The notion of a “rich farmer” is almost an oxymoron.

Like “Jumbo Shrimp” “Civil War” or “New Classic”.

Do you know any rich farmers?

Do they exist?

People with dirt under their fingernails usually reap modest economic rewards. For this reason the original wave of licensed marijuana growers is morphing into cannabis retailers and branders.

Case in point: On March 19, 2018, ABcann (ABCN.V) announced that it has invested $4 million in Choom while agreeing to supply Choom with premium cannabis products, subject to regulatory approval.

Choom (CHOO.C) is “planting our flag in the rapidly growing legal cannabis industry in Canada with our own brand of high-grade handcrafted herb.”

According to the press release, “Choom was inspired by a group of buddies in Honolulu during the 1970’s who loved to smoke weed—or as the locals called it, Choom.”

The “Choom Gang” included former U.S President Barrack Obama, who’s behavior was reportedly “right out of a buddy stoner flick,” according to Adam Sorensen at TIME.

Choom knows how to make pot look sexy:

But Choom will have to tailor its branding campaigns to fit a regulatory framework that is still in flux in Canada.

In the U.S. Colorado allows print, radio, TV and Internet ads if the weed company can produce “reliable evidence that 70% of the audience is over 21”, while Washington state requires ads to contain advice about responsible usage.

There are similarities between the challenges of marketing cannabis – and craft beer. Corporate beverage companies that gobbled up craft breweries are discovering it’s not easy to create a loyal customer base.

Craft beer drinkers crave new experiences: Milk Stout; White Chocolate Moo-hoo; Monday Night Slap Fight; Mama’s Little Yelper etc. One of the ways to win over craft beer drinkers is with ultra premium-quality branded products.

One thing is for sure:

Sex – and its nerdy cousin “hipsterism” are going to be at the forefront of recreational weed marketing initiatives.

On April 20, 2018 [420] Choom, took “a look ahead at the forecast for the legal recreational industry, giving the weather forecast for 4/20”.

“Choom recognizes that we’ve just started paddling into a wave that will only build momentum once legalization is in place,” stated Choom’s CEO Chris Bogart, “In every major market, Colorado, Washington, California, we’ve seen adult-use grow year over year by double digits. Choom sees the same growth potential in a legal adult-use market for Canada as just the beginning.”

Choom Strategy:

-

- Produce a steady supply of cannabis through the acquisition of 4 ACMPR licenses, all in the late stages of the approval process.

- Vertically integrate production with a distribution network of branded retail stores.

- Delivering elevated customer experiences through a portfolio of brands.

Choom recently signed an agreement to acquire a company called MSP – a weed growing applicant expected to receive a cultivation license from Health Canada shortly.

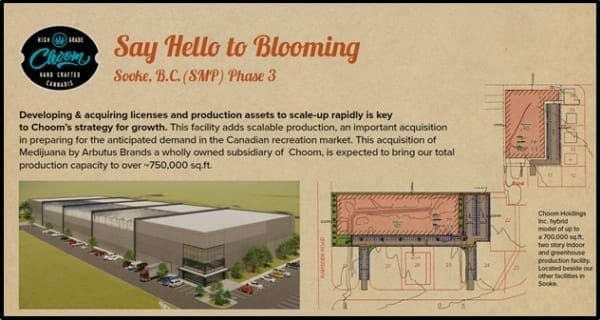

The MSP plan has three phases:

- Phase 1: Obtaining a cultivation license and sales license.

- Phase 2: Expand the existing production capacity to total footprint to over 29,000 sq. ft

- Phase 3: Building two additional facilities with 700,000 sq. ft. of production capacity.

On May 3, 2018, ABcann provided a business update that signaled its intention to expand into the high-margin retail weed business.

“ABcann is well-positioned, with approximately $130 million in cash, to accelerate the growth of our business,” commented Barry Fishman, ABcann CEO.

Like most Canadian weed companies in this frontier industry, ABcann is spending more money than its making:

ABcann showed a cash balance at December 31, 2017 of $70.8 million, annual net sales of $0.9 million and operating expenses totalling $27.5 million. These expenses included one-time costs related to restructuring and taking ABcann public. The impact of these costs is expected to have a far lesser impact on the Company’s financial statements going forward.

ABcann 2018 Growth Strategy:

- 800 kilograms of indoor grown premium dry flower and 1,500 kilograms of seasonal greenhouse cannabis

- rebranded and new consumer brands to be rolled out mid-year

- Harvest Medicine to open second clinic in Edmonton in early Q3

- secure distribution agreements for its adult-use products

- increase promotional interactions with cannabis clinics

- increasing marketing and communications

- develop innovative first-to-market products

- Launch new medical brand.

- Launch two new adult-use brands, each targeting a distinct segment of the soon-to-be-legalized recreational market.

- Australia sales initiatives

- GMP status approval, required for European sales, targeted for late 2018

- The Company expects to announce a new company name.

“With our strategic investment in Choom, we are signaling a strong move into the recreational market,” stated Barry Fishman, CEO of ABcann. “ABcann intends to pursue other accretive opportunities to diversify our industry presence.”

In other words, ABcann is becoming something-more-than-a-farmer.

That’s good news for ABcann shareholders.

Receiving an infusion of cash and access to a larger production pipeline is good news for Choom shareholders.

We think these two companies make good bedmates.

Full Disclosure: ABcann and Choom are Equity Guru marketing clients, we also own stock.

yet the stock drop at abcn continues…

Bob, Yes, the stock price has been sliding. Probably went up too high, too fast to begin with, and some of that is just the general weed sector cooling. We’re shareholders too. So it’s annoying. Key Question: Is ABcann a real company? With a fighting chance to make some noise in this frontier industry? We believe it is. The CEO Barry Fishman has a pharmacy background, which is the right way to tackle the medical weed opportunity. Now he’s bringing in marketing/branding people to tackle impending recreational opportunity. Half the market cap is cash.