Three days ago, Equity Guru scribe Greg Nolan alerted readers that results from Blue Sky Uranium’s (BSK.V) 61-hole, 1,029-meter reverse circulation drilling program at their Ivana Uranium-Vanadium deposit in Argentina are on deck.

“Ivana is largely a surficial deposit,” wrote Nolan, “It begins right under your feet. What Ivana lacks in thickness, it more than makes up for in lateral scale. The sprawl-potential at Ivana is considerable.

This 1,000 meters could go a long way toward expanding the current resource, a resource boasting some 19.1 million pounds of uranium and 10.2 million pounds of vanadium. Results could come at any time.

Well – the results came.

On Oct. 09, 2018 BSK announced the results from the recently completed reverse circulation (RC) drilling program on its wholly-owned Amarillo Grande Uranium-Vanadium project in Rio Negro, Argentina.

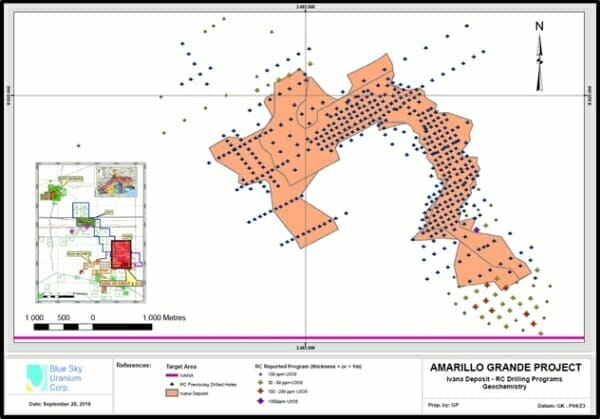

Results from all 61 holes demonstrate that the Ivana Uranium-Vanadium deposit extends 1 kilometer to the south of the current mineral resource.

That’s a large geographical expansion.

“We are pleased that drilling in the Ivana uranium-vanadium deposit area has demonstrated it is open to expansion outside of the current mineral resource,” stated Nikolaos Cacos, Blue Sky President & CEO. “Blue Sky continues to advance high-priority targets in the Ivana area while progressing the processing design and metallurgical test work to support a PEA.”

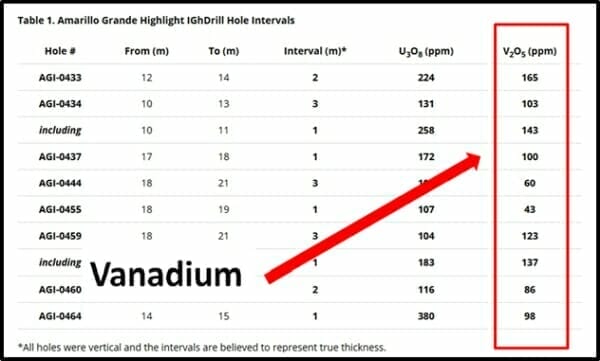

These latest results indicate lower uranium grades than the deposit average – over a much wider area.

Compare these results to October 30, 2017 results from BSK’s Phase II RC drilling at the Ivana target which boasted highlights.

- 1,131 ppm U3O8 over 5 m

- within 431 ppm U3O8 over 15 m in AGI-0170

- 1,030 ppm U3O8 over 5 m

- within 431 ppm U3O8 over 14 m in AGI-0169

Granted, the October 9, 2018 announced drill program didn’t have super-star holes, but the results are solid while maintaining significant levels of Vanadium.

Vanadium is a steel-blue metal used in the manufacturing industry owing to its malleable, tensile and corrosion-resistant qualities.

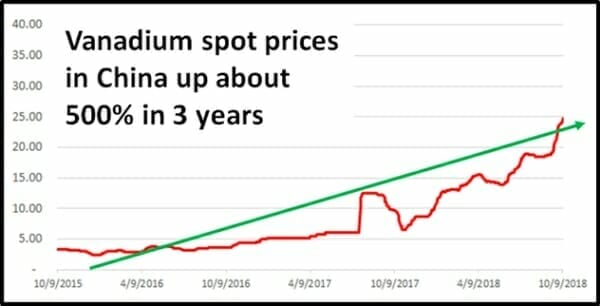

“In the Ivana deposit we announced 20 million pounds of uranium, and 10 million pounds of vanadium,” stated Cacos in a recent InvestorIntel video interview, “In the past that was considered a nice by-product, now it is a significant because the price of vanadium moved from $4.00 a pound to $19.30 a pound.”

“Vanadium redox flow batteries (VRFB) are quickly becoming the Cadillac energy storage solution for “peak-shaving, load leveling, microgrids, wind and solar, off-grid power supplies, and uninterruptible power supplies.”

A $500 million, 200 MW system being built on the Dalian peninsula in China, will serve 7 million residents – single-handedly tripling China’s grid-connected battery storage capacity.

Vanadium redox flow batteries last for 20 years, stay cool and retain their capacity even when fully discharged and they scale up easily to megawatt levels.

Today, about 85% of Vanadium production is used to harden steel. Battery vanadium demand is about to explode – although the metal is still little talked about among North American investors.

“Vanadium is difficult to find so it is relatively rare,” continued Cacos, “Demand is being driven by energy storage usage, but it is also being used in the production of steel.”

Events in China are catalyzing further increases in the spot price of vanadium.

After a series of deadly building collapses, the Standardization Administration for the People’s Republic of China, recently announced a new rebar standard – requiring the use of vanadium.

“Rebar” is used to give internal structure to poured concrete.

China produces about 200 million metric tons of rebar each year. Argentina is one of China’s main trading partners in South America. $13 billion of goods move between the two countries.

Blue Sky’s recent progress can be tracked in the articles below:

Blue Sky Uranium (BSK.V): Exploration blue sky at Ivana deposit – assays pending

Blue Sky Uranium (BSK.V): Advancing Amarillo Grande to the PEA stage – Update

Blue Sky Uranium (BSK.V) ups financing as vanadium draws interest and trading starts to roar

Blue Sky Uranium (BSK.V) Concentrating U308 with a significant Vanadium kicker

https://equity.guru/2018/04/19/blue-sky-bsk-v-announces-resource-estimate-global-metal-prices-surge/

Argentina Uranium Drivers:

- Argentina has three nuclear reactors generating 10% of its electricity.

- The construction of two additional reactors is planned.

- Nuclear Energy output is expected to increase by 250% by 2025

- All uranium for the nuclear industry is currently imported.

“In Argentina, we have first mover advantage,” Cacos told Equity Guru. “We have 25 years of Argentina mining experience. We share the wealth with the locals, and we’ve never had issues getting permits.”

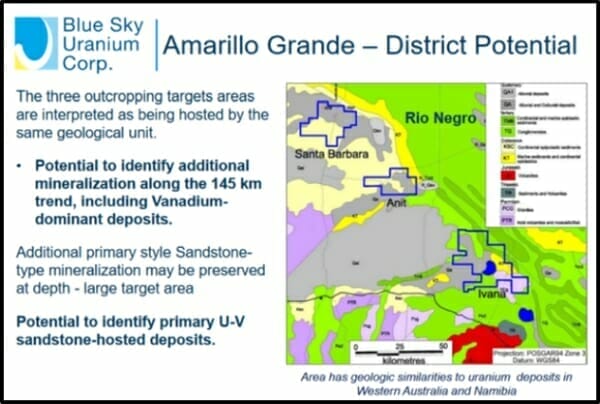

The Ivana deposit eats up about 7,000 hectares, in the southern portion of the 14- kilometer uranium-vanadium exploration trend.

Blue Sky Uranium controls over 280,000 hectares of mineral exploration rights.

The Ivana Deposit is only about 2.5% of the total property area.

Blue Sky traded down half a penny on the October 9, 2018 news – to .19 with a market cap of $20.8 million.

Full Disclosure: Blue Sky is an Equity Guru marketing client, and we own stock.