I heard a wise man once say that nearly everything we do in life centers around changing the way we feel. Whether we aspire to satiate or suspend immediate sensations of hunger, loneliness, pain, boredom, lust – a lack of sufficient scratch – we are always looking for ways to bend our reality in a manner we think will produce feelings of relief or satisfaction.

Hmmm… kinda makes sense from where I currently sit (uncomfortable chair, lumbar strain, alone in this miserable… never mind).

With that in mind, it’s no wonder the cannabis industry – both recreational and medicinal – is expected to grow by leaps and bounds, by ‘billions and billions’ of dollars year over year (Carl Sagan voice).

In the US alone, legal cannabis sales are expected to reach $75 billion by 2030, according to research firm Cowen & Co. Those numbers are set to rival current North American soft drink sales figures. Damn… is it just me or is that a shitload of weed?

Friday Night Inc (TGIF.CN) is all about growth.

Yes, it’s a weed company. No, I’m not some hapless punster hoping to land some cheap yuk yuks. TGIF is all about growth – literally, figuratively, in a biological and business sense.

The widespread acceptance and growth of the medical cannabis industry, and now the legalization of recreational weed, will provide a boon for those companies with the expertise to capitalize on this rapidly expanding frontier.

Early-entry, first-mover advantage…

If I had the expertise, and I had a choice of areas to operate in, I’d choose those that represented the highest volume tourist destinations, those where people go to have a good time.

Nevada would certainly rank at the very top of the partay destination list.

Friday Night is a 91% majority-owner in the very first licensed cultivation facility in what is oft referred to as ‘The Entertainment Capital of the World’, the ‘City of Lights’… ‘Sin City’. Las Vegas has to be considered one of the largest recreational markets on the planet.

The economic engine for the state of Nevada, Las Vegas accommodates the majority of the states 2.8 million residents and draws in more than 40 million visitors each year.

Friday Night boasts early-entry, first-mover advantage in this key city and state.

Friday Night and its multiple facets:

Friday Night’s 91% owned cultivation facility – Alternative Medicine Association (AMA) – is the company biggest revenue driver.

The company has also diversified into the hemp and cannabidiol (CBD) product market via its 91% stake in Infused Mfg.

A relatively new acquisition to Friday Night is its 100% stake in Spire Secure Logistics, providing support services to a number of sectors, enabling businesses to stay secure, compliant, and competitive.

Friday Night’s current cultivation facility and expansion plans – Alternative Medicine Association (AMA) …

The cannabis products Friday Night cultivates and produces are high quality. Very high quality. Demand is strong.

Demand is so strong, retailers are having a difficult time keeping their shelves stocked. Prices have apparently skyrocketed as a consequence. This, according to a 2017 Forbes article Equity Guru’s Lukas Kane brought to light last month.

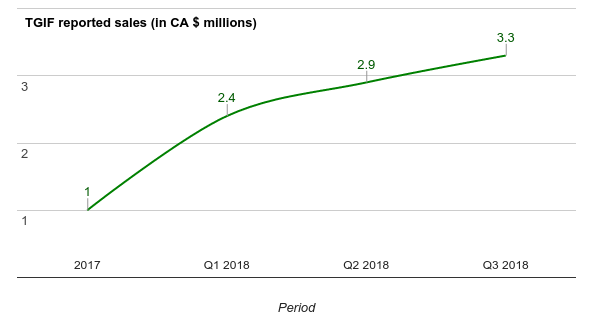

Friday Night’s current facility is 12,000 square feet. In the third quarter ending April 30th, AMA reported $2,102,453 in sales representing an increase over the previous two quarter’s revenue. There are obvious efficiencies at work here, efficiencies cultivated by management expertise.

Growing cultivation space…

Friday Night, seizing on its early-entry first-mover advantage in the state of Nevada, has aggressive plans to grow its cultivation space. Exponentially. After being granted approval for a two-story, 67,750 square foot cultivation facility on 1.4 acres, up from a previously envisaged one story, 35,000 square foot complex, the company is busy in the build-out phase of those upsized plans.

Once up and running, with completion expected by the winter 2018/19, the company will boast a total of 79,000 square feet of state-of-the-art flower cultivation growing space. This will support AMA’s line of well known cannabis-based products across the state of Nevada.

This expanded facility should have a dramatic impact on AMA’s contribution to overall company revenues.

A sample of AMA’s products…

Friday Night’s current hemp-based CBD processing facility and expansion plans – Infused Mfg…

The company currently produces a diverse line of hemp-based, CBD products sourced from high quality organic botanical ingredients.

A recent US$2,500,000 acquisition of a 12,160 square foot production facility located adjacent to the construction site that will house Alternative Medicine Association’s new cannabis cultivation complex, will be utilized solely for production, processing and extraction.

This new production complex will house a separate hemp (CBD Lab) processing facility operated by Friday Night’s subsidiary, Infused MFG.

This CBD Lab is expected to produce 440 lbs. /200 kg of cannabidiol or CBD extracts, which will be utilized to produce full spectrum oils, distillates and isolates. With a current market range of approximately USD $5,000 – $7,000 per kg, the CBD Lab will become a significant revenue generating division for the Company in wholesale hemp derived CBD extracts. The Company anticipates that the CBD Lab will be in production in the fall of 2018, in order to process what is expected to be Nevada’s largest fall harvest of industrial hemp crops.

In the third quarter ending April 30th, Infused Mfg’s sales increased from $937,663 in Q2 to $1,192,051 in Q3 from its Canna Hemp product line which sells in Nevada, California and Colorado.

Chris Rebentisch, President and CEO of Infused MFG commented,

“The CBD Lab will allow us to cut production costs of our Canna Hemp™ product line by more than one-third and provide us with the ability to control the quality of extracts. This in turn will increase the amount of CBD used in our products without needing to raise prices.” Mr. Rebentisch added, “As production of CBD in the United States increases and prices fall, having our own processing facility will better position our price points in any market conditions”.

With the new CBD lab slated for production in H2 of this year, Infused Mfg’s contribution to future revenues should also have a positive impact.

A sample of Infused Mfg’s product line…

With the dramatic increase in flower cultivation, production, processing and extraction space, overall company revenues are set to increase markedly.

Spire Secure Logistics…

With the company’s newly acquired Spire Secure Logistics subsidiary, $280,000 in contracts were signed and executed covering the next few months.

On April 12, 2018, the Company announced that its subsidiary, Spire signed a contract to provide strategic advice and expertise to a Canadian provincial government for the design and implementation of security programs and infrastructure for the legal distribution and sale of cannabis. Under the terms of the contract, Spire will be working with the provincial government to implement program system protocols for both retail and online sales of cannabis, focusing on the prevention of organized crime infiltration and black market diversion.

We will have to wait until next quarter to see what real impact Spire will have on company revenues. The division is brand spanking new.

A word on First Night’s most recent quarter…

For the three-month period ending April 30, the Company reported $3,317,497 in sales with total revenues for the first nine months of $8,744,683 million and gross profits of $4,176,656 on strong and growing sales from its US operations. Total sales increased from $2,962,699 in the second quarter to $3,317,497 in the third quarter with third quarter gross profits totaling $1,463,550 versus second quarter gross profits of $1,579,127.

For a little perspective, it’s interesting to note the trend developing in quarterly revenues.

Cash at the end of the reporting period was $13M.

Funding this aggressive expansion…

Friday Night is cash-flow positive. The construction of the expanded facilities have been budgeted for and those costs will be funded internally. The company’s $13M cash position provides a nice cushion should the company go over budget during the build-out phase.

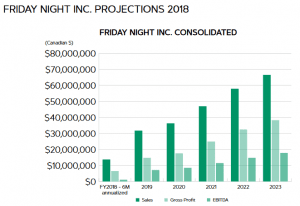

Projections…

Based on the scheduled near-term increase in flower cultivation, production, processing and extraction space, these numbers strike me as a tad conservative….

Management is Key:

There is only so much production a company can pull out of one single 12K square foot facility. Friday Night management has obviously pulled out all the stops, employing every efficiency at their disposal to increase revenues Q over Q. And it’s a good thing the company is so efficient – Nevada appears to need all of the high-quality bud it can lay its hands on.

The company is run by one Brayden R. Sutton, President, CEO & Director.

Mr. Sutton has been involved in the legal cannabis sector since 2012, where he held various executive positions with both public and private companies at the leading edge of the emerging cannabis industry.

Final Thoughts:

Friday Night, with 222.5M shares outstanding, currently has a market-cap of approximately $102.5M.

It’s price chart shows some nice base building action.

There’s an old market proverb about long base building patterns like the one pictured above – a bullish proverb – that goes, ‘the longer the base, the higher in space’ (yet another pun… apologies). But there is wisdom in these punny old adages.

END

~ ~ Dirk Diggler

Full disclosure: First Night Inc is not currently an Equity Guru client – they may be soon, however.