On the surface, the rights issue announced by Creso Pharma (CPH.ASX) looks to be a decent deal for long-suffering shareholders, albeit it a little unusual.

The rights issue is non-renounceable meaning the rights are not transferable, and therefore cannot be bought or sold.

Once we dive deeper, however, it quickly becomes apparent that shareholders will likely suffer massive stock dilution as a result of this rights issue.

More on that below.

Paying lipservice to those caught up in the recent stock malaise

In the announcement Creso say:

One of the intentions of the Offer is to reward the Company’s long-term Shareholders for their loyalty, many of them having committed their capital at or before the Company’s initial public offer.

The Offer will also serve to help maintain shareholder loyalty and Share ownership for any shareholders who have purchased Shares since the Company’s Shares commenced quotation on the ASX.

Sure it’s a great deal for those who got in at the IPO price of 20c. These shareholders are still sitting on a 3-bagger at current prices. Seed holders have likely sold out a significant portion of their holdings and cleaned up already.

It’s also a good deal for anyone currently flat.

If you buy CPH shares before the record date, you’re entitled to participate in the rights issue. You’re buying the stock close to a 52 week low and the options will be a real kicker profit wise if the share price puts in a bottom at this level.

What if you bought in at the last cap raising, outlaying $1.10 for new stock?

You’re underwater by a fair margin and now have little choice in participating in this deal in an effort to cut your losses.

The carrot and stick approach will likely mean the offering is fully subscribed.

A wolf in sheep’s clothing- How to raise 30 million by stealth

While the $2.7 million Creso are likely to receive via this rights issue seems a little paltry, it pails in comparison to the roughly 34 million dollars they will receive if the share price is above the $0.80 strike price of the options within the next two years.

Given there are roughly 86 million shares outstanding, if the offer is fully subscribed then 43 million new shares will eventually be issued should all new options be exercised.

At $0.80 a pop that’s AUD 34.4 million which will flow into Creso’s coffers.

Dilution is a bad thing because it decreases a companies Earnings per Share or EPS, which invariably leads to a lower stock price.

On top of that, the rights issue signals Creso may feel they will have trouble raising capital by more traditional means in the near future.

Fool me once, shame on you. Fool me twice, shame on me.

The mechanics of the deal

It’s an options entitlement issue, not your typical rights issue involving straight shares.

Here’s what we know so far…

For every two shares held on the record date (July 30th, 2018), shareholders can apply for a $0.05 option with a strike price of $0.80 which expires in two years.

Given that these options can’t be traded, the only way you can make money is if the stock price is higher than $0.85 (which is your cost basis) within the next two years.

To cash out, you would need to exercise your options, paying your $0.80 per share to the company and then sell your shares when they appear in your account.

Also, don’t expect to make a lot unless the share price returns to old highs.

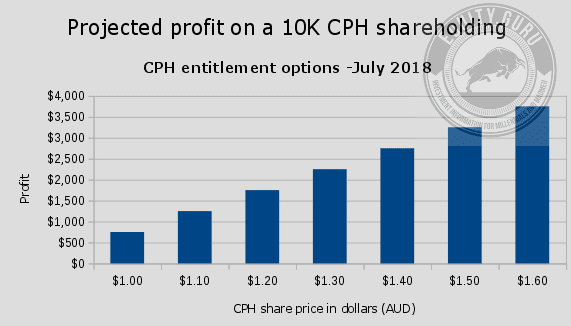

We’ve run the numbers on a 10K shareholding – not atypical for a smaller investor.

If you own 10,000 shares you are entitled to apply for 5,000 options at 5c a piece – a $250 outlay.

Based on the above, here’s how much you’ll likely pocket based on the share price being between $1 and $1.60 in the future.

As can be seen above, you don’t really start making decent coin until the share price hit’s the buck twenty mark.

That’s the question anyone looking to buy into this caper needs to ask themselves – “Do I see the share price doubling from here?”

Creso are asking you to pay 5 cents for an option valued at less than 2 ½

While it’s a moot point given the options are unlisted, it’s still worth mentioning.

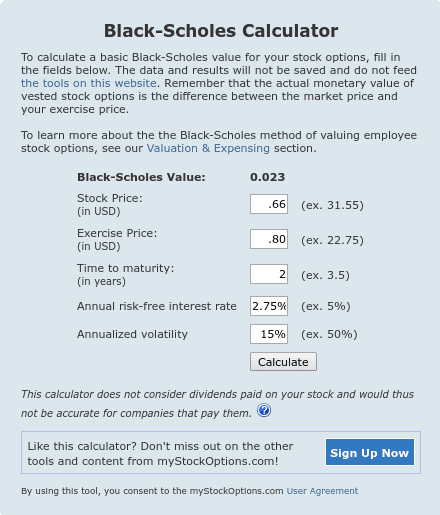

Option pricing, the realm of rocket scientists, is based on an area of financial mathematics known as the Greeks.

Inputs such as time to expiry (Theta θ ) and volatility (Vega Λ) can dramatically change an options ‘fair value’.

This is what makes them attractive to speculators.

We quickly pumped some numbers into a Black-Scholes calculator to determine the ‘fair value’ of the option based on yesterdays closing stock price of 66 cents.

We think we’ve been generous in assigning an annualized volatility of 15% given recent price action of late.

The result?

The option is worth 2.3 cents.

A parting thought: Creso Director Adam Bluementhal has an indirect holding of 4 million shares coming out of escrow in October this year.

Your ASX commentator,

Craig Amos

FULL DISCLOSURE: While we have traded CPH is the past we hold no position at this time. Creso are not an Equity Guru marketing client.

hi Craig,

the higher the volatility, the higher the pricing for the option. If you try increasing the volatility to 35% in that formula, you will see that its actually underpriced

Thanks for reading! – sure and you have to bump the IV up to 23% for ‘fair value’. That becomes the question – based on historical volty what is a fair value for implied? If I get time I’ll run the numbers and report back.

Offering closed. Wonder how many took ’em up?