This week the weed markets corrected.

Equity Guru readers are worried.

They have every right to be.

Money is important.

Unless you already have too much of it.

We, the Equity Guru foot-soldiers, are not going to predict the length or depth of the cannabis sector pullback.

But this we do know: “The weed business is real. The product is real. The demand side is real. It is not going away. If you own stock in a weed company that is 98% ‘story’ (blue-sky), it will be more vulnerable to a sustained sell-off than a company with a strong business engine.”

There are many weed companies (clients and non-clients) that have strong business engines.

Case in point: on October 23, 2018 Crop Infrastructure (CROP.C) announced that Hempire, the tenant at its 49% owned Nevada CBD farm, has signed a three-year, 500,000 pound/year supply agreement with deliveries starting August 2019.

The CBD flower is to be delivered in shipments of 50,000 dry pounds on a bi-monthly basis with payment to be made of $36.00 USD per pound to $57.00 USD per pound plus the cost of delivery depending on the CBD content indicated by the Certificate of Analysis.

If market conditions change adversely in favor of, or against the company, the contract stipulates that prices will not fluctuate more than 25% over, or below, the range of $36 – $57 per pound.

1.5 million pounds (3 years product) X $36/pound = $54 million sales.

CROP has a market cap of $40 million.

With 49% ownership, that’s significant.

For the uninitiated, CROP invests capital in land and equipment to increase weed operators sector growth, through leasing programs and ongoing management fees.

CROP’s opportunity arises from the fact that federal regulations prevent mainstream lending institutions from investing in weed companies. CROP invests in producers and processors through lease programs and fee-based management options.

“If you want to dumb down the CROP business model – think of it as a weed-specific Real Estate Investment Trust (REIT).”

On August 22, 2018, Crop announced that its Nevada subsidiary leased “an additional 750 acres of contiguous agricultural farmland bringing the total Nevada acreage to 1,065 acres with 240 acres under pivot.”

Pivot irrigation typically consists of galvanized steel pipe with sprinklers positioned along their length and mounted on wheeled towers. The flat Nevada landscape is ideal for this type of irrigation.

The lease also provides access to over 300 acres of additional water rights.

It is estimated that the 240-acre pivots will yield 240,000 pounds of hemp flower. The total cost of production is expected to be below $700,000 USD.

The tenant is planning a state-of-the-art extraction facility to make high-value CBD isolate.

“This is our first major supply contract,” stated CROP Infrastructure CEO, Michael Yorke, “We have been extremely encouraged by the number of interested off-takers that have contacted us about our 2019 CBD crop as all of our 2018 harvest will be used to produce CBD isolate.

With CROP’s footprint now consisting of 1,865 acres with 1,340 acres of water rights under pivot, CROP’s 2019 tenant production at the Nevada CBD farm will be approximately 2.6 million pounds.

CROP has developed a portfolio of assets including Canna Drink, a cannabis-infused functional beverage, US and Italian distribution rights to over 55 cannabis topical products and a portfolio of 16 Cannabis brands.

On October 11, CROP announced a 2,100 pound California weed harvest.

On October 4, 2018 Crop announced its in-development functional beverage, will now include a hemp seed additive designed by Naturally Splendid (NSP.V).

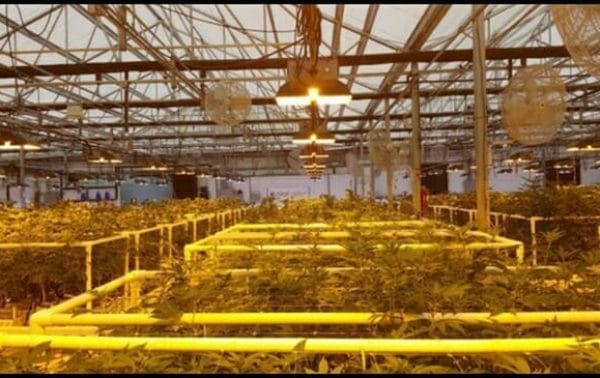

On October 1, 2018, CROP announced that it is leasing of a 87,120 square foot greenhouse in Italy through its joint-venture with local partner, Exemplar.

The company’s Italian CBD-hemp operations include 435,000 square feet of outdoor grow space and 87,000 square feet indoors. 25 acres of CBD hemp have been planted, according to CROP Infrastructure.

CROP is also developing a cosmetic and therapeutic product line created by Urban Juve Provisions.

Additionally, in June, 2018 CROP acquired exclusive Italian and non-exclusive US distribution rights for products created by Urban Juve Provisions and its parent company, The Yield Growth.

“CROPs portfolio of cannabis infrastructure assets now includes cultivation properties in California, Washington State, Nevada, Italy and Jamaica,” stated CROP Director & CEO Michael Yorke, “Management will continue to aggressively pursue new international opportunities.”

Cannabis industry analysts, The Brightfield Group, estimate the hemp-CBD market alone could reach $22-billion by 2022.

To paraphrase the great U.S. writer Mark Twain, “Reports of the weed market’s death are greatly exaggerated.”

Full Disclosure: Crop is an Equity Guru marketing client and we own stock.

You didn’t include the dispensary applications.

Nel, I agree. That was by design. Crop has so much deal flow, that the story will sprawl if we try to wrap a ribbon around the whole thing in one article. The primary focus here was Nevada CBD farm 3-year, 500,000 pound/year supply agreement with deliveries starting August 2019. Please stay tuned for more articles. This company is a beauty.