depth of 25 meters. In light of these initial results, we are accelerating efforts at deploying the most effective underground techniques to fully leverage the Castle mine cobalt opportunity for shareholders.”

Newsflow from multiple fronts…

The above assays represent only the first three holes out of sixty-seven drilled so far this year. Fueling speculation, the company’s August 24th news release stated the following:

“… ongoing underground drilling has intersected visual cobalt mineralization in most of the 40 drill holes completed to date, covering a distance of 200 meters…”

There are no guarantees, but the above noted visual cues suggest there are more high-grade assays on deck.

The Company eagerly anticipates additional assay results and has fully winterized the Castle mine for continued underground work including drilling over the coming months.

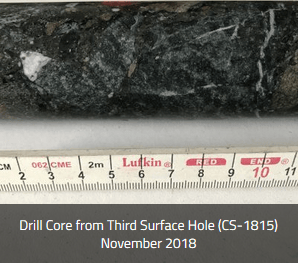

And let’s not forget about CCW’s recent discovery 1.5 kilometers east of the Castle Mine – 86 meters of “well-mineralized felsic Archean units at a downhole depth between 77 meters and 163 meters as well as mineralized mafic to ultramafic units above and below over significant widths starting from surface.”

This discovery was the result of some impressive geological sleuthing as the anomaly lay hidden under a thin layer of sedimentary rocks. Geophysical surveys and methodical (MMI) soil sampling helped uncover the anomaly.

Canada Cobalt also expects to provide an update shortly on the surface drill program east of the mine where a potential new discovery has been made with the third drill hole of the 2018 program.

CEO Basa uses the term ‘real time’ to describe the progress the company is making on multuple fronts.

Aside from extensive exploration and underground resource definition drilling, the company is busy working real time on…

- continued bulk sampling of the vein structures running along the first level at Castle Mine.

- dewatering and rehab of additional levels at Castle in preparation for future drilling (there are a total of eleven levels spanning some eighteen kilometers underground).

- the permitting of an onsite state-of-the-art 600-t/d gravity flotation cyanidation mill (key components and equipment have already been sourced).

- examining toll milling opportunities for customers with ore to process.

- ongoing metallurgical testing with its proprietary Re-2OX process via its 500 kg per day pilot plant where it’s already producing various cobalt formulations for end-buyer evaluation. (Re-2OX is a simple process – simple means easy to scale).

- follow-up lab testing with RE-2OX to recover lithium, cobalt and other metals from used computer and cell phone batteries.

- examining licensing opportunities with Re-2OX – multiple NDA’s (Non Disclosure Agreements) have been signed with interested parties.

Cool beans…

The goal of this ambitious ‘real-time’ business plan: production in 2 years!

If you’re new to the cobalt space and want to learn more about this dynamic company, the following Equity Guru offerings should bring you up to speed…

Canada Cobalt Works (CCW.V): Accelerating its activities in a prolific Cobalt Camp

Canada Cobalt Works (CCW.V): fires up its Re-2OX

Is Canada Cobalt (CCW.V) the mother of all wealth creators?

Canada Cobalt Works (CCW.V): continues to fire on all cylinders

Canada Cobalt Works (CCW.V) drum roll: Castle drill results on deck

The company’s website is also recommended – the video interviews are chock full of insight.

Final thoughts…

The late session news on Friday (November 2nd) exceeded my expectations.

With just over 70 million shares outstanding (92.45 million fully diluted), the company sports a very modest market-cap of roughly $47M.

There is a strong case to be made that CCW is undervalued at current prices.

END

~ ~ Dirk Diggler

Disclosure: Canada Cobalt Works is an Equity Guru client. We own the stock.

Feature image courtesy of the Republic of Mining.