On October 18, 2018 C21 Investments (CXXI.C) announced that it has entered into a “definitive agreement” to buy Phantom Farms.

Phantom Farms has 80,000 square feet of outdoor grow space plus an additional 40,000 square feet under development in Southern Oregon.

A “legacy cannabis brand” based in Oregon, Phantom is known for its organic cultivation practices, with a focus on quality terpene development.

According to Leafly.com, “Terpenes are fragrant oils that give cannabis its aromatic diversity.”

These oils are secreted in the flower’s sticky resin glands, the same ones that produce THC, CBD and other cannabinoids. Like cannabinoids, terpenes bind to receptors in the brain and give rise to various effects.

Phantom received ‘Outstanding Terpenes’ award at the 2018 Cultivation Classic. It also won ‘Best CBD Flower’ at the Dope Cup in 2016 and 2018.

Cannabis is currently illegal at the federal level in the U.S., so Phantom Farms can not truck its product across state lines.

We believe that the potential for cannabis to replace opioids will eventually melt U.S. resistance to legalised pot.

Twenty-five years ago, a U.S. drug overdose victim was typically from a ghetto. The new victims are farmers, construction workers, traffic cops, lawyers, housewives. People-who-know-people-who-vote.

When country-wide legalisation comes – established brands like Phantom Farms will have a leg up in the new federal market.

“Joining C21 Investments will enable us to expand our operations and establish our brand as a powerhouse in the global cannabis industry,” stated Sky Pinnick, CEO of Phantom Farms.

Check out the drone photography in the video below, as Pinnick tours you around Phantom’s commercial outdoor weed farm.

[side-note: as every novelist knows, names are important; if you are going to grow outdoor weed in Oregon – the correct name is “Sky Pinnick”.]

The Phantom Farms deal requires the approval of the Oregon Liquor Control, which should take about 3 months.

C21 will pay US$8,010,000 to Phantom Farms by issuing 2,670,000 shares at USD$3.00 per share, and 2 million $1.50 warrants.

Chris Parry’s article, “Canopy Growth Corp (WEED.T) has $5 billion to buy something: What’s on the list?” – identified C21 Investments as a potential target.

“C21 Investments is a total bargain,” wrote Parry, “They’re buying up grow facilities, processing facilities, and dispensaries, putting serious effort into branding, and in quick time they’ve amassed significant revenue.

Here’s how that looks in terms of deals done:

- Silver State Relief: First licensed dispensary in Northern Nevada, serves 1200 customers per day, $10m expansion underway, $37.5m in revs over trailing 12 months

- Eco Firma Farms: 23k sq ft grow facility in Canby, Oregon

- Swell Companies: Developing public-facing brands that include Dab Society Extracts, Hood Oil, and the cannabis oil processor LoudLab Cannabis Refinement. Over 50 SKUs serving 275 dispensaries

- Dispensary acquisitions: The company has been picking up high performing Oregon based dispensaries as they emerge

Parry, who has pretty good track record guiding investors in and out of weed deals, calls C21 Investments “a literal steal.”

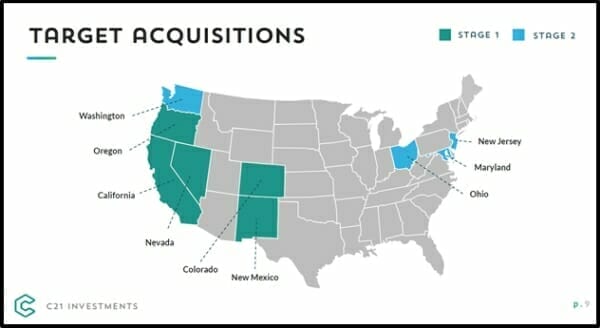

C21 is expanding into jurisdictions where it can own indoor/outdoor cultivation operations, processing/extraction facilities, bakeries, branded products, and retail dispensaries with established distribution.

C21 also recently agreed to acquire Grön Chocolate and Grön Confections (GrönCBD) LLC, one of Oregon’s largest companies specializing in luxury edible cannabis products.

“Grön is a critical addition to C21’s growth strategy to acquire operations that can vertically integrate in each state and compete aggressively in the US$11 billion cannabis market in the United States,” stated Robert Cheney, President and CEO of C21 Investments.

Other Phantom Farm assets:

- A 5,600-square foot wholesale distribution facility

- an extraction laboratory

- 7,700 square foot indoor grow facility

“Phantom Farms is among several successful companies set to join C21 Investments in order to make us a world-class, vertically integrated cannabis company,” stated Cheney.

Full Disclosure: C21 Investments is an Equity Guru marketing client, and we own stock.