On September 25, 2018 The Green Organic Dutchman (TGOD.T) updated shareholders on a “spin-off transaction” – which is expected to close in mid November, 2018.

According to Investopedia, “a spinoff is the creation of an independent company through the sale of new shares of an existing business. The spun-off company is expected to be worth more as independent entity than as part of a larger business.”

The low-down:

- TGOD shareholders will receive 0.15 SpinCo Unit Warrant for each TGOD share held.

- SpinCo Unit Warrant holders have 30 day to purchase one unit of SpinCo at a price of $0.50.

- Each SpinCo Unit will consist of one share SpinCo and a half warrant.

- Each SpinCo Warrant is exercisable into one SpinCo Share at the exercise price of $1.25 per SpinCo Warrant Share

- Expiry date is 24 months from the beginning of SpinCo Share trading

The previously discussed repayable loan from TGOD to SpinCo, and the 25-year warrants are “no longer contemplated” by either party.

The press release cautions that “The Offering is subject to TGOD shareholder, regulatory and court approvals”.

The SpinCo Offering will be presented to TGOD shareholders at the AGM and special meeting of TGOD shareholders, around November 7, 2018.

According to the press release, the SpinCo will be “focused on investments in the cannabis industry in Canada and internationally.”

SpinCo’s investments may include the acquisition of equity, debt or other securities of publicly traded or private companies or other entities, in exchange for pre-determined royalties or distributions.

SpinCo’s board of directors and management team is strategically assembled to execute weed acquisitions and mergers. The initial team will consist of David Doherty, CEO and Director who is transitioning from TGOD, Nick Demare, CFO, and Jeff Scott, Director.

TGOD grows high quality, organic cannabis. It has a funded capacity of 170,000 kg and is building 1.3 million sq. ft. of cultivation facilities in Ontario, Quebec and Jamaica.

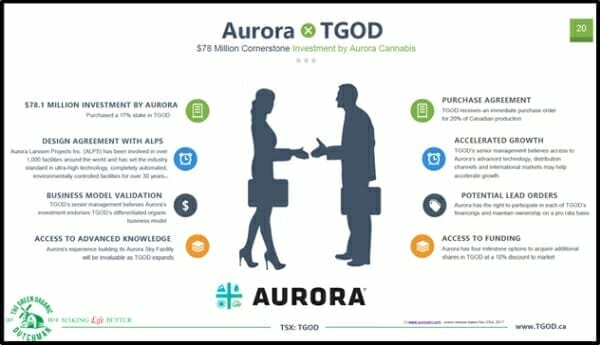

Aurora Cannabis (ACB.T) has invested approximately $78 million in TGOD for a 20% off-take agreement on Canadian production.

“Multi-tasking” works great – until it doesn’t.

Should TGOD be growing organic cannabis at the same time that it scours the world for good investment opportunities?

Possibly.

But from a messaging point of view – it’s a nightmare – fracturing investor focus. From an operational point of view – it will either create top-heavy management – or leave the existing management spread too thin.

In fact, this echoes Canopy Growth’s (WEED.T) – recent investment in Canopy Rivers (RIV.V).

RIV was created through a reverse-takeover of a shell company.

Prior to the IPO, Canopy Rivers made about a dozen weed investments, including licensed producers, weed tech companies and retailers, giving investors to exposure to a diversified basket of cannabis companies. RIV has a market cap of about $1.2 billion.

In the meantime, TGOD is getting things done.

On Sept. 12, 2018 TGOD launched its premium, certified organic cannabis brand – using no synthetic pesticides, herbicides or fertilizers.

According to a 2018 Hill & Knowlton research study, 57% of Canadian medical cannabis consumers and 43% of recreational cannabis consumers prefer organic cannabis. Of 116 licensed producers in Canada, TGOD is one of only two that are certified organic.

“We are delighted that TGOD will be able to provide the option of cleanly grown, certified organic cannabis to the Canadian marketplace,” stated Tia Loftsgard, Executive Director of the Canada Organic Trade Association (COTA).

TGOD’s Q2, 2018 financial and operational results included the following highlights:

- On-going construction of Ancaster, Ontario and Valleyfield, Quebec, facilities spending a total of $20.7 million

- Received organic certification

- Complete IPO, raising gross proceeds of $132,264,000

- Expanded its shareholder base from 4,000 to over 20,000

- Strategic partnership with vertically integrated Jamaican cannabis company

- L.O.I with Denmark’s Queen Genetics/Knud Jepsen A/S, which could increase TGOD’s total organic-funded capacity to 195,000 kgs

- Licensing agreements with US brands including Stillwater Brands, Evolabs, and CBx Sciences

- Completed a $25 million bought deal financing.

As Chris Parry reported last month, TGOD has also acquired “a significant European organic CBD oil brand, with associated licensed flower and seed production, consumer product lines, and multi-country distribution.”

“Gaining market share with CBD products now, in the EU, with over 700 locations, allows TGOD to establish immediate brand awareness across all verticals including infused beverages,” stated Brian Athaide, CEO of TGOD.

SpinCo intends to offer a private placement of up to 20 million units at a price of $0.50 for gross proceeds of up to $10 million.

To gain approval the Spin-co initiative requires 66.6% of the votes cast by TGOD shareholders.

TGOD will have no ownership rights in SpinCo after the Spin-off.

Full disclosure: TGOD is an Equity Guru marketing client and we own stock.