On July 12, 2018 HashChain (KASH.V) announced that it has closed a deal for two cryptocurrency mining companies, “contributing an aggregate total of 5,000 more Antminer S9 Rigs to HashChain’s existing 4,495 Rigs.”

HashChain acquired all of the shares of these 2 companies for an aggregate of 55 million HashChain shares at .35 per share for a total aggregate value of $19.25 million.

Equity Guru’s Chris Parry recently weighed in on this proposed acquisition. Now that the deal is closed, we’ll drill down further into it.

But first, let’s discuss the elephant in the room.

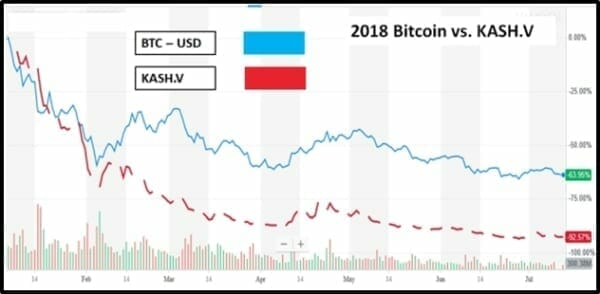

The HashChain chart.

It’s ugly.

How ugly?

To paraphrase Rodney Dangerfield, “So ugly we have to feed it with a sling shot.”

“HashChain came out with all guns blazing at $2.25,” wrote Parry, “making many who jumped into the early financing ‘on paper’ rich. But it quickly shunted downwards as crypto mining went out of fashion and blockchain 2.0 became the thing.”

HashChain is currently trading at .13, with a market cap of $17 million.

As we see from the chart below, HashChain’s stock price has moved in lockstep with the price of Bitcoin.

A couple of weeks ago, HashChain announced a plan to split into two independent publicly traded companies: “one business focused on cryptocurrency mining (HashChain) and a second business focused on cryptocurrency accounting and tax compliance software, including other disruptive blockchain technology solutions (NODE40).

“Creating two stand-alone businesses will allow each entity to maximize its respective growth opportunities and drive long-term shareholder value.”

According to Patrick Gray, CEO and President of HashChain, the two businesses “require separate strategies, focused investments, and dedicated leadership.”

Key Take-aways From Latest Acquisition:

Purchase Price Allocation

- 5,000 Rigs at $1,500 CDN per Rig equals $7,500,000;

- 7.5 Megawatts installed for $700,000 per MW

- 5-year commitment from the existing Targets’ management at $300,000 per year equals $1,500,000;

- 15 MW facility commitment for 4 years equals $2,000,000; and

- Goodwill equals $3,000,000.

Terms of the Agreement

- 22,000,000 HashChain Shares issued on the closing date of the Acquisition

- 11,250,000 HashChain Shares issued on the date the 5,000 Rigs are installed

- 5,250,000 HashChain Shares 90 days from the Closing Date; and

- 16,500,000 HashChain Shares 120 days from the Closing Date.

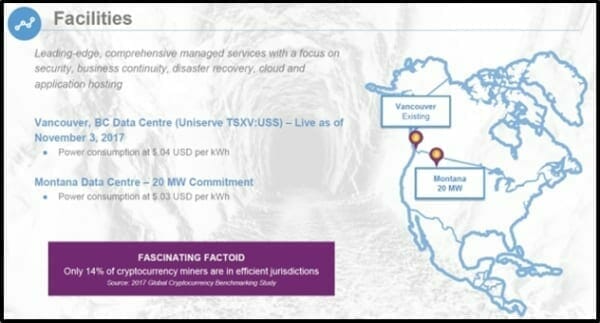

“We are currently installing the remaining 4,000 Rigs in our mining facility,” stated Gray, “Which upon expected completion at the end of the month will net us 9,495 Rigs operating at 14 megawatts of power.

At the current time, HashChain shareholders have stakes in two connected – but significantly different businesses.

With Bitcoin falling another 3% today to USD $6,178 – investor interest is shifting to cryptocurrency accounting and tax compliance software.

“The biggest challenge with blockchain is producing an audit trail of cryptocurrency transactions,” stated Gray in a recent CIO Applications blogpost, “We address this problem by translating blockchain transactions into a fiat denominated ledger that can be easily understood.”

The ledger can be modified to reflect a business’ real-world interactions on the blockchain. A full audit history is produced using specific identification that is in-line with existing IRS guidance on how to treat cryptocurrency as property.

HashChain’s Balance software takes something that “isn’t a standard asset for tax reporting purposes” and tracks and transcribes this information into a document that accurately lists crypto gains and losses as a “standard tax form that a CPA can understand.”

According to CNBC, “Over 800 cryptocurrencies are now dead and worth less than one cent, as Bitcoin has fallen 70% percent since its record high near $20,000 last year, adding to bearish sentiment around cryptocurrencies.”

There are three strong reasons why cryptocurrency wheezing is not a precursor to a fatal heart attack:

- Cryptocurrency prices spiked fast – and declined slowly. Typically bubbles like the Dot Com crash – do the opposite (rise steadily then fall apart at hyper-speed). The slow decline in crypto prices looks more like a correction than a crash.

- Blockchain is healthy. The underlying technology that made cryptocurrencies so attractive when Bit Coin was trading for $20 – is gaining traction across a matrix of industries.

- Spreading user adoption: There are 25 million blockchain wallet users around the world. The user-base is growing at about 15% per year.

“We are committed to expanding our global reach to provide investors with the highest returns in the market in the future,” stated Gray, “Whether through cryptocurrency mining, the tax solution, or the Masternode hosting service.

The possibility that cryptocurrency will die young is baked into HashChain’s share price.

If you think cryptocurrency will still be a thing in 2023, take a look at this vibrant, innovative company that has been living in a world of hurt.

Full Disclosure: HashChain is an Equity Guru marketing client, and we own stock.