We’ve been talking about CUV Ventures’ (CUV.V) plans to open a crypto-backed, blockchain-enabled, tourism/lending/remittance platform for some time, and for the most part you guys have been unable to envision it, judging by recent market stiffness.

https://equity.guru/2018/04/06/cuv-ventures-cuv-v-built-bank-nobody-looking/

Today, CUV launched what it had been promising for some time – at least the first version of it. And I downloaded it into my phone.

This is a big moment for me, because I buy into head honcho Steve Marshall’s plans to help folks send money home to mia madre without having to pay Western Union’s extortionate middle man fees. Using crypto to do it makes sense. Having the app extend out to bill payments and merchant lending likewise.

But it’s a lot to comprehend. There are more pieces to this puzzle than you’ll find in any other 6 companies combined, so being able to point to an actual functioning app is not a small thing.

The page on Google Play says:

RevoluPay® will allow users of the application:

– Charge funds to the digital wallet through Bank Transfer or Credit or Debit Card.

– Transfer your funds from the digital wallet to other users of the RevoluPay® application.

– Receive remittances instantly from family and friends around the world.

– Transfer your funds from the digital wallet to a bank account.

– Pay for the services offered by the associated companies

At first glance at the app proper, there’s not a lot there. Bill payments are coming soon and ‘mobile to…’ isn’t functioning, or even clear as to what it is. Entering my credit card details was done in Spanish, though it was pretty clear what needed to go where.

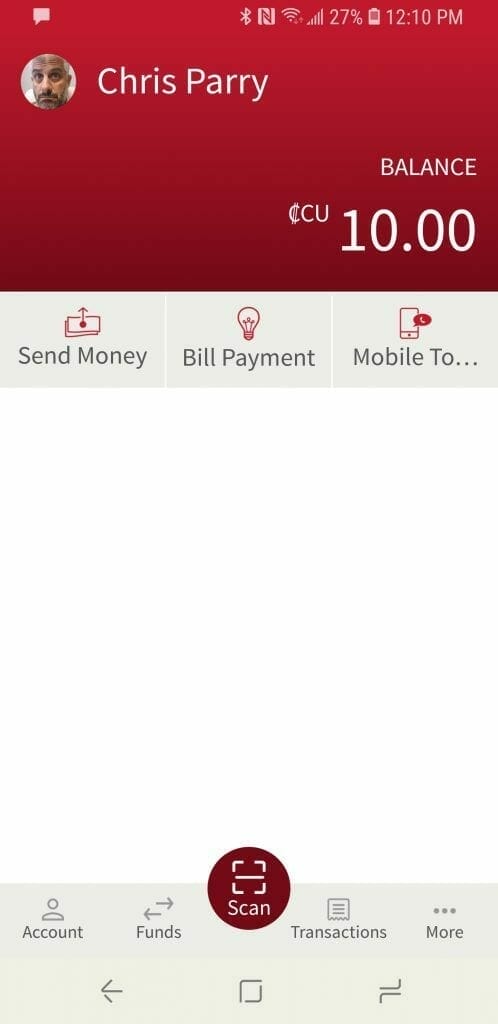

I know, I know, I should recharge my battery.

All the options on the bottom are functioning, and the send money option up top is functional. I’m no entirely sure what the ‘scan’ option does, but it’s positioning tells me it’s important.

As I don’t have someone in Cuba to send money to (call me), I didn’t test out that side of things, but adding money to my account, and thus turning it into CUV’s CCU cryptocurrency, works just fine. To withdraw money, the app uses a QR code to integrate with your bank or another user. That may be what the scan option is for, now that I think about it.

The app isn’t yet available in the Apple Store, so IOS folks will have to wait, at least a short while, and realistically there’s not enough good marketing info on the app’s page to compel people to sign on who haven’t been specifically directed there.

But this step, where RevoluPay exists in the world and has users, is an important one.

In addition, the company has launched RevoluPay Merchant, which allows people to do business with companies using CCU.

This is how you start a platform. With actual functioning software. Next comes the biz dev side of things, the filling out of the app with companies to trade with, places to borrow from, and functions to add – travel, accommodation, car rental, factoring loans and the like.

The news of the launch has been great for CUV’s trading volume. Today, as I post this, the company has traded around 5m shares, with a slight bump in share price.

But it’s still early days. As this thing fills out, one would expect revenues to start showing themselves, and margin, and real world business. When that happens, the current $11m market cap will look like amazing value, in my opinion.

— Chris Parry

FULL DISCLOSURE: CUV Ventures is an Equity.Guru marketing client, and has recently renewed its contract in the anticipation of upcoming news.

Hi Chris,

What are your thoughts Veslin Investments wanting to take more of the Revolupay app and CUV Ventures walking away from that?

The RevoluPAY app as released was done by Paynopain, a company in Spain.

Veslin has investments in other parts of CUV businesses. They are involved in RevoluFIN and are putting up some of the initial amount of money RevoluFIN is to loan out.

The news release states CUV is committed to working with Veslin in all the other parts of the business.

How secure do you think that is, in light of what happened with the RevoluPAY app?