Yesterday it was announced that Canopy (WEED.T) was acquiring Hiku (HIKU.C), no one saw this one coming. The adolescent cannabis space continues to get more and more unpredictable.

Hiku shareholders will receive 0.046 of a Canopy share for a common share of Hiku representing the equivalent of C$1.91 per Hiku Share and a premium of 33% based on the 20-day volume weighted average prices of the Canopy Shares and the Hiku Shares as of July 9, 2018, and a premium of approximately 21% based on the closing prices of the Canopy Shares.

This news also came hours after Organigram announced it was supplying Hiku’s retail locations in Manitoba with 1,000 kgs of cannabis per year for the next three years.

Hiku finds a prettier girl to take to the prom

Canopy’s acquisition led to the formal termination of Hiku & WeedMD’s (WMD.V) previously announced ‘transformational transaction‘ that would have merged the two companies.

It’s hard to blame Hiku for taking the superior deal. Who wouldn’t take the opportunity to be in business with Canopy? It’s like bringing the prettiest girl to the prom, or having the state wrestling champ as your best friend. The offer is for stock in the world’s largest marijuana company, at an attractive premium.

Hiku hasn’t sold a gram of weed yet, and their 40,000 square feet of planned production space can’t be something Canopy considers important. It’s the unique brands and storefront location that they acquired in the Tokyo Smoke deal that Canopy is after.

“Hiku equals brands. Canopy is built on brands. So we combined them.”

– Canopy CEO Bruce Linton

In that context, WeedMD who?

Runner up…

WeedMD got more than just an apology and a fresh corsage. They will receive a $10M CAD termination fee, which is a decent chunk of change considering in Q1 of 2018 they generated a total of $1.1M CAD in revenue.

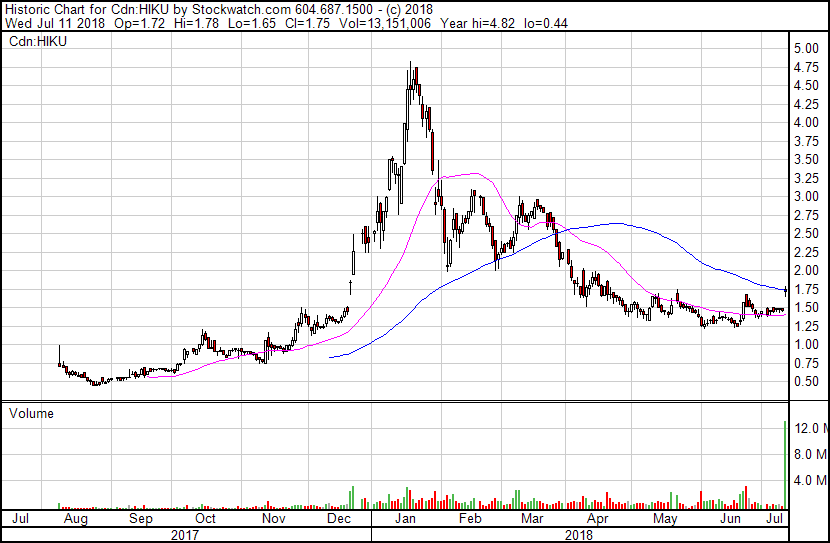

Before the trading halt yesterday, WeedMD’s stock had gone up 29.8% since the announced merger in April. Hiku’s stock is -17.3% over the same time period. Today’s action could be considered a re balancing, sending WeedMd down -16.1%, and putting Hiku +19.86%, in line with Canopy’s offer price.

If WeedMD’s 30% bump came from piggybacking on Hiku’s brand, and they ended up +14% with a $10M cash prize just for playing ball, that isn’t so bad.

The new WeedMD holds $58M CAD in cash, 25,620 sq/ft of completed grow space, and has plans to build out 390,000 total sq/ft of grow space. The company presently sells about between 50 kg and 60 kg of product per quarter. At yesterday’s $1.72 closing price, WeedMD has a $185M market cap.

Aphria sittin’ pretty

Aphria (APH.T) has to be happy watching all of this unfold. In June, 2017 Aphria bought 140,845 shares of Tokyo Smoke at $1M CAD. Those shares were later converted to 1,830,985 Hiku shares. Aphria upped their investment in December, 2017, by buying an additional 7,194,985 Hiku shares at $10M CAD. Aphria’s $11M CAD investment is worth $15.79M today.

If the acquisition goes through, Aphria will own 415,161 Canopy shares which would be worth $16.17M CAD today.

First of all, I’d like to say I laughed my ass off at the article’s main photo. Great choice! It’s hilarious!

But now, on to serious matters.

I’d like to run something by the EG experts to make sure I’m not missing something, because as it stands, I don’t see how Hiku shareholders are winning anything in this Canopy deal.

As I understand it, we will receive 0.046 Canopy shares for every Hiku share owned. If I do some quick math using today’s closing stock price, each Hiku share would be worth roughly $1.65 (0.046 x $35.81). This, compared to Hiku’s actual closing price of $1.62, is a disgrace of a “premium” on our shares and cannot seriously be considered a good deal.

My average cost with Hiku at this moment is just above $2. Being as much as almost 40% down during the last few months is not something that bothered me too much because I believed in the company and was looking forward to the day the stock price would hit its former highs (or at least go up something decent for a clean profit).

Now, presuming I hold on through this conversion, I would have to hope Canopy’s stock price hits $44 just so I could break even. My dreams of 100 % gains with HIKU are beaten, shot, and then spat on – maybe with one last kick thrown in.

In my (perhaps mistaken) eyes, it would be much easier (and more likely) for HIKU to jump 40 cents once legalization hits than for WEED to go up $8.20 since Canopy’s value is already so high.

Obviously, these numbers I’ve thrown out are not fixed and are subject to fluctuations between now and the date of acquisition, but the likelihood of this working in my favor is not very high and I can’t be the only shareholder faced with this disadvantage. I can’t see how this transaction works out mathematically to our benefit.

Am I mistaken? Am I looking at this the wrong way? What is Hiku’s management thinking in accepting a losing deal for shareholders? Is there hope the terms will be re-evaluated and amended to make more sense?

I greatly appreciate your attention to my posting. Have a good one!