If you got a phone call from an exec at Cronos Group (CRON.T) and said exec offered to let you buy 30% of their entire grow, which we have down as 42k sq ft, on current market cap ($1.6 billion) they’d likely be looking for around $500m for it.

If you got another call from an exec at The Hydropothecary (THCX.V) offering the same 30% of their $900k valuation and similar square footage, they’d likely want around $300m for it.

Maricann (MARI.C) has a valuation of $200 million, so 30% of their 40k sq ft would come to around $70m, give or take a few.

But hey, those guys have other business which blows out that valuation, so maybe you wanna go shopping further down the tree where the prices are lower.

Dosecann just sold out their 42k sq ft operation to Cannabis Wheaton (CBW.V) for $38 million, which puts 30% of their play at a bit over $12m.

Why am I harping on about 30% of facilities around 40k sq. ft?

Because CROP Infrastructure (CROP.C) just got 30% of a Washington State facility for $2.4 million.

Crop Infrastructure Corp. has entered into a membership purchase agreement with Wheeler Park Properties LLC, a Washington state limited liability company. Crop Infrastructure has agreed to advance up to $2.5-million (U.S.) to Wheeler Park for equipment purchase and retrofit upgrades of the licensed cannabis greenhouse complex in return for a 30-per-cent interest.

What’d they get?

The state-of-the-art 35,000 sqft Cannabis Greenhouse sits on approximately 9 acres of land and has undergone a complete retro-fit for full hydroponic automation including sophisticated irrigation and the addition of five hundred Gavita HPS grow lights. The greenhouse facility has 5 flowering bays that are designed to yield tenant growers over 10,000 pounds of high quality cannabis on an annual basis.

Fair value.

And not CROP’s first such deal.

Crop Infrastructure Director & CEO Michael Yorke states: “Wheeler Park complex is a technologically advanced Cannabis production facility that automates many aspects of the growing cycle, designed to maximize crop yields and quality while minimizing margin for error. This acquisition of a 30% interest in Wheeler Park represents Crop’s second interest in Washington State cannabis facilities and its third overall portfolio [company] including the recently announced Humboldt California interest.

The Company now has investments in three operations totaling over 67,000 sq ft of completed canopy space.

Crop intends to continue to pursue new opportunities and expand its portfolio of tenant growers, branding and infrastructure assets in strategic jurisdictions.”

67k sq ft of active canopy, kids.

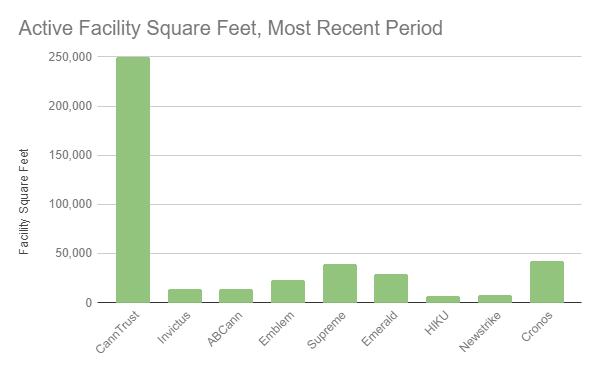

Where would this put them in value terms?

Take your pick.

Abcann (ABCN.V) is worth $270m.

Invictus (GENE.V) is $150m.

Emblem (EMC.V) is $166m.

Emerald (EMH.V) is $558m.

And CROP?

$30m.

— Chris Parry

FULL DISCLOSURE: Abcann, Invictus, Hiku, and CROP are Equity.Guru marketing clients.

https://equity.guru/2018/04/11/marijuana-datajam-gram-gram-seeing-really-growing/