Equitorial Exploration (EXX.V) has four North American lithium properties:

- Little Nahanni Pegmatite Group (LNPG) is a 43-101 compliant, hard rock, lithium property in the North West Territories.

- The 26-acre Tule Valley Project consists of 26 claims located 190 kilometers south west of Salt Lake City, Utah.

- The 1,780-acre Gerlach project comprised of 89 claims, located in the San Emidio desert, 120 km north of Tesla Gigafactory #1.

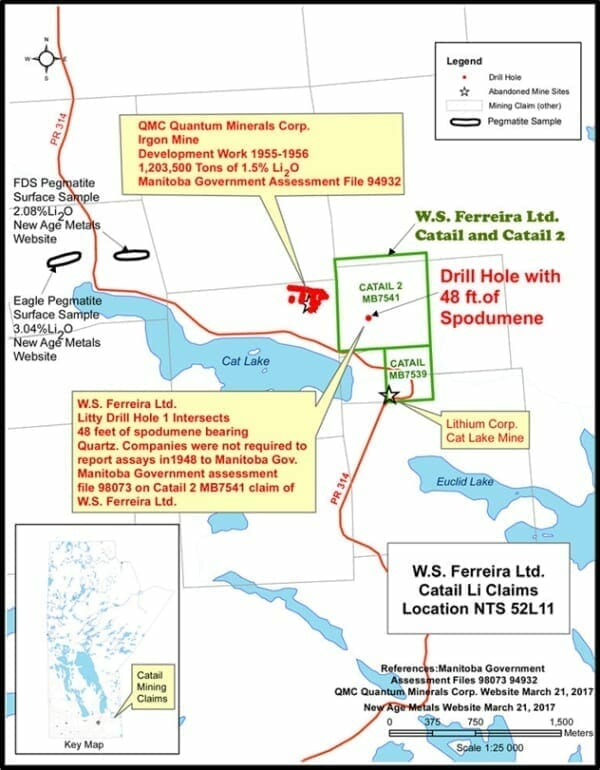

- The Cat Lake Lithium Property in Manitoba, Canada is directly adjacent to the Cat Lake Mineral Project

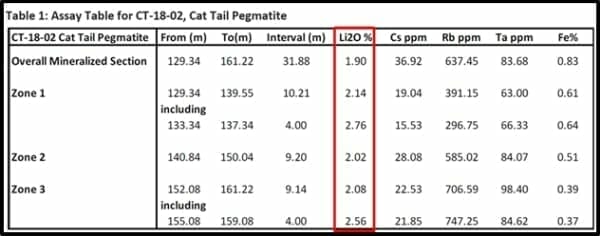

On June 13, 2018 EXX announced assay results from the discovery hole CT-18-02 in the Cat Tail Pegmatite in The Cat Lake Lithium Property.

This was the 2nd drill hole of EXX’s 1,256 meter seven-hole drill program, designed to intersect a possible extension of the Irgon, Pegmatite system, currently being developed by QMC Quantum Minerals to the west.

Assay Results from CT-18-02

A weighted average of 1.90% Li2O was obtained over a mineralized length of 31.88 meters from the discovery hole into the Cat Tail Pegmatite.

Drill holes CT-18-04 and CT-18-06 also intersected the Cat Tail Pegmatite, over a distance of 50 meters and remains open along strike and to depth.

The market reacted somewhat grumpily to the June 13, 2018 drill results, falling from .10 to .085 on 1.3 million shares.

Here’s the reason for the mini-selloff:

“At this time it is difficult to predict if the Cat Tail Pegmatite is a new pegmatite system,” stated the press release, “or an extension of the Irgon Pegmatite system to the west.”

Nine times out of 10, stocks are punished for anything that sounds like uncertainty.

“It could be this – and it could be that” is an entirely reasonable interim conclusion. But it is seldom greeted warmly by shareholders.

EXX would probably have received more love if they’d said: “Well that hole blew chunks – we’re bailing on Manitoba – getting on the next plane to The North West Territories – where we’re gunna dig aggressively into the frozen tundra with plastic shovels.”

But EXX didn’t say that – because the hole didn’t suck.

The close-by former underground Irgon Mine registered a historic pegmatite estimate of 1.25 million tons of ore grading 1.51% Li20, which lower grade than the weighted average of 1.90% Li2O from EXX’s last hole.

EXX Cat Lake Lithium Property Highlights

- Property situated directly along strike of Quantum Minerals’ Cat Lake Mineral Project

- The Irgon Mine (1956-1957) was an underground mining operation for spodumene

- Claim block 150 meters from south end of Irgon Lithium Mine shaft

- Claim block 93 meters east of the last exposed outcrop of the Irgon Pegmatite

- 63 meters of spodumene bearing quartz were reported drilled in 1948 on the company’s present claims (Manitoba Assessment File 98073 – not 43-101 compliant)

- Excellent infrastructure – Provincial Highway 314 in southeast Manitoba cuts through the property

Drilling costs money. On June 12, 2018 EXX closed a private placement by issuing 6,342,260 units at a price of $0.08 per Unit, for gross proceeds of $507,380. An insider subscribed for an aggregate of 500,000 Units.

In an April 26, 2018 article, Equity Guru’s Chris Parry called Equitorial Exploration, “The cheaper, busier lithium alternative to Quantum Minerals”.

“It stands to reason that if there’s lithium at QMC’s Irgon mine at Cat Lake, Manitoba, there’s going to be something similar at the edge of EXX’s property,” wrote Parry, “QMC’s market cap is $35 million. EXX’s market cap is $5 million. I maintain one is not inherently worth six times the other.”

Seven weeks later, EXX has a market cap of $6.2 million and QMC has a market cap of $31 million, so that gap is closing.

Parry’s central point is that, by comparison to QMC, EXX is a hive of industry, and busy companies that get-shit-done are often good investments.

Equitorial completes drilling program at Cat Lake

Equitorial hits 20 metres of pegmatite at Cat Lake

Equitorial drilling hits 36 m of pegmatite at Cat Lake

Equitorial Exploration begins drilling at Cat Lake

Equitorial Exploration to drill Cat Lake next week

By any reasonable measure, CT-18-02 (weighted average of 1.90% Li2O) was a good hole.

There are assay results from 5 more holes coming.

Full Disclosure: EXX is an Equity Guru marketing client, and we own stock.

Hi Lukas,

I like what the company is doing and it seems to be pretty transparent, the only thing that bugs me is the integrity of the CEO Jack Bal. From some of the decision and transaction he has done in the past with the companies he has been leading, i’m not sure if he is trustworthy. Since EXX is now your client is that something that concerns you? Your team have yet to talk about him so I was wondering if it was just in my head or if there was something there.

Anyways I really enjoy reading your articles, Best regards

Philippe

Hey Philippe, you’re right to look into management on any deal that you take part in. The thing is, the more companies a guy is connected to, because of the nature of the venture exchange, where most companies eventually fade out, the more likely it is that they’ll have been part of a loser.

This applies to your Frank Guistra’s and your Howe Street rounders, your noble executives giving it their all who get sold out by insiders dumping stock, and your two bit, four-month traders who blow paper out while telling you to buy.

I don’t have any issues with Jack, and the company is doing what they promised. That works for me, but we’ll take a deeper look at Moriarty’s claims and talk to Jack and see what we can see.

Update: I don’t see any news since June and others tell me they’re not getting phone calls returned. We’re turning off the coverage on this one and will dig deeper to see if it warrants anything scathing. Certainly shares are being sold off hard.

Any update on this? Seen some news come out today showing work being done. bought it awhile back but dropped it when we weren’t seeing news. is it worth getting back into?

YES. Sat down with the CEO yesterday, they’re doing a lot of work, putting money into the ground, and the last two batches of results have been lights out great.

We are all in.