One month ago, we profiled Oracle Energy (OEC.V), an aggressive Oil and Gas junior focused on the Eagle Ford Formation of South Texas.

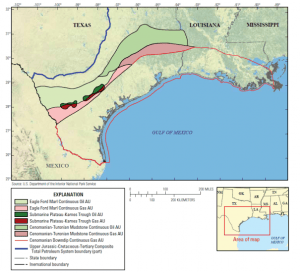

The Eagle Ford is a prolific oil producing formation…

The formation, according to the USGS (United States Geological Survey), is estimated to hold some 8.5 billion barrels of oil, 66 trillion cubic feet (TCF) of natural gas, and 1.9 billion barrels of natural gas liquids in “undiscovered” and “technically recoverable” resources.

The following link will take you to the full report…

USGS Estimates 8.5 Billion Barrels of Oil in Texas’ Eagle Ford Group

Those ‘undiscovered‘ and ‘technically recoverable‘ resource figures represent the volume of oil and gas that are in place and extractable using current technology. Technology changes almost daily. The above figures are conservative.

According to USGS scientist Kate Whidden, lead author of the above report…

This assessment is a bit different than previous ones, because it ranks in the top five of assessments we’ve done of continuous resources for both oil and gas. Usually, formations produce primarily oil or gas, but the Eagle Ford is rich in both.

Oil and gas are well-distributed throughout the Eagle Ford formation – more so than other shale area plays. And this formation contains a much higher percentage of carbonate shale – up to 70%.

Why is this carbonate component important? Because it makes these types of shale formations brittle. The more brittle the host rock, the easier it is to frack. The easier it is to frack… the greater the production potential.

Moving along…

A quick review of how Oracle evolved into an ‘Eagle Ford Only’ development play…

- in December of 2017, the company consolidated its shares.

- in early March of this year, the company announced that it was evaluating the acquisition of leases in the prolific Eagle Ford Shale Formation in South Texas.

- several private placements between March and June totaling $5.5M put the company in a position to execute on its targeted acquisitions.

- on June 19th, Oracle officially announced its ‘Eagle Ford Only’ change of strategy entering into an agreement with a private Texas entity to acquire oil and gas assets in this key oil producing region.

- on July 31st, Oracle retained Petrie Partners as financial advisors to assist in raising development capital for this development project. Petrie boasts more than 25 years of energy investment banking experience, including over 300 energy M&A and capital raising transactions representing over $350 billion of aggregate consideration. Big guns, these south-of-the-border banking types.

- on August 31st, Oracle provided an update on its Eagle Ford acquisition, results from a NI 51-101 report, and funding plans.

You don’t assemble a land position this extensive without good contacts. Safe to say that Oracle management enjoys heaps of respect in South Texas.

On the subject of management…

This team boasts decades of experience. Their skillsets range from geoscience to reservoir engineering – from facilities engineering, drilling and completions, to operation best practices.

This crew has an impressive résumé, having overseen a broad range of operations on projects which include the Pearsall Formations in Texas, the Bakken, and the Red River Formations in the Williston Basin. It’s a team that places great value on technology, particularly from a drilling-completion frack-design standpoint. They have access to the “latest and greatest technology“, and the expertise to run with it.

The assets…

The held by production (HBP) assets include 2,490 acres of mineral lease rights, 7 producing wells, 6 shut in wells, a water disposal well, and all production infrastructure.

July production from the HBP assets was 1273 barrels of oil and 5020 thousand cubic feet of gas.

There is an opportunity with the existing wells for workovers to significantly increase production.

The company also has an option agreement to acquire an additional 5000 net acres adjoining the HBP Assets (the Adjoining Lands).

The bigger play…

During a conference call with CEO McKenna last month, Equity Guru learned that Oracle anticipates spudding its first horizontal well within the next 4 to 6 months.

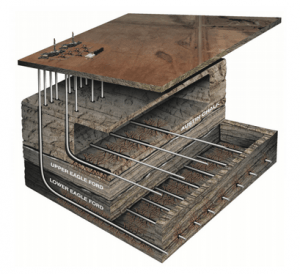

The company’s primary target with this drilling will be the Lower Eagle Ford Formation, with upside in the Upper Eagle Ford and Austin Chalk horizons.

This first drilling plan, which may include a pair of wells drilled from a single pad, will have a lateral extent of 1.5 miles. These wells get drilled fast – 16 days is the anticipated time frame for each well.

These first two horizontal wells may only be the start. The company anticipates a development campaign that could run for 3 years.

Greater insights into the company can be gleaned in the following Equity Guru article…

Oracle Energy Corp (OEC.V): a company with an aggressive Eagle Ford growth plan

Update…

Oracle required an extension – an amendment to the closing date for the completion of the HBP assets acquisition. It succeeded in its negotiations with the private entity seller.

Details of the amended purchase and sale agreement are spelled out below…

In the June 19 news release Oracle advised it had entered into an Agreement to acquire certain assets (“the HBP Assets”) in the Texas Eagle Ford, including acquiring 2490 acres of oil and gas leases located in South Texas. The HBP Assets include: the acreage, 6 producing wells, 7 shut in wells and the production infrastructure situated on the properties. The HBP Assets are currently producing approximately 70 boepd and have the opportunity for well workovers to significantly increase production. Pursuant to the terms of the Purchase Agreement, the Company will acquire a 100% working interest and a 74% net revenue interest. On Oct 1, 2018, Oracle advised that it was in active negotiation with the private entity owner of the HBP Assets to amend the closing date for the completion of the purchase. Oracle is pleased to advise that the parties have signed an amendment to the Purchase and Sale Agreement (the “Amendment”). This Amendment changes the closing date from Sept 28, 2018 to Mar 29, 2019 and changes the effective date from July 1, 2018 to Jan 1, 2019. The Amendment requires Oracle to make an additional cash deposit, before Oct 31, 2018 of USD $250,000 which will be applied against the purchase price.

An amendment was also negotiated with the mineral rights owners of the 5,000 acres of ‘Adjoining Lands’. This amended agreement requires an increase in the cost per acre. The details are spelled out below.

The June 19 news release also announced that Oracle has signed an “Option Agreement”, dated May 19, 2018, with the mineral rights owners of an additional 5000 net acres adjoining the HBP Assets (the Adjoining Lands). On Oct 1, 2018 Oracle advised of an option amendment agreement (the “Option Amendment”). Pursuant to the Option Amendment the exercise period for the Option has been extended to January 15, 2019 subject to Oracle making a US$250,000 non-refundable extension payment on or before October 1, 2018 and October 31, 2018 and by agreeing to an increase in the lease payments per acre upon Oracle exercising the Option.

Oracle advises that the required October 1, 2018 payment has been completed and Oracle intends on making the second required payment before October 31, 2018.

Final word…

Closing these transactions to gain control of the Eagle Ford assets appears to be on track.

Those selling their stock positions in recent sessions have likely lost sight of the compelling underlying fundamentals here. ‘Weak Hands’ might best characterize recent selling pressure.

At the center of this play is a tech savvy management team and an extensive land package in a prolific oil producing region. Management’s horizontal development plans have the potential transform this company into a significant producer.

There are roughly 55 million shares outstanding giving Oracle, based on its most recent close, a dirt cheap market-cap of > $5M.

Inside ownership currently sits at approximately 25%. Management’s interests are well aligned with its shareholders.

At current levels, Oracle looks like a compelling buy.

END

~ ~ Dirk Diggler

Full disclosure: Oracle is an Equity Guru client. We own the stock.