A maddening mystery inspires manhunt in Mississauga. The oil market didn’t fall, so much as it was tripped. Leaks have us wondering about Kinder’s commitment and the projects profitability in an uncontrollable environment, and we found another Friday flyer.

Here’s what happened May 25

We want to first express solidarity with all of our readers in Mississagua and the greater Toronto area. At press time we still didn’t have any updates on who the two masked terrorists who put a bomb in a busy Indian restaurant yesterday were or why they did it, but if they wanted to get our attention they’ve done a pretty good job. While the motives and affiliations of the attackers are what everyone wants to know, right now they aren’t important. Law enforcement has a difficult job to do here, and we know enough about the resilience and intelligence of the people in TO to know that the police are going to have all the help they need. To everyone affected, you’re in our thoughts. Stay strong.

Oil is slippery

Brent and WTI both fell off the table today losing 3.2% and 4.2% respectively. We don’t have a lot of time to waste here at Equity Guru, so whenever the oil price takes a dive we head to oilprice.com, the only petrol news site worth reading, and figure out the why.

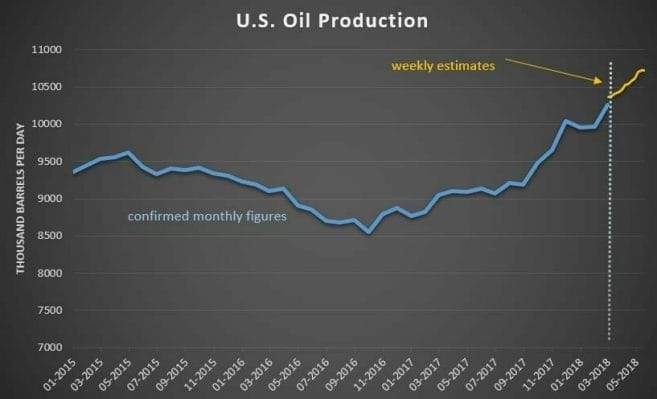

It turns out that oil fell for the same reason it usually falls: producers opened up the supply. Saudi Arabia and Russia didn’t even have to ship more barrels, just tell Reuters they are considering announcing that they’ll ship a million more barrels next week in Vienna, and it’s down we go. Between that and an increase in projected US production, it was time for oil to give back the gains it had been making all month.

Meanwhile, in Ottawa…

This all too common oil move and its reasons calls to question the urgency of the Federal and Alberta governments to effect the building of a pipeline from Alberta’s high-cost, low-margin Athabasca oilsands projects to the BC coast over the objections of BC’s government. The unusual (and undefined) step of protecting the project owner against losses incurred by political action took on new context today, when The Globe and Mail‘s Jeff Lewis and Robert Fife reported that the Kinder Morgan (KML.T) project is already $7.4 million over budget, but their source isn’t worried.

The official said it is understandable that Kinder Morgan is nervous about the B.C. NDP actions to stall the project just when the construction costs are expected to grow from $15-million to at least $150-million a month if Kinder Morgan resumes active construction.

However, the insider said Ottawa has seen the company’s books that show the “rate of return is healthy” and remains convinced the project will be built.

Assuming that the source’s assumed rate of return was calculating using the assumption that the line would be moving most of the 890,000 barrels per day of expanded capacity, we are reminded of the old adage about what happens when you ass-u-me.

In direct contrast to the light, sweet, liquid petroleum operations of the Saudis and the Russians who just picked up the phone to tell a reporter what the price is going to be and made it so, Canada’s oil sands are high in cost and low in margin. Bitumen producers anxious to get their product to tidewater will become anxious to keep it in the ground a while longer if OPEC decides that’s the way they want it, and pipeline tolls are generally collected by volume.

The Friday Flyer

On quiet May Fridays we usually look for a resource stock that’s on the move despite no news. This method tipped us to Pilbara basin land-grabber Pacton Gold (PAC.V) who had another big day today, up $0.13 to $0.77 (+13%) on 2.8 million shares. But we don’t watch for Friday volume to find good stories in moves that are already happening. Besides: we did Pacton yesterday.

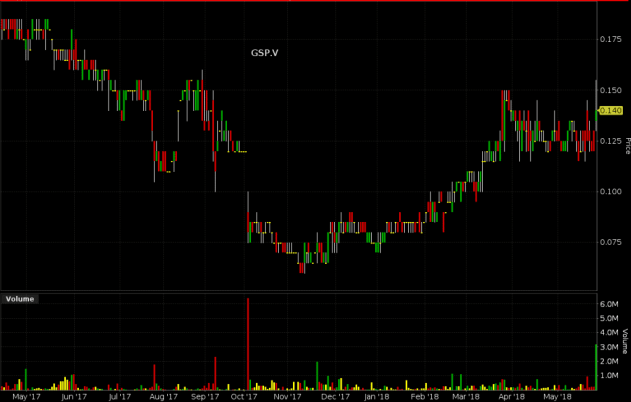

Today it’s $45 m market cap Saskatchewan based Gensource Potash (GSP.V) making market noise. The company traded 3 million shares (10x their average volume) to close up $0.02 (+16.7%) at $0.14. They announced a week ago that they’ve tied up an offtake deal with “a senior North American agriculture industry leader” for 250,000 tonnes of potash production. Now all they have to do is build the mine. The company is in the middle of a $3 million private placement that they plan to close at the end of the month. That should get them started.

Despite an aggressive plan, there’s a lot to like in Gensource. The part we like the most is the fact that they’re threatening to make something work in a dismal potash market. Gensource has an attractive narrative that presents well. Their leading edge is all about “food security” and “macronutrients.” They follow it up with a well constructed deck that paints a picture of a small operator who can cut a leaner path to the end user. They plan to use a solution mining technique that we’ve heard pitched before, but are unaware of having ever been pulled off. There’s a lot to like about an earnest Saskatchewan company who clearly believe in their story no matter what the market thinks. The Canadian equity markets are busy with pot and blockchain right now, but these guys couldn’t care less. They’ve got a vision, they signed the deal, they’re raising some money… it’s the kind of thing that’s easy to cheer for.

There’s always a market for fertiliser, but the capital markets only really care about it when the supply pinch is on and the price gets high enough quick enough (see our potash explainer for a replay of the 2007 Potash Panic). The next time that happens it will be the active, well organized companies who take advantage of the lift.

That’s the week, folks. By popular demand, we’re going to integrate more marijuana datajam next week.

(feature image: yellow squash by flickr user Liz West.)