Here’s the thing: if you’re intent on weighing in heavy, with greater confidence, at the high risk/reward podium in the junior exploration stock arena, you need to do your homework, you need to perform some due diligence. You need to begin short-listing potential buy-candidates with an eye toward management.

Management is everything. Nearly. Some veteran speculators believe it trumps geology. Fact is, you can have the most geologically prospective chunk of ground in the most mining friendly region on the planet, but without a serious, focused and experienced CEO at the helm, you’re initial stake in the company can end up horribly diluted, monies misspent, misused… squandered.

Been there. Once burned, twice shy. Actually… truthfully, I’ve been burned more than once by incompetent management teams. Twice burned, thrice shy doesn’t even cover it…

The Company – The Team:

Falcon Gold (FG.V) is run by Stephen Wilkinson (BSc., M.Sc., MBA). I remember this guy, having followed Northern Orion back in the day. CEO Wilkinson was at the helm of Northern Orion from 1999 to 2002 while the company was exploring projects in northwest Argentina (Northern Orion would eventually be acquired by Yamana Gold in a transaction valued at $1.63 Billion).

Prior to Orion, in the mid to late 1990’s, Wilkinson was the Vancouver-based mining analyst for RBC Dominion Securities where he was responsible for small capitalization gold and base metal companies.

Adding further depth to the resume, from the Falcon Gold website ‘Management’ page, CEO Wilkinson is…

…currently President and CEO of WPC Resources Inc., a British Columbia – based gold exploration company. Mr. Wilkinson has extensive international experience in the mining and finance industries having served as an officer and director of several private and public companies. Mr. Wilkinson has a Bachelor of Science from the University of Western Ontario (Geology, 1976), a Master of Science from Carleton University in Ottawa (Geology, 1983) and an MBA degree from Clarkson University in New York (1995).

The team behind CEO Wilkinson also boasts quality pedigree. This is a very competent group.

Management: a major hurdle cleared with air to spare.

The Ground:

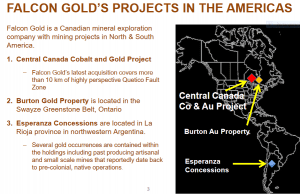

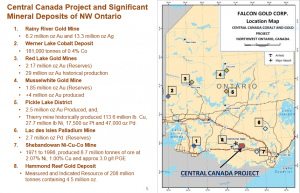

Falcon Gold controls the Central Canada Cobalt and Gold Project in N.W. Ontario, the Burton gold property in the Sudbury region of Ontario, and the Esperanza gold project in Argentina.

The company’s Central Canada Cobalt and Gold Project, a recent acquisition, is situated approximately eighteen kilometres east of Atikokan, Ontario. This is the project that has my 100% of my attention.

The Acquisitions:

This is an early stage project, but it’s one where a number of cobalt, copper and gold occurrences have been identified via historical surface & shallow drilling.

From the January 23rd news release:

The Property is positioned along 10.6 km of the trend of a metasedimentary-meta-volcanic greenstone belt that hosts the targeted cobalt and gold occurrences. The Quetico Fault Zone (the “QFZ”), a regional east-west structure separates the Archean-age sub-provinces of Quetico on the south and the Wabigoon to the north and has been reportedly recognized for a 300 km strike distance.

Two weeks after their initial acquisition, the company announced news of additional claims, a property which shares a common border with their Cobalt and Gold Project.

Actively adding to one’s claims in a geologically prospective area makes a Whole Lotta Sense…

Regarding this 2nd acquisition, CEO Stephen Wilkinson commented,

“The Central Canada Property adds to our strategic land position in a largely overlooked greenstone belt where there has been economically significant historical mining. In addition to the past producing gold mine, the Property covers about 2 kilometres (“km”) of our target Cobalt bearing iron formation — on strike from the Staines Cobalt Occurrence reported in Falcon’s news release dated January 23, 2018.”

The Staines Cobalt Occurrence – remember that name.

Location, Location, Location…

As you can clearly see on the map below, these claims are tucked in amongst a number of significant orebodies – Agnico Eagle’s 4.5 million oz Hammond Reef gold deposit is only a few kilometers to the north.

The Occurrence:

Here’s the part I like with respect to these recent acquisitions, and it involves a massive sulphide zone in the Staines Cobalt Occurrence. There’s that name again.

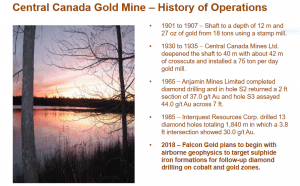

This highly prospective zone is referenced in a 1985 Ontario Geological Survey (Open File Report 5539) which Falcon noted in their Jan 23rd 2018 news release:

“The main sulphide zone has been outlined to be 1,155 metres long and 76 metres wide. Analyses of earlier drill holes returned values of 32.7 percent soluble iron, 0.23 percent copper and 0.71 pound per ton cobalt over an estimated true width of 25 metres.”

Duly noted in the company’s corporate presentation, the historic ‘Staines Cobalt Occurrence’ also coughed up a drill intercept of 0.64% Cu, 0.15% Co, 1.1% Zn and 0.35 g/t Au over a true width of 40 meters.

The copper in the above intersection is interesting, as is the zinc, as is the gold. But .15% Co over a true width of 40 meters… that’s intriguing. Here’s why…

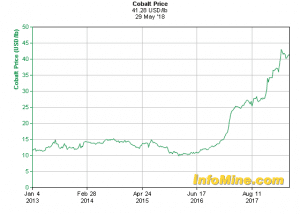

Cobalt is a key ingredient in the production of EV’s (Electric Vehicles). The metal is in great demand. Supply is lean. Much has been written on this subject here at Equity Guru. Leaf through the pages. Take your pick.

Regarding these recent acquisitions, CEO Wilkinson stated the following during a recent Equity Guru interview.

For most of our history we’ve been recognized as a gold company although we’ve held copper, molybdenum and silver assets. Our recent acquisition near Atikokan in NW Ontario – with its cobalt potential – has been a long-term objective of management.

When asked to comment on the underlying geology, CEO Wilkinson stated,

The claims cover about 10 kilometers of the Quetico Fault Zone, within which are a number of major occurrences of “banded iron formation”. These “BIF’s” are unusual due to contained zones/bands of sulphide mineralization – both massive and disseminated. The historic BIF-hosted Staines Cobalt Occurrence (0.64% Cu, 0.15% Co over 40m) is located within one of our claims.

When asked if an airborne survey had been flown over the project – an important step in delineation of drill targets – CEO Wilkinson replied…

Yes, a regional airborne geophysical indicates that about 4 kilometers of the QFZ has the likelihood of hosting similar Cobalt-mineralized BIF and affording us major drill targets.

A geophysical target some four kilometers in length opens up a fair amount of area to explore. I like big targets.

The second recent acquisition, aside from increasing the company’s exposure to over 10.5 kms in the geologically prospective Quetico Fault Zone, holds the past producing Central Canada gold mine.

It’s important to note that these projects are strategically located in the vicinity of a highway, rail, electrical power, a natural gas pipeline… all of the things that make a mining operation hum.

The Terms:

Both of these projects were acquired on the cheap. When you consider the latent geological potential, the significant news-flow the company could generate over the weeks and months to come, these projects were an out-and-out steal:

The initial Cobalt and Gold Project acquisition announced on Jan 23rd of this year was tabled with the following option terms…

To earn its 100% interest, Falcon has agreed to make escalating payments over a 4-year option period to the vendor totaling 400,000 common shares and cash payments totaling $250,000. Subsequent to Falcon acquiring its 100% interest, the vendor will retain a 1% Net Smelter Return (“NSR”) that Falcon will have the right to purchase for $1,000,000 at any time up to commencement of production

The Central Canada Property acquisition announced on Feb 7th was executed via the following terms…

To earn a 100% interest in the Property, Falcon has agreed to make escalating payments over a 4-year option period to the vendor totaling 325,000 common shares and cash payments totaling $141,500, and to incur minimum exploration expenditures of $100,000. Once Falcon acquires its 100% interest, the vendor will retain a 2% Net Smelter Return (“NSR”). Falcon will have the right to purchase 1% for $1,000,000 at any time up to commencement of production.

This is how it’s done. It takes a savvy CEO to ink deals like this.

The Evolution:

When Equity Guru asked CEO Wilkinson what comes next? His reply was…

Firstly, to solidify our project deals and make sure the market understands the “where what and why” that justifies the acquisition. Secondly, the initiation of first stage sampling. Thirdly, steady flow of exploration news. Fourthly, data compilation. Fifthly, create drill targets.

In order to facilitate the need to hit the ground running, the company recently closed an oversubscribed $221,000 financing – 4,420,000 units priced at $0.05 per, each unit consisting of one common share and one two-year warrant exercisable at $0.10. Notably, Falcon insiders subscribed to 45% of the financing.

One last Wilkinson quote from the recent Equity Guru interview:

My geological team believes that the Central Canada Project is the model type of asset where very old exploration work has defined significant potential for commodities such as cobalt and gold.

The Price of Admission:

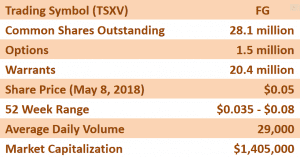

It’s always important to take a look under the hood, to see what the company actually costs.

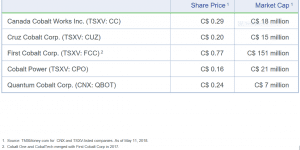

This is what really intrigues me about companies like Falcon. Trading at a mere $1.12M market-cap (based on the May 30th closing price), any exploration success, especially success relating to a Cobalt discovery, could have a dramatic impact on FG’s share price. Note the market-caps of other juniors in the Cobalt space. These are the role models..

(note that the above companies are much further along on the Cobalt exploration curve)

(note that the above companies are much further along on the Cobalt exploration curve)

The Current State of the Junior Exploration Market:

No one likes junior gold exploration co’s right now. I suspect many people currently chasing some of the hotter sectors don’t even know they exist. No one except ‘Smart Money’ types who are quietly, stealthily, accumulating positions.

Falcon Gold has ‘gold’ in its name. They’re looking for the precious metal. They’re also looking for other metals, including Cobalt. The market is keenly aware of Cobalt. Many explorers in the space witnessed dramatic price gains over the past six months. Though the excitement has settled down in recent days, the demand/supply crunch in this critical battery metal is still full-on. There’s more to come – that’s my opinion.

Final Thoughts:

I’ve seen this movie before. I’ve seen it several times. The third act always plays out the same way: junior exploration stocks mysteriously catch a bid, they move to a slightly higher level without slipping back, then they stair step higher, consolidating occasionally but relentless in their pursuit of higher ground.

Falcon Gold, with a market-cap of a mere $1.12 M, appears to me to be a unique ground floor opportunity. Investors seeking leverage in the Cobalt and Gold exploration space might want to investigate this one further.

END

~ ~ Dirk Diggler

(feature image courtesy of Defenders of Wildlife)

Full Disclosure: Falcon Gold Corp is an Equity Guru marketing client. The author does not own shares in Falcon Gold but may purchase shares in the future.