On August 28, 2018 Supreme Cannabis (FIRE.V) announced that its 100% owned subsidiary, 7ACRES, has agreed to supply recreational cannabis to the Nova Scotia Liquor Corporation and the PEI Cannabis Management Corporation beginning October 17, 2018.

Supreme Highlights:

- secured six provincial supply agreements

- Listed in provinces from coast-to-coast.

- Supreme Cannabis’ 7ACRES product to be listed as a “premium offering.”

Other companies with five or more provinces locked down, include: Canopy Growth (WEED.T), Aphria (APH.T), Aurora (ACB.T), Tilray (TLRY.NASDAQ), and Organigram (OGI.V).

Combined, these companies have a market value of $28 billion.

WEED alone is worth $12 billion.

Supreme currently has a market cap of $467 million – about 24 times smaller than WEED.

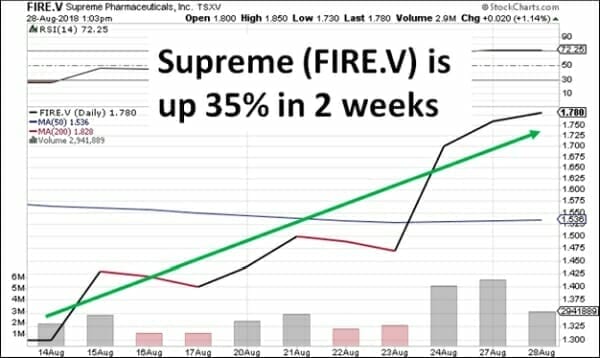

On January 3, 2018, Supreme was trading at $3.28. By August 14, 2018, the stock had sunk to a low of $1.30.

Since then it’s been on a tear.

“We expect to be one of Canada’s few producers who will be in stores coast-to-coast when the Canadian recreational market kicks off on October 17th,” stated John Fowler, CEO of Supreme Cannabis.

Supreme’s annual production capacity is targeted to reach 50,000 kilograms of premium-quality cannabis flower once the 7ACRES facility is fully operational.

Many of the companies we cover are a tangle of partnerships, subsidiaries, foreign patents, lease-backs, licensing and streaming deals.

In general, simpler is better.

“We make electric cars” (TSLA.NASDAQ) is a more effective thumbnail than, “We are developing clinical-stage lipid conjugate nucleotide analogs while testing investigational drugs in animal models to support effectiveness in diseases that are not feasible to study in humans” (CMRX.NASDAQ).

Supreme grows premium quality weed.

That’s its religion.

Its hobby.

And the reason it exists.

7ACRES’ 340,000-square foot hybrid greenhouse is situated in Kincardine, Ontario. It combines the best practices in indoor cannabis cultivation with the power of the sun.

The result is indoor-quality buds with sun-grown characteristics.

Supreme has recently signed deals with the Province of Ontario and British Columbia

According to a recent Financial Management Discussion & Analysis (MD&A), “Supreme management is focused on developing and maintaining 7ACRES’ position as a leading brand of premium cannabis flowers at scale. Sales of cannabis are completed via Business-to-Business (B2B) transactions.”

The B2B model is designed to allow 7ACRES to grow its revenue through high value bulk sales while maintaining its focus on cultivation, without the expense of patient acquisition and retention or retail order fulfillment and logistics.

During 9 months ended March 31, 2018 Supreme generated revenues of $5.3 million.

All dried cannabis produced by 7ACRES is marked as “Grown by The Supreme Cannabis Company”.

Included in the MD&A was a summary of investment risks including:

Reliance on a Single Location: Supreme’s current and future production is expected to take place at the Facility in Kincardine, Ontario. Adverse changes or developments affecting the Facility could have a material adverse effect on Supreme’s ability to continue producing medical cannabis.

Agriculture Business: Medical cannabis is an agricultural product. As such, the business is subject to the risks such as pests, plant diseases, crop failure and similar agricultural risks.

Brand Perception. Any negative changes to 7ACRES’ brand as a quality cannabis producer could have a material adverse effect on Supreme’s sales, profitability and financial condition.

Mitigating these risks is a brilliant bullshit-free CEO, John Fowler, who understands agriculture, politics, products, branding – and numbers.

“Profitability remains the measure of any company and the most significant metric for our shareholders,” stated Fowler in an excellent Pharma Board Interview, “Beyond our ability to lead in terms of profitability, I would like The Supreme Cannabis Company to be recognized as a dedicated actor in the social field.”

“You have to treat all stakeholders involved in your business model fairly. Not just shareholders, but all stakeholders.

It is our duty to focus on research, not only on the medical side but the entire supply chain of cannabis. Our government took a leadership position with its forward-thinking approach to the regulation of medical cannabis and the forthcoming legalization for adult use.

I believe cannabis can change the world and it can change the way we look at medicine.”

Supreme’s gross profit for the nine months ended March 31, 2018 was $4.5 million.

Full Disclosure: Supreme Cannabis is an Equity Guru marketing client, and we own stock.