I’ve written this story three times in as many days, because every time I get to the bottom and am ready to post, the valuations of everything seem to have changed. So, to hell with it: I’m sticking the landing on this version.

Time for Equity.Guru to veer off market news and into fantasy sports for a bit with this look at the potential field for a big money acquisition or two from Canada’s largest cannabis player.

White Russians ready? Let’s roll.

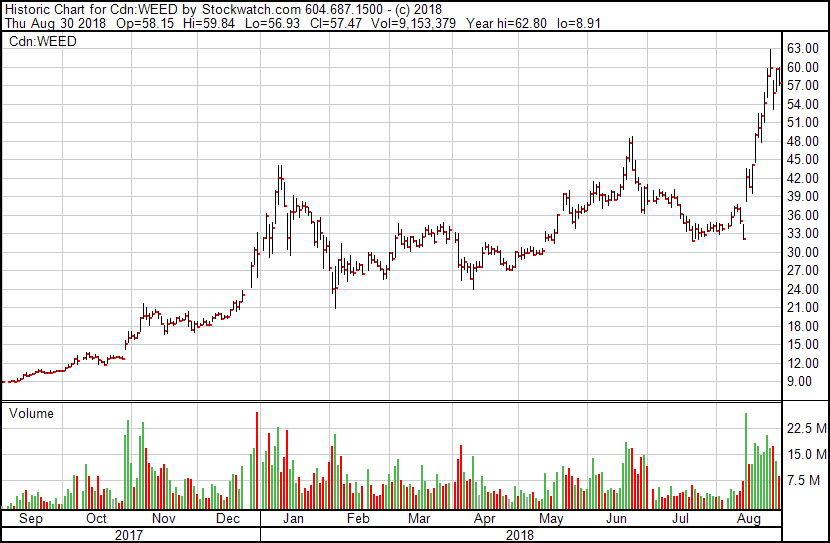

Two weeks back, Canopy Growth Corp (WEED.T) announced two important pieces of news:

- A $90m net loss, with much of that attributed to purchases but a still disturbing number attributed to

- A big investment by Constellation Brands, home of Corona, taking them to 38%, which will deliver up to $5b for the company to go on a buying spree

That first news drop brought with it a general feeling that we were at a point, in the cannabis sector, where financials were starting to actually matter. Big stock price slumps since January had begun to pick up new steam, with Aurora (ACB.T) moving from $9.50 to as low as $5.25 over the past six weeks, Green Organic Dutchman (TGOD.T) slipped from $8 to a bit above $5 in the same time, Maricann (MARI.C) went from $2 to $1.40, and the normally stable Aphria (APH.T) had downshifted from $11.50 to under $9 in just a few weeks.

Those fall offs, in percentage terms, were akin to the losses seen from January to March, wherein the entire industry took a swan dive, regardless of good news or relative value. It was brutal, and tested the testicular constitution of many a long holder.

When Canopy announced their losses for the quarter, cannabis social media channels got very dark, very quickly. I was drafting my story on the subject, in which I was going to announce that it was ‘reality trough time’, and that any weed stock not presenting real value or real revenues would be something to ditch for the foreseeable.

Here’s the bell tolling.

Canopy Growth loses $90.97-million in Q1 fiscal 2019

Canopy Growth Corp. has released its consolidated financial results for the first quarter fiscal 2019 ended June 30, 2018.

CANOPY HIGHLIGHTS Q1 2019 Q4 2018 Q1 2018 Active registered patients 82,700 74,000 59,000 Kg/kg equivalents sold 2,695 2,528 1,830 Kilograms harvested 9,685 4,811 5,575 Inventory assets (millions) $171 $118 $75 Revenues (millions) $25.9 $22.8 $15.9 Average selling price per gm $8.94 $8.43 $7.96 Cash/cash equivs (millions) $658 $323 $115 [..] Net loss in the quarter, after taxes and after the other expenses of $60.4-million just described, contributed to a reported net loss of $90.8-million or 40 cents per basic and diluted share compared with a net loss of $9.2-million or six cents per basic and diluted share in the comparative period last year.

Any way you slice it, those numbers aren’t great. Growth is good, and growth costs obviously, but if the biggest dog around can’t bring profits, who can? Canopy, at the time, was down by a third from what it sold for two months previous. Death was upon us all. The Hiku (HIKU.C) acquisition, Canopy stock-loaded as it was, was beginning to look like maybe it wasn’t a foregone conclusion. I’d even talked to HIKU CEO Trent Kitsch about whether he had a ripchord on the deal and could just abandon ship on it.

But then Canopy did what Canopy tends to do: It bullied the table.

Constellation Brands, a leading beverage alcohol company, and Canopy Growth Corp. have expanded their strategic partnership to position Canopy Growth as the global leader in cannabis production, branding, intellectual property and retailing.

Constellation Brands will increase its ownership interest in Canopy Growth by acquiring 104.5 million shares directly from Canopy Growth, thereby achieving approximately 38-per-cent ownership when assuming exercise of the existing Constellation warrants.

Constellation Brands is acquiring the new shares at a price of $48.60 per share, which is a 37.9-per-cent premium to canopy’s five-day volume-weighted average price of the common shares on the Toronto Stock Exchange and a 51.2-per-cent premium to the closing price on Aug. 14, 2018. Constellation will also receive additional warrants of Canopy that, if exercised, would provide for at least an additional $4.5-billion to Canopy Growth.

The $90m loss dropped at 8pm.

The buy-in was dropped at 5am the next morning.

I don’t normally cede to another bro’s excellence, but god damn, that’s some serious market jiu jitsu you pulled right there.

‘Hi, I’m Bruce Linton, and I’ve lost a ton of money every single quarter but FUCK YOU, COMPETITORS AND SHORTERS, LOOK AT THE SIZE OF THE DICK THAT I AM CURRENTLY SLAPPING YOU ON THE FACE WITH FROM MY OFFICE IN TORONTO!’

The market responded not just by boosting Canopy back up to where it had been pre-slide, but by also boosting Canopy competitors who, it is presumably reasoned, may benefit from others coming in with big buys of their own.

The market boost has not stopped in the days since. Canopy hit as high as $63 before leveling off, well above the premium paid by Constellation. We were beginning to get to that place where the stock was running too high, a stunning turn of events considering where things were days earlier.

The beverage market has always been looming as an important space – hell, we’ve been talking about it since Tinley Beverage (TNY.C) showed up a few years back.

Heineken has made moves towards ‘weed water’ through their acquisition of Lagunitas, Molson Coors has toyed with a few options through Hydropothecary/HEXO (HEXO.V) but committed to none, and there are public companies already out there, such as Tinley and TGOD, who have already either made moves in the beverage space or are in the final stages of same.

Here’s Lagunitas’ entry into the space:

‘Hoppy sparkling water’ is code for ‘alcohol free beer with weed in it’.

And here’s one of Tinley’s, from their website:

A single-serving, alcohol-free, ready-to-drink twist on the popular classic. Tinley Margarita is infused with real tequila and lime extracts, and Pineapple Jack Sativa. Less than half the calories of ready-to-drink alcohol margaritas (only 60 calories/serving). Drink cold and enjoy.

Pineapple Jack is a sativa-dominant cannabis strain bred with Pineapple family and Jack Herer genetics, designed to provide a euphoric, blissful effect.

FOR DELIVERY, LOS ANGELES COUNTY

BARC – BEVERLY ALTERNATIVE RELIEF, (323) 762-4683

We’ve been barking about the real money in cannabis coming from consumer products for a long time. Despite Aphria boss Vic Neufeld claiming (after Molson Coors chose to partner with a competitor) that he doesn’t think anyone wants weed in their beer, I sure as hell do.

Hey man, I’m diabetic, so setting the phasers to ‘blasted’ means I’m going to not just take a hangover L the next day, I’m also going to be high in blood sugar. This is a concern on both fronts and has led to the occasional night where a blood sugar spike has spun me into a bad place.

A non-alcohol drink that tastes like a margarita, gets me blasted like a margarita, but doesn’t rely on sugars to get me there, and has effects that will wear off by the time it’s time to drive home?

Aphria is butt hurt.

Last week Molson Coors (TAP.N) and Hydropothecary (HEXO.T) announced a joint venture to develop cannabis infused beverages, with 57.5% of ownership to Molson.

On the day of the announcement HEXO.T jumped $0.48 CAD and, even though Aphria released impressive financials, it dropped $0.94 CAD. There was a growing feeling among investors that Aphria was going to land this deal.

Stealing from Taylor Gavinchuk’s piece pre-Constellation buy-in:

In an August 8th interview with James West regarding Molson, Neufeld was asked “what happened?” Neufeld replied;

‘It’s not what happened, it’s what didn’t happen, and what didn’t happen is a major global beer brand making a real big statement in this space”.

Fast forward a week later and the market is abuzz that the world’s largest alcohol company, Diageo Plc (DEO.N), is chasing.

Diageo Plc is pursuing a deal with a Canadian cannabis firm, holding serious discussions with at least three major producers as the world’s biggest alcohol company seeks to add marijuana-infused beverages to bolster flat volume growth in its portfolio of global brands, multiple sources familiar with the matter have told BNN Bloomberg.

The entry of Diageo (DEO.N) – which sells big-name brands like Guinness beer and Crown Royal Canadian whisky – into the cannabis market would be another milestone in the burgeoning sector that has seen other major alcohol players such as Molson Coors Brewing Co. (TAP.N) and Constellation Brands Inc. (STZ.N) enter the space to fend off pot from cannibalizing alcohol sales.

Quick side note here: Constellation has a $49b market cap. Diageo has an $87b market cap.

Molson Coors, at $14b, is an after-thought.

So now we know the beverage/weed crossover is real, and here, and bringing literal billions in investment, it’s time to open the form guide and start looking to figure out a game we like to call…

WHO WILL CANOPY BUY?

Here’s what we know:

- Linton has said he’s looking to build global exposure, wants to be the Canopy of each country where weed is legalizing

- Linton has said he wants US exposure as that country opens up

- If anyone is looking to buy a given company and announces ahead of time what it is he’s looking to buy, the price will go up that instant, so I don’t think Linton is looking to buy internationally at all and we should disregard everything he’s said on the topic.

Here’s what Canopy and Constellation need to acquire for their plans to reach full effect:

- Beverage tech: If Constellation has an eye on the potential for a weed/liquor crossover, they need to get the tech right, and that’s not easy

- Cheap weed, wherever it is, including hemp: Which just got easier to grow legally

- Retail distribution: With Ontario changing it’s rules without warning, Linton wants 300-400 stores open quickly in that province

- Consumer brands: Anything that’s stuck it’s head out and acquired market share on the back of a nifty marketing package

- International exposure: It’s heavy lifting to walk a federal government from ‘marijuana is evil and we will jail you for touching it’ to ‘marijuana is taxable and healthy’, so why not just buy someone who has done it already?

- Competitors who may be a threat to the Canopy/Constellation alliance at some point and can amp up WEED’s market cap/share through acquisition

That’s a lot of stuff, granted. But here’s how I think it shakes out.

https://equity.guru/2018/08/28/cannabis-value-plays-100-200-million-cad-market-cap-region/

TARGET SECTOR #1: BEVERAGE TECH

TARGET SECTOR #1: BEVERAGE TECH

Top pick: SPROUTLY (SPR.C)

Sproutly just closed their acquisition of Infusion Biosciences and, frankly, if what IB says they do is accurate, we can put down the glasses and call the other runners off the track.

Extraction is costly and requires a significant capex and opex investment. Infusion’s technique has the potential to radically change how we go from weed grown to weed utilized in consumer products.

There are companies that are working on making cannabis oils water soluble (EG: turn them into powder), but the process tends to break down a lot of what’s good about those oils as it goes. Essentially ‘washing’ the good stuff off the plant into a water product is the golden fleece of this business, and Sproutly thinks they have it.

Again: …If it indeed works.

They’re working on proving out exactly how well it works now.

[Trace Research Institute founder Gordon] Fagras commented: “This is why our research collaboration with Infusion Biosciences is so unique in that the samples are naturally in water solution(s) where, we have seen not seen fallout of any manner so far, and thus we feel they are highly shelf stable. Modifying sample processing and analytical testing with these concentrated water solutions of cannabinoids (and terpenes) should provide us with a unique opportunity to develop analytical methods for cannabis beverages.”

Sproutly has a licensed LP facility as well as the Infusion Biosciences tech, so their current $83m market cap is an absolute steal, in my opinion, and make them a target not just for Canopy/Constellation, but for any company looking to not just make a decorative weed investment, but a first step into actual products.

https://equity.guru/2018/07/09/can-sproutly-spr-c-shake-cannabis-beverage-market/

Also lined up: TINLEY BEVERAGE (TNY.C)

Tinley shot up from a ten-month low of $0.45 the day before Canopy’s deal to $0.92 in the days since on the back of its industry leading position as a real cannabis beverage producer.

Their sales numbers aren’t going to blast you out of your seat, but that’s a result of their being in a long product development process, rather than a lack of market demand. By ‘industry leading’, I mean they’ve gone through the months of product testing and test marketing needed to launch something that doesn’t taste like cabbage water, which is something others have yet to do (*cough*Lagunitas*cough*).

CEO Jeff Maser, a month ago, told me, “The last thing you want to do is a splashy product launch when you haven’t figured out the kinks yet. We don’t know which of our products will kick on hardest, but each one – margarita, coconut rum, spiced whiskey, and amaretto extracts – is designed for a different type of demographic, use, and experience. In small pushes into test markets, we take what we learn back to the lab and then plan to expand on that sub-sector or sectors that really stand out, with more SKUs quickly released, leading to a hard launch that we have confidence will build on something real.”

More:

The company is acquiring additional bottling equipment and has also identified additional licensed facilities where additional production capacity may exist. The company cautions that total sales volume may remain limited until such improvements are in place, and there is never complete assurance of capacity with third party manufacturers. As such, full production capability will not be achieved until the company’s facility in Long Beach is operational.

There’s a fat target on Tinley’s back for anyone who wants in on the weed beverage space today, rather than in six months from now, and the way that stock price is jumping, there’s real incentive to make that deal happen ASAP.

Who they won’t get: GREEN ORGANIC DUTCHMAN (TGOD.T)

TGOD is neck deep in beverage tech, and just bought a big European hemp processing and production play in Poland that will plug beverages in really nicely, but Aurora has a piece of the TGOD franchise and unless Canopy really wanted to overpay, they’ll remain competition.

Top target: Supreme Cannabis (FIRE.V)

When I started writing this story, just after Supreme had engaged us to help them with marketing, it was a straight up takeout target. In the week since, it’s nearly doubled and volume is ramping up hard. The world is starting to figure out what John Fowler, Supreme’s CEO, has built here.

At a $380m market cap last week and with 340k sq ft of production space, and a reputation for both quality and low cost automated production that’s allowed them to profitably sell to other LPs, Supreme was a screaming buy.

Now that Supreme started a marketing program with us, the company is wearing a brand new $578m market cap… So, sorry to, anyone who wanted a stupid cheap deal back when the company never talked about itself – now you’re going to need to pay what it’s actually worth.

But Supreme won’t go quietly. They have ample cash to go a-hunting for their own targets, and Fowler has sniffed a few rear ends over the last year in the hunt for the right fit, but it wouldn’t surprise at all to see someone go after a group that has so deftly hit every one of their targets as a company, yet received no love from the market AT ALL until this past week.

If Canopy wants them, they’ll want to come get them now, because the world is waking up to what Fowler has built here.

One of Canopy’s big problems to date has been consistency of product. When you’re growing in a bunch of different places, some facilities of which you bought because others weren’t working out so well, and others you got because the market expected uber growth, getting a nice, straight, consistent, uniform product can be difficult.

Here’s what Linton said in the wake of the Constellation deal:

“This is about uniform product based on dried cannabis. [..] It’s drug research and identification, insurance coverage, dog care, geriatric, it’s a bunch of products that will come out in all areas of need, and then there’s recreational.”

Uniform product based on dried cannabis: That’s Supreme’s wheelhouse. It’s why they exist.

From the Supreme website:

[Supreme brand] 7ACRES is the largest facility of its kind to grow with advanced HVAC and C02 enrichment using the full-spectrum sun, rather than the limited-spectrum lamps used by many ‘hybrid’ growers. This advantage has allowed us to emerge as leaders in growing a craft quality product at consumer scale.

Canopy or not, recreational or not, if you believe, as I do, that you shouldn’t be chasing the puck as an investor, but should be skating towards it – if you should be looking for value, and the easiest likelihood of a double down the road, you just gotta do some DD right here.

I’m not going to tell you to buy Supreme stock, because that’s not my job and, with the jumps of the last few days, that likely double that I’m looking for on any buy just became harder work.

But what’s important to me right now is not who is buying the stock, but buying the product. The list of companies currently buying off Supreme is sick. If those companies approve, I imagine you will too.

Pure Global Cannabis Inc.’s (PURE.V) wholly owned subsidiary, PureSinse Inc., has agreed to purchase from The Supreme Cannabis Company Inc. an additional 210 kilograms of medical cannabis for resale.

Pure’s president and chief executive officer, Malay Panchal, stated: “We are very pleased to secure a significant volume of additional product that meets our standards of quality from our great partner, Supreme. With this order, our company will have ample cannabis inventory to go to market within the next few months, in addition to enabling us to launch several clinical studies in specific therapeutic areas.”

Mic drop.

Also lined up: INVICTUS MD STRATEGIES (GENE.V)

Also lined up: INVICTUS MD STRATEGIES (GENE.V)

Look, the Gene Simmons thing has been a giant bomb, but if you push past that misstep of hiring a spokes-celebrity who has a long history of ranting against weed use, Invictus has some really nice possibilities and a LOT of upside, especially for a measly $155m in market cap.

Here’s what they own:

- 2 x Licensed producers: Acreage Pharms in Alberta, and AB Labs in Ontario

- 1 x Late stage applicant: AB Ventures in Ontario

- 2 x Late stage applicant options: Unknown and unknown, both in BC

- 1 x Fertilizer producer: Future Harvest in Alberta

Yes, you saw it the same as I did: 27,000 kg planned capacity in 2018.

Now, a case could be made that the recently listed pubco artisinal roll-up, Greentec (GTEC.C), which is founded by the guys who helped grow Invictus back when it was a pup, might be an easier play to consume for a big guy like Canopy, and the $82m market cap on that play is smaller still than even the underpriced Invictus cap.

Whether you’re a GTEC homer or a GENE fan really comes down to what you value. For size, Invictus has plants growing and a pair of licenses on the move with, you’d have to assume, more coming on top of that. For upside, GTEC has beverage folks just signed on, has a dealers license through its Zen Labs, and has 100% ownership of everything it touches, while GENE likes to buy in chunks.

For mine, it’d be silly to side with one or the other, when you could buy both, right now, for a smidge over $230m.

That’s a handful of grow licenses and a dealer’s license and a lab and beverage tech and fertilizer production and more late stage applicants than a guy should feel comfortable with, and cross-country distribution, for less than half what it would cost to buy Newstrike (HIP.V), which is ass.

I mean, if Canopy doesn’t want them, maybe there’s scope for them to join hands and wade into battle as partners reunited. Either way, nothing this loaded stays this cheap for long.

[UPDATE: They just joined hands]

GTEC Holdings Ltd. has entered into a binding letter of intent with Invictus MD Strategies Corp. to provide GTEC with a non-revolving unsecured convertible loan in an amount up to $2-million, and an interest rate of prime plus 5 per cent. Subject to regulatory approvals, all or a portion of the principal and accrued interest on the loan facility may be convertible into common shares of GTEC, at the option of Invictus, at any time prior to or on the last business day immediately preceding the maturity date, as defined below, at a conversion price equal to $1.50 per common share. Upon mutual agreement of both parties prior to the maturity date, Invictus may increase the amount of the loan facility up to $6-million.

[..] The definitive agreement will also provide Invictus with a right of first refusal to fill up to 30 per cent of any cannabis purchase order domestically and internationally (whether for flower or oil) that GTEC, or its wholly owned subsidiaries, are seeking to purchase from third party licensed producers for a period of two years. The Invictus products will be sold under one of four recreational brands: Dukes, Zooey, Sterling & Hunt, and Sinister, each designed to target a specific audience and his or her lifestyle.

Who they won’t get: Organigram (OGI.V)

Look, OGI is cheap to buy, but it isn’t cheap to grow. It hasn’t got its organic certification back after its pesticide scandals of 18 months ago, there’s still the stink of potential lawsuits out there, the old CEO is still hanging on to his corner office with his stacks of paper and a big ‘MINE’ stamped across it all, and when you’re spending the money to grow organic weed but not getting the stamp that says it’s actually organic, the whole ‘Organigram’ name becomes a running joke.

Take it from me, OGI has been for sale for a long time and ain’t nobody buying. As for Canopy, they bought a pesticide problem once before when they took on Mettrum right before it was discovered they were hiding pesticide in the roof panels. They don’t need that grief – and open lawsuits – again.

TARGET SECTOR #3: RETAIL DISTRIBUTION

TARGET SECTOR #3: RETAIL DISTRIBUTION

Top pick: iAnthus (IAN.C)

Check it: Canopy already has not just plans for 300-400 cannabis retail stores just in Ontario, but they’ve already acquired the means to do it, there and in other places. With a partnership already going with Delta 9 to open 30 stores in Manitoba, and the existing deal acquiring Tokyo Smoke/HIKU (HIKU.C) giving them a recognizable brand they can roll out across Canada with minimal hassle.

But that’s Canada. Let’s talk the US.

MedMen (MMEN.C) is out there, telling the world that its dispensaries will rule the US, but they’re a long way from showing the sort of revenue their market cap demands, and some of those dispensaries they don’t even own but rather manage. And that’s before we even talk about the absurd bonus structure and voting weirdness at that company.

So let’s strike them from the conversation. If we want value, IAN has all the things MMEN has, but for a $374m market cap, and they have cultivation licenses in Florida, Vermont, Massachusetts and New York. Importantly, many of those states allow license holders to home deliver, which means the company can sell state wide, not just out of a shiny Apple store. They also have partnerships in places where direct ownership isn’t feasible, including Colorado and New Mexico.

Acquiring iAnthus would give Canopy – or Diageo, or whoever else – significant US coverage in a wide array of places that aren’t already at mass market saturation.

Added bonus: While all the other weed plays were getting beat up earlier in the year, iAnthus was going the other way – and it’s STILL undervalued.

From The Globe:

The top performing stock on the BI Canada Cannabis Competitive Peers Index is iAnthus Capital Holdings, which owns and operates cultivators, processors and dispensaries in six states. It has gained 144 per cent this year.

It’s gained a lot more since that article. Indeed, it picked up $50m in market cap during the time I have been writing this one.

For mine, this is a significantly undervalued enterprise that brings wide US exposure to any brand that plonks down the pocket change required to take it over and I fully expect it to be fought over.

https://equity.guru/2018/07/30/ianthus-capital-ian-c-bucks-downward-weed-trends-us-dispensary-plans/

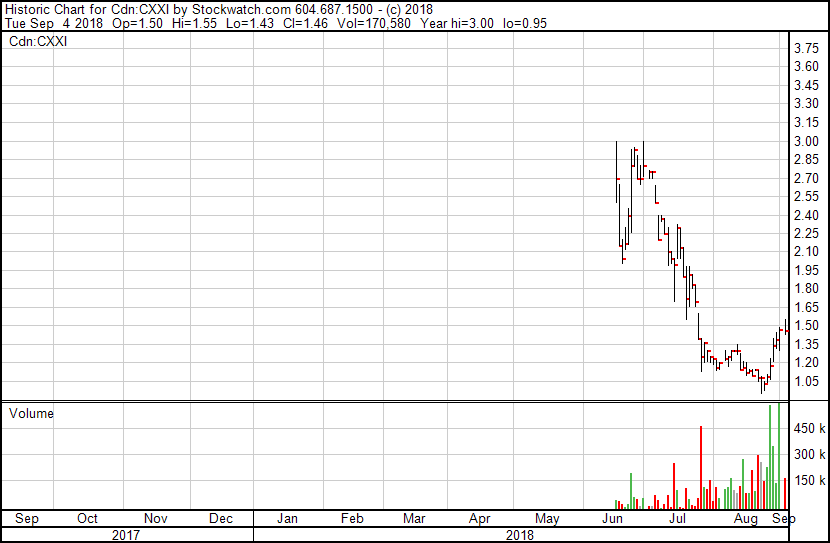

Also lined up: C21 INVESTMENTS (CXXI.C)

Also lined up: C21 INVESTMENTS (CXXI.C)

This thing is a total bargain. With Canada a literal wild west (and eager east) on the dispensary front, there’s no clear ‘buy it and you’re good to go’ option for Canopy or anyone else. So the US continues to be a more interesting retail distribution option.

Enter C21.

Admittedly, the pitch needs work:

We are an ecosystem of leading businesses in strategic markets focused on value creation through supply chain optimization, quality manufacturing, brand extension, and distribution and retail channels.

Translated: They’re buying up grow facilities, processing facilities, and dispensaries, putting serious effort into branding, and in quick time they’ve amassed significant revenue.

Deeper in the website, the plan becomes clearer:

C21 has definitive agreements to acquire cannabis companies in Oregon and Nevada, that when closed will make C21 one of the largest public cannabis companies in the world.

Here’s how that looks in terms of deals done:

- Silver State Relief: First licensed dispensary in Northern Nevada, serves 1200 customers per day, $10m expansion underway, $37.5m in revs over trailing 12 months

- Eco Firma Farms: 23k sq ft grow facility in Canby, Oregon

- Phantom Farms: Four farms in Oregon of over 80k sq. ft., serving over 175 dispensaries with award winning flower

- Swell Companies: Developing public-facing brands that include Dab Society Extracts, Hood Oil, and the cannabis oil processor LoudLab Cannabis Refinement. Over 50 SKUs serving 275 dispensaries

- Gron: North America’s first CBD cafe brand, as well as a producer of edible brands respected throughout Oregon, California expansion happening, two licensed facilities operating

- Dispensary acquisitions: The company has been picking up high performing Oregon based dispensaries as they emerge

If you’re thinking, ‘fine, they own Oregon, but what else?’, that Silver state Relief deal is what else. They have plans to go wherever others haven’t yet taken over, and small states that they can lock up without too much competition, that’s a nice move for the future.

Also, the stock hasn’t been supported at all, so you could grab it today for $66m, which is a steal.

A literal steal.

All that said, it won’t stay a steal for long. The volume is starting to notch up, ditto the stock price, and I know they’re working on more deals. I can see this moving quickly on the back of the right kind of future news.

They won’t get: CHOOM HOLDINGS (CHOO.C)

Don’t get me wrong, the market loves this strategy to tie in the Hawaii lifestyle into a weed brand, complete with the ‘don’t say the name Obama’ nod to his college legacy. And they’re starting to stack retail store applications now with dozens afoot in BC and Alberta.

But here’s the thing: Aurora already has a sizable chunk of the thing, and they also have a chain of hundreds of liquor stores that only need a good brand on the front door to be in business real quick.

https://equity.guru/2018/08/23/choom-choo-c-army-invades-bc-alberta/

Choom will do just fine, but it won’t be Canopy that gets it to a double, it’ll be Canopy’s competition.

TARGET SECTOR #4: CONSUMER BRANDS

TARGET SECTOR #4: CONSUMER BRANDS

Top pick: CannaRoyalty (CRZ.C)

There’s really only one pick in this category, ever, and it’s not only been built for this very purpose, but its share price has been on a tear all year while the rest of the sector got beat up.

Seeking Alpha’s Kevin Jackson makes some good points:

Beyond Cultivation

The CannaRoyalty investment strategy is built around [CEO] Marc Lustig’s core belief that cannabis will ultimately become commoditized, leading to plummeting prices and margins for the raw ingredient.

Rolling Stone magazine published a recent article entitled “Oregon’s Weed Glut: What Happens to Excess Pot?” that paints a grim picture of cannabis entrepreneurs. While investors need to keep in mind that the situation in Oregon does not mean that all markets will suffer the exact same fate, it does indicate that the commoditization of cannabis will affect all markets to various degrees in the future. Lustig is banking on this.

He also believes, however, that there is an opportunity to capture significantly higher margins through brand building, R&D, extraction, delivery devices, IP acquisition, and licensing. As evidenced in their June 2018 Corporate Presentation, one can clearly see that their track record of investments remains consistent with their “beyond cultivation” strategy. This is a strategy I strongly agree with and one that offers a needed diversification to many investors who are too heavily in licensed producers (LPs), particularly Canadian ones.

What does CannaRoyalty have?

Well not AltMed:

CannaRoyalty Corp. has entered into a binding letter of intent with Tidal Royalty Corp., a leading provider of royalty financing to licensed U.S. cannabis operators, whereby Tidal Royalty will acquire the company’s equity stake and royalty entitlement in Alternative Medical Enterprises LLC for a consideration of $8-million. CannaRoyalty will maintain the right to license MuV products in California, Nevada, Canada and other select markets.

And it’s not Wagner Dimas:

CannaRoyalty Corp. has closed the previously announced sale of its exclusive Canadian licence to use and commercialize the preroll technology developed by Wagner Dimas to Aurora Cannabis Inc. CannaRoyalty’s exclusive Canadian licence to use and commercialize preroll technology developed by Wagner Dimas was valued at $7-million at the time of the execution of the binding term sheet.

And it’s not Anandia Labs:

CannaRoyalty Corp. (CSE:CRZ) (OTCQX:CNNRF), a leading North American cannabis products and brands company, today announced the close of the previously announced acquisition of its investee company Anandia Laboratories Inc. by Aurora Cannabis Inc. for approximately $115 million.

Under CannaRoyalty’s formerly disclosed investment relationship with Anandia, CannaRoyalty initially invested approximately $4 million in Anandia, in February 2017. With the close of the Acquisition, CannaRoyalty’s equity stake in Anandia is valued at approximately $17 million based on the closing price of Aurora shares on August 8, 20181, representing a return on investment of approximately 315% for the Company’s shareholders.

I mean, CRZ just keeps banging out the equity events and bringing in cash that cost them less cash to acquire, and more and more investors are locking them in as a beautiful piece of their RRSP.

I just can’t be bothered listing out all their assets and brands because there’s too many, but here’s the brand page… And the IP/research page… and the infrastructure page…

That’s all well and good, but do they have revenue?

- Q2-2018 Revenue of $3.5 million compared to $643,437 in Q1-2018 – marks the successful initiation of California distribution and manufacturing strategy.

- Net income of $9.3 million (EPS of $0.18) and EBITDA of $10.4 million generated through execution of stated strategy to rationalize non-core assets and an increase in gross margin related to growing product sales.

- FloraCal (closed July 2nd) and RVR Distribution (“RVR”) (closing in Q3-2018) are performing above plan and are expected to drive sequential revenue growth through the second half of 2018 and beyond.

- Premier cannabis brand development platform powered by five licensed distribution and manufacturing facilities across California, delivering several of the state’s top independent branded products to the majority of licensed dispensaries in the state.1

CannaRoyalty is filthy. It’s a god damned beast, and has been from the outset.

But the market cap? Just $336m. But don’t wait around, Canopy – it was $273m a week ago

TARGET ACQUIRED. FIRE AT WILL.

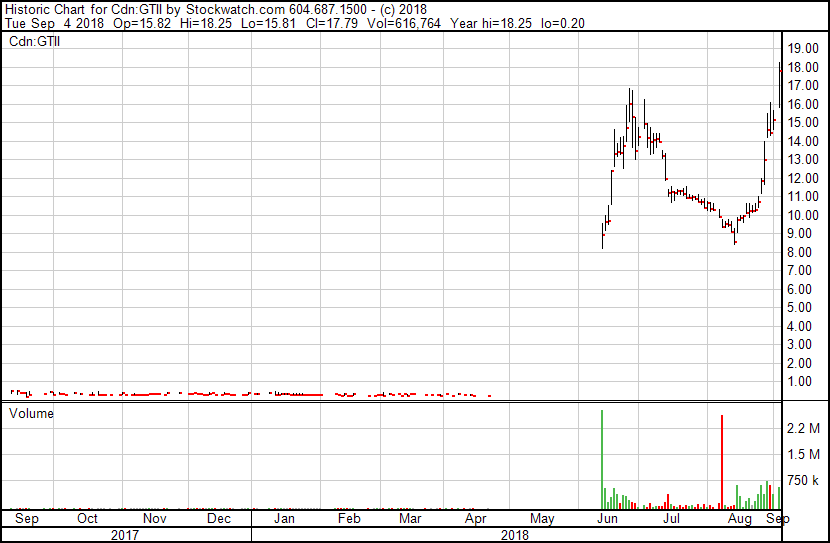

Also lined up: GREEN THUMB INDUSTRIES (GTII.C)

Also lined up: GREEN THUMB INDUSTRIES (GTII.C)

The $281m market cap on this recently RTO’ed US-based dispensary and grow roll-up is not at all absurd, especially since…

In connection with the reverse takeover, Green Thumb raised approximately CA$87 million through a brokered and nonbrokered private placement.

With more than 350 employees, Green Thumb operates seven cannabis manufacturing facilities and has licenses for 50 retail stores in seven states.

Jeepers. MedMen can eat a bag.

That said, the stock has gone up way too hard, way too fast, on not a whole lot of volume considering, so there may be some short term settling in the near future.

They won’t get: Dixie Elixirs (public soon)

In the annals of history, under ‘took too long, missed the boat’ you’ll find Dixie Elixirs. Yes, they have some name recognition, but what was once the monster of cannabis branding has taken way too long to penetrate beyond Colorado, California, and a few other spaces, being as it started in 2010.

Also, if they were going to get acquired, the time to do that would have been while it was still private. If it’s going public shortly, it’ll have to be a flop of a debut to leave the market cap looking like an attractive target.

TARGET SECTOR #5: INTERNATIONAL EXPOSURE

TARGET SECTOR #5: INTERNATIONAL EXPOSURE

Top pick: CROP INFRASTRUCTURE (CROP.C)

This REIT-like smallcap helps licensees with land, facilities, equipment and financing in return for a piece of future earnings, and they’ve managed to load up on opportunities from Washington state to California to Nevada to Italy to Jamaica.

The downside: Nobody gets it.

Still, this:

That’s their deal in Italy, 435k sq. ft. of outdoor grow, 87k indoor under construction.

Here’s what else they’re into:

- Jamaica: Applicant, 4 acres, 12k sq. ft. extraction facility

- California: Applicant, West Hollywood and San Bernadino dispensary locations with one partner, 10k sq. ft. grow with another

- Washington: 35k sq. ft. of canopy growing with one partner, 44k sq. ft. with 114k sq. ft. expansion planned with another partner

- Nevada: Applicant, 315 acres production ready, ready to seed

Now, it’s important to understand that CROP doesn’t own these locations or their associated businesses. What it does is finance their construction, retrofitting, upgrading, expansion, etc., and then takes a piece of future earnings going forward as repayment.

Until a few of those pieces fall into place and begin generating revenue that falls into financial quarterlies as profit, the greater market will wonder at what the real value of their deals is.

Here’s a hint: It’s worth a lot more than the ***$11m MARKET CAP** it boasts currently.

https://equity.guru/2018/04/05/crop-infrastructure-crop-c-cashing-washington-states-1-4-billion-cannabis-industry/

Also lined up: GREEN STRIPE (Public soon)

Also lined up: GREEN STRIPE (Public soon)

This one is waaaaaaaaaaaaay quiet, so get your reading glasses on and catch up with a deal that I think is going to be a killer.

Green Stripe has Jamaican licenses for cultivation, extraction, R&D, transportation, and retail, and off-take and joint venture agreements with the Gangja Growers and Producers Association of Jamaica, which sounds like a bunch of guys hanging out eating Johnny Cakes and getting baked, but is actually a very important lobby group in Jamaica, and not to be toyed with.

Cannabis has a long and storied history in Jamaica and, while it’s technically illegal, has been a cultural touchstone for as long as the island has been a thing. The over 3000 growers have deep political connections and don’t take kindly to outsiders coming in and taking liberties.

Hell, white boys even did a song about it.

Green Stripe has acquired the following conditional licenses:

- Tier 3 Cultivation Licenses for an initial 20 acres of cannabis cultivation

- Tier 2 Extraction License for 10,000 sq. ft. facility to be located at the University

of the West Indies (Mona Campus) in Kingston- Experimental and Analytical License

- Transportation License

- Herb House (Dispensary) License

The Jamaican government is currently working through new cannabis rules, one of which is expected to allow for export, which is the long term plan for Green Stripe.

In addition, the GGPAJ has negotiated a deal with Green Stripe to sell them up to 30,000kgs per month for $0.55 per gram. Hell, at that price, Green Stripe doesn’t need to grow its own.

The kicker in the short term will be the tourism market. The company will readily admit, most locals in Jamaica have their own connections that are long established to supply them what they need – or they just grow it themselves.

But 4 million tourists every year land in the country’s two main cities, expecting the ‘Jamaican experience’, which currently means being accosted by a guy with long dreads as they get off the boat after four days eating cold crab on the Lido deck.

There’s one ‘herb house’ currently, and it’s way out in the woods. Green Stripe’s plan is to place one that looks like a Jamaican, well, Apple store, right where the boats dock.

To make this, and all the other opportunities above, happen… they need $3m, which they’re raising (plus another $1m for future needs) right now, at an $11m valuation.

If you have a Mackie brokerage account, give your guy a call and ask about the pre-public raise.

[pdf-embedder url=”https://e4njohordzs.exactdn.com/wp-content/uploads/2018/09/Green-Stripe-Naturals-v12-July.pdf” title=”Green Stripe Naturals v12 – July”]

Canopy won’t pick up: Scythian Biosciences (SYCB.C)

If any pubco serves as a guide as to what the future may hold for Green Stripe, Scythian Biosciences – which acquired Marigold Acquisitions, a 49% owner of one of the only two other license holders in Jamaica – is exactly the ticket.

Scythian bought Marigold for $34.5 million, and just flipped it as part of a $193m deal to Aphria. Again, Green Stripe is raising money today at an $11m valuation.

So if Aphria is headed into Jamaica, and paying a bunch for a 49% share of a license, what’s the chance Canopy may follow suit?

Top pick: VIVO (VIVO.V)

I’m not necessarily a fan of renaming a company with a name that’s already shared by a cellphone provider, but the former Abcann Global has some really interesting elements that make it a real target for a grownup LP that wants international exposure.

The front page of the old Abcann website (the new Vivo one is a work in progress) opens with a very distinct message.

Yes, Vivo is international. It’s not making any bones about it – the company is very global. It even used to have ‘Global’ in the company name.

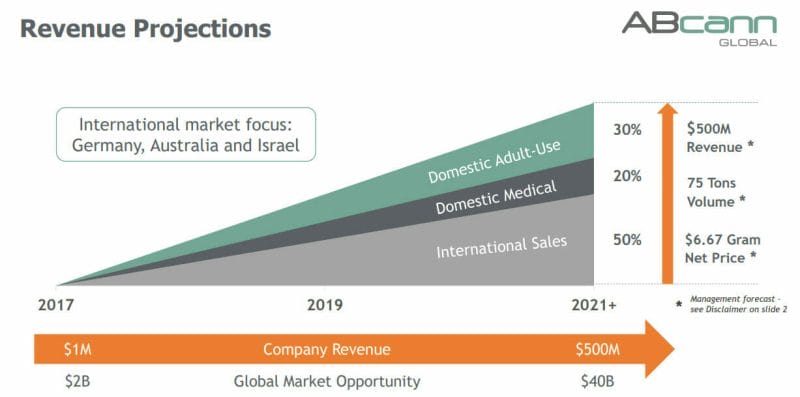

How international? They even have a graph.

Half of their revenue! While others have been inching their grows from 15k sq ft to 30k, then 60k, then 1 milion, Abcann/Vivo has been eyeing the foreign shores and working with regulators in far flung places to be first, or at least in the first group, to lock in.

“BUT HOW DOES THIS MAKE VIVO A BEVERAGE TARGET,” I hear you yelling, inconsolably.

Another graphic: Spot the mic drop.

DIAGEO!?!

Here’s board member Richard Fitzgerald, former CEO and Chairman of Diageo Canada.

Now I’m not saying Vivo has an inside track on getting Diageo to a billion dollar deal. But they don’t specifically NOT have an inside track to Diageo either.

And, just as an aside, you know who else has a Diageo exec on the board? GTEC.

GTEC Holdings Ltd. (TSXV: GTEC) (OTC: GGTTF) is pleased to announce that Lawrence Law has been appointed as GTEC’s Global Marketing & Branding Director. Mr. Law was previously employed at Diageo plc, the world’s largest alcoholic beverages company.

At Diageo, Mr. Law was Global Brand Director for Johnnie Walker’s Blue Label and Super Premium Portfolio. He was accountable for building a premium brand strategy, revenue performance and growth of Johnnie Walker’s Luxury Portfolio globally.

But back to Vivo – they have a retail storefront strategy, and skin in the game rather than just talk, which makes them an ever tastier option. This is Harvest Medicine, which they acquired and are rapidly building out.

- Education focused, patient-centric, cannabis discovery center and clinic

- Acquiring over 1,300 new patients monthly from a single location

- One of Canada’s most successful and fastest growing cannabis clinics

- Expand the highly-rated and scalable initial location to add over 15,000 active patients per year

Vivo also has a deal with Choom, which we mentioned earlier.

Lastly, in the spring, Vivo had a cash balance of $130m, which means not only are they able to scale up fast, but over a third of their $338m market cap comes in cash on hand.

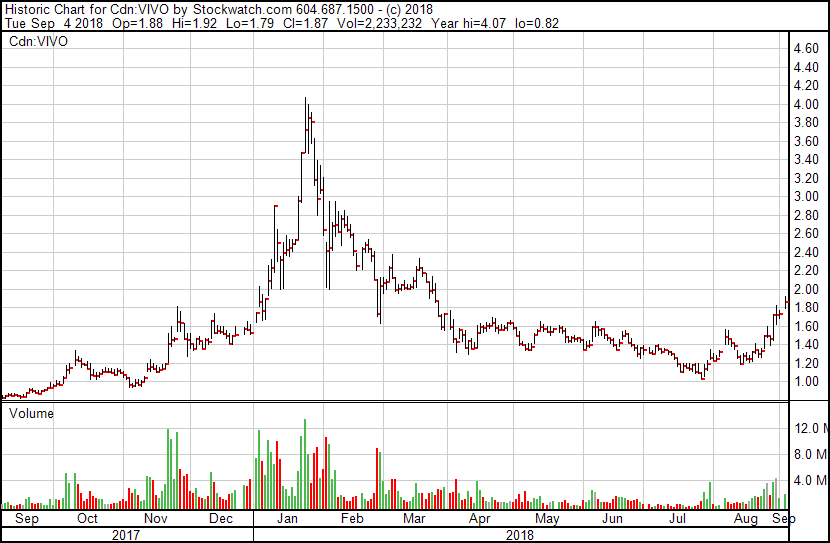

Risk reduced, potential for surges in value not unlikely. The chart looks balls out ready for a march up.

Also lined up: Emblem (EMC.V)

The first words on Emblem’s most recent corporate investor deck are, “FOCUSED ON GROWING SHAREHOLDER VALUE, NOT JUST GROWING CANNABIS.” If that’s true, it’s in regards to people who buy the stock today, not the people who have held it for the last few years, because those guys got BONED.

The most underperforming LP stock of the last few years, brought to market by the smart guys behind Organigram and TGOD but run by folks who seem to think that talking to investors is a skeezy act, Emblem is only now starting to move up its share price and make moves that have been long awaited.

This is a company that grows and sells weed (albeit at small levels) well, runs its ship reasonably tightly, has managed to avoid controversy and grow consistently in every way but market awareness, and grabbed a side hustle in GrowWise cannabis education clinics, which may give them a leg up on retail store frontage at some point going forward.

In April, $85m of their $185m market cap was held in cash.

That’s going to be important, because in October the laws will liberalize and allow for a much wider pharmaceutical approach to things, which has been Emblem’s strategy from the outset, since they hired former Purdue Pharma President and CEO John Stewart.

Now would be the time to come in hard and take it out.

Canopy won’t pick up: Emerald Health (EMH.V)

A cannabis company with a grow license, especially one that got theirs several years ago, should be selling cannabis. Or even growing it.

There’s no evidence in any of Emerald’s filings that it grows a damn thing, and the revenue that rarely changes tells me that they’re doing no (successful, if at all) customer outreach.

What’s the deal, Emerald? Do you guys just go buy some weed from someone else and stick it in the post any time someone stumbles upon your website and purchases some?

“I am proud of the success we’ve had scaling our business so far this year,” said Chris Wagner, chief executive officer of Emerald Health Therapeutics in the most recent financials news release.

Let’s be clear: He’s scaled that business from $279k per quarter in revenues in Q4 of last year to $284k per quarter in Q2 2018.

What’s to be proud of?

Revenue:

- June 30, 2018: $284k

- March 31, 2018: $373k

- Dec 31, 2017: $279k

- Sept 30, 2017: $211k

- June 30, 2017: $245k

- March 31, 2017: $201k

- Dec 31, 2016: $124k

- Sept 30, 2016: $48k

Net loss:

- June 30, 2018: $5.6m

- March 31, 2018: $5.0m

- Dec 31, 2017: $4.0m

- Sept 30, 2017: $1.9m

- June 30, 2017: $1.7m

- March 31, 2017: $1.2m

- Dec 31, 2016: $880k

- Sept 30, 2016: $1m

Share-based payments:

- June 30, 2018: $2.0m

- March 31, 2018: $1.9m

- Dec 31, 2017: $1.9m

- Sept 30, 2017: $271k

- June 30, 2017: $369k

- March 31, 2017: $201k

- Dec 31, 2016: $137k

- Sept 30, 2016: $467k

This is a company that has never lost less than 6x revenue in a quarter, currently loses 19x revenue, and is paying 7x more in share-based payments than it gets in revs.

And that’s supposedly worth $625m on the market? For what?

Oh, they did some deals recently, sure. They picked up Northern Vines lab from the odious Abattis Bioceuticals (ATT.C), basically for the price of their dealer’s license, and they talk a lot about 4m square feet of this and expansion of that, but the numbers tell the real story. This is an overblown promote that is trying to justify its cap by grabbing shit, and losing money by paying out stock to who knows who. Anyone who buys this, or the stock that underlies it, has probably been fooled by a Nigerian email spammer at least once before.

ONE FINAL TARGET: FRIDAY NIGHT (TGIF.C)

It didn’t fit easily into the other sections because, frankly, it touches on all of them, but Friday Night, under the helming of long time BC cannabis mover-shaker Brayden Sutton, has a serious mix of interesting pieces, any one of which could light up soon. They’re making a big play into hemp, they have a cavalcade of consumer products, they’re all over retail, they’re even pushing in on the logistics front.

- First marijuana cultivator approved in Southern Nevada

- 17k sq. ft. of grow and processing space

- Pre-rolls with over 30% THC already on local shelves

- High quality extracts produced with custom equipment

- Only licensees can apply for recreational licenses, putting them in great shape going forward

- Brands include AMA, Kurupt’s Moonrock, Krypted, and Vader Extracts

And the kicker? REVENUE:

Alternative Medicine Association (“AMA”) and Infused MFG (“Infused”) reported combined sales in July of $1.6M CAD, a 362 percent increase over July 2017.

Assuming that doesn’t increase in months to come, you’re looking at $4.8m per quarter in revenue.

And that’s before the big move into the hemp market, which Nevada is a perfect venue for:

The Company announced on June 6th that its newly-purchased production building would house a separate CBD Isolate Lab to process hemp biomass into CBD extracts, to be utilized in the production of full spectrum oils, distillates and isolates. The Industrial Hemp Handler Certificate was issued by the Nevada Department of Agriculture (NDA) Industrial Hemp program, conditional until final Fire Inspection and Health Authority documentation has been submitted before processing begins. Architectural plans are now being finalized for the building retrofit and rezoning applications have been submitted.

They haven’t been as loud as some of the other players out there, but Friday Night has been well steered and smartly put together, just as the stablemate of their founders, Supreme Cannabis, has. What Fowler is doing in Canada, Sutton is doing in Nevada; quietly building a cannabis company suitable for the next phase.

— Chris Parry

FULL DISCLOSURE: Supreme, Crop, C21, Vivo, TGOD, Sproutly, Tinley, Choom, GTEC, Invictus, and iAnthus are all Equity.Guru marketing clients, and the author maay own stock in those companies. Green Stripe has been in discussions. All companies mentioned are included on their own merits, or lack of.

A WHOLE lot to digest. Thanks, I will peruse tonight. However….I too am a Big Lebowski fan, and it ain’t a BLACK RUSSIAN, but a White Russian, as in a “caucasian russian” Even in your GIF, you can see it is white…now, on to the in depth reading….

Fair criticism.

This article is very informative and soooo entertaining:)

Thank you!

no mention of EMH’s 50/50 grow with VFF?

NOPE.

VFF does grow some of the finest peppers in all of East Delta.

Amazing article, Chris! I’m curious, though: what’s the reason you didn’t mention “Little Canopy” (LVWL.V) anywhere? With WEED’s 10% in the company, I would have thought they’d be at the top of the list.

Mostly it was due to space, but the fact Canopy is already in there indicates to me that an expansion of that deal is likely. I just don’t think it’ll be a mad premium to market necessarily, which is what an IAN or FIRE or TNY would take to nab.

Thank you, very informative!! Much appreciated!

Bruce seems to be proud that Canopy doesn’t do business in the US due to the federal laws. Do you think he will change his mind and purchase a US company? I’m thinking specifically of cxxi.