Prize Mining (PRZ.V) might best be classified as a diversified exploration company. They have two substantial projects, one copper, the other gold. Diversification – having more than one ball in play – can be a good thing.

Feisal Somji, Prize Mining’s Executive Chairman and Director, stated at the conclusion of a recent presentation that the company is in the process of rebranding itself as ‘more of a copper-focused company’. In deference to this transitional way of thinking, we’ll focus on their copper asset first, leaving their gold project until the end.

Copper:

Cu (according to the periodic table) as a story is very much a demand-driven one. It’s one of the key building blocks to the foundations of our modern world.

Aside from the more obvious uses of this malleable and ductile metal, copper has a number of drivers (‘scuse the pun): EV’s (Electric Vehicles) require four times more copper than do internal combustion vehicles – 83kg’s versus 23kg’s.

Prize Mining’s prize asset:

I took this slide off of the front page of Prize’s corporate presentation. It’s an impressive shot (even if it’s been enhanced somewhat). Imagine a geologist, performing a recce on a new project, happening upon a structure like this on their first walkabout. To say that it might produce some excitement would be an understatement. Said geologist would likely have themselves a little accident…

This is a very visual type of deposit. Note the sedimentary layers. That greenish color you see on the surface is oxidized copper. When copper is exposed to the elements, it undergoes a series of chemical reactions which cause it to turn color. That lovely greenish hue is the deposits patina (antique dealers take note: your precious over-priced oldies aren’t the only things donning patinas).

The Manto Negro Copper Project in NE Mexico:

The more I study this project, the more I like it.

The Manto Negro Copper Project consists of seven mining concessions covering nearly 18,000 hectares. It’s located in the State of Coahuilla approximately 300 kilometers northwest of Monterrey, 100 kilometers west of Monclova, Mexico.

Multiple mineralized zones stretch out across the landscape, some 40 to 50 kilometers in length, up to four kilometers in width. Over thirty-five showings are present along this massive corridor (a ‘showing’ is a mineralized surface feature, much like the patina-rich rockface pictured above).

This is not a grassroots project – it’s a brownfield project (it resides in an area that was once actively mined). Over the years, Manto Negro has seen a fair amount of exploration – drilling, sampling and trenching.

The underlying geology:

Manto Negro is a series of sediment hosted stratiform copper-silver-lead-zinc type deposits.

The analog: Manto Negro shares similar characteristics with the uber rich copper belts in Zambia and the Democratic Republic of Congo (DRC). If the analog holds up, this could be a monster.

The deposits are also oxidized, which means they’re close to surface. Translation: aside from throwing off a surreal green hue on the surface, the company should be able to dig the ore out of the ground cheaply, and process it cheaply.

This is a high-grade system. Average grades run 1.5% – 2% Cu. There are also higher grade areas running 6% – 8%, with some of the feeder dikes running a crazy 45% Cu (a feeder dike might best be described as the deposit’s plumbing system).

“Ojitos” Feeder – 35% Cu & 1.2kg/Ton Ag

Some areas within this system demonstrate strong silver, lead and zinc credits. This is an important feature. These byproduct commodities will improve the overall economics of the project once the company begins crunching numbers.

Due to the near surface oxidized nature of these deposits, permitting should also be a fairly straight forward affair – the simpler the operation, the fewer the concerns… the fewer the obstacles.

Extracting the copper at Manto Negro should be fairly simple too. Preliminary metallurgical tests have demonstrated good recoveries of 93% over a 24-hour bottle roll test. Acid consumption was low. Translation: Manto Negro gives up its copper with little resistance.

All of the above factors point toward an economically positive mining scenario, one which the company should be able fast track to production.

Introducing Don Indio and Grazino…

You gotta love the names. They could be headlining DJs for the Grand Mambo in Cancun.

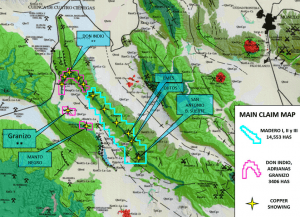

‘Don Indio‘ and ‘Grazino‘ are two historic mines within the Manto Negro project area. They will play a significant role in Prize Mining’s plans going forward.

You can see Don Indio in the upper left of this map, Grazino slightly below. Note the cluster of yellow stars – the Cu showings – in the vicinity of both of these historic mines. This starry cluster should trigger your speculative juices… it does mine.

The Don Indio Project:

This is a historic underground mine with four levels. Prize went in last December and took samples across 15 channels on levels three and four. They sampled more than 30 different outcrops of manto-type copper mineralization across the project area. They also performed 400 meters of trenching.

Copper grades range from 1.5% on the surface to 3.3% on level three. This is high-grade, particularly for an oxidized Cu deposit.

Importantly, the mineralized zone at Don Indio is 20 meters thick and sports a strike length of some four kilometers. There’s a load of mineralized rock at DI. The tonnage potential here is excellent… most excellent.

The Granizo project:

This is another historic mine. It’s approximately 17 kilometers south of Don Indio.

Last December, Prize went in and collected 22 samples along three channels. They also performed 300 meters of trenching.

Granzino has a strike length of some three kilometers. Copper outcrops in the area are approximately eight meters thick. Again, there is significant tonnage potential here.

It’s important to note that both Don Indio and Grazino have resource estimates…. ‘internal resource estimates‘. The company can’t talk about these numbers because they are not NI 43-101 compliant – that is, they don’t adhere to the strict standards set out by the Canadian Securities Administrators that would be required to release them to investors.

My point here is that the company is working with actual numbers. They just can’t talk about them. Yet.

It’s also important to note that Prize has initiated a comprehensive work program for 2018 which will include tabling a 43-101 compliant resource for the project. According to Exec Chairman Somji, they’ll be out with a fully compliant resource ‘fairly soon‘. (Authors note: I believe the whole 43-101 compliance thing is a mere a formality here – Somji and co. know what they got).

Recent Exploration Results:

The Manto Negro project was acquired only a few short months ago and already Prize is pulling assays from some of the more prospective targets.

On February 28th 2018, the company reported partial assays results from their recent sampling program:

Highlights

- 2.1 percent weighted average Cu over 8.90 meters from the Don Indio zone

- 05 percent weighted average Cu over 1.85 meters from the Pilar Grande deposit

- Four samples at the Pilar Grande deposit exceeded the 5 percent (50000 ppm) Cu detection limit. Results from this analysis are still to come.

- Samples ranged between a weighted average of 1.13 and 3.69 percent Cu and the majority of samples exceeded the 200 grams per tonne Ag detection limit. These final results are pending.

On March 14th 2018, the company reported complete assay results from their initial sampling program at Manto Negro:

Highlights

- 2.61% Cu and 212g/t Ag over seven meters from the Pilar Grande Mine

- 5.53% Cu and 711g/t Ag across 0.30 meters from Level 4, Pilar Grande Mine

- 45.5% Cu and >1,500g/t Ag across 0.25 metres at Los Ojitos.

Commenting on the above results, Prize Mining’s CEO and President, Michael McPhie, stated

We are very pleased with the high grades of copper and silver from our preliminary sampling program as the results are consistent with those found in red-bed deposits around the world. Another significant feature of these deposits is that they are laterally extensive over many kilometers, and our next step will be to characterize and explore the almost 18,000 hectares of the Manto Negro Project.

Manto Negro’s aggressive schedule:

Executive Chairman Somji believes that Manto Negro will be in production within 18 to 24 months. That’s an aggressive forecast. He envisions a speedy permitting process followed by a fast buildout – a low Capex * low Opex operation.

Now, I’ve been around the junior mining sector for a good while. That kind of optimistic forecasting is almost always pure bunk… pure, unadulterated, pie-in-the-sky bullshit.

But we’re not talking about just any mining-man here. Exec Chairman Somji is a rockstar in the junior arena. He was at the helm of Rio Alto Mining, a 150K oz per year gold producer in Peru, when it was acquired by Tahoe Mining in 2015 for $1.3 Billion. Making significant discoveries and creating substantial value for shareholders = ‘Rockstar’ in my book.

So… move aside and let the man go through.

Gold:

We’ve heard all of the arguments, all of the pros and cons, for holding gold in our portfolios. You don’t need a degree in economics to understand its place, even in our modern digitized world.

Gold has been used as money since 700 BC. It’s survived the test of time. It’s endured dramatic societal and economic changes throughout the ages.

Gold is real. It’s tangible. Swapping even the smallest amounts for fiat paper will put a bulge in one’s wallet. Example: a single one-ounce coin will set you up in a not-so-bad all-inclusive resort in Mexico for a couple of weeks, airfare included.

It’s divisible, but it’s difficult to debase. Unlike paper money, it can’t be printed off by the billions (trillions) and blown-out into the system like so much confetti.

Despite what the pontificating ‘talking heads’ preach over the financial news channels, gold is a real currency. It’s a valid currency. It has a place in this modern world, one that will likely assert itself even deeper in the months/years to come…

Gold is here to stay. Deal with it!

The Kootenay Kena-Daylight Gold Project in the Southern Interior of BC:

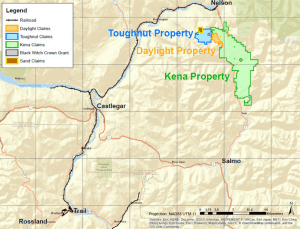

Looking at the above map…

The town of Nelson is shown at the very top. If a person had to – if they were really jonesing for an Americano, say – they could walk from Kena-Daylight to any number of very decent coffee houses in downtown Nelson BC.

Obviously, the project has easy access to every conceivable form of infrastructure, including the Trail Smelter operated by Teck Resources (only 45 minutes south via paved highways).

Inside the main Kena claims (green outline), there’s a 1.8M oz gold resource outlined in red.

There’s a Cu porphyry target (outlined in hatched blue) just to the south of the resource area; a Cu porphyry target that has yet to be tested with the drill bit.

The Daylight project (outlined in orange) was mined for high-grade gold back in the day.

The other two project areas – Toughnut (light blue) and Sand (yellow) – are the final pieces that create one large contiguous land package covering the entire gold-bearing district.

The Resource:

There’s a 1.8M oz gold resource outlined in the red (above map).

- 24,890,000 @ 0.60 g/t Au Indicated = 481,000 ounces of gold

- 85,790,000 @ 0.48 g/t Au Inferred = 1,318,000 ounces of gold

- (the resource was calculated using a 0.3 g/t gold cut-off)

Let’s be honest here… the above numbers represent a heap of gold, but the grade is low. This kind of deposit is all about LARGE – a large open pit, a large volume of rock being moved around, a large Capex (Capital expenditures), large Opex (operational expenditures) and a large number of concerned locals wielding furrowed eyebrows.

Developing such an open pit would require a permitting and community-consultation marathon. It’s doable, but it would take time. It makes far more sense targeting a different type of deposit – a higher grade deposit – a deposit like the miners focused on two decades earlier.

High-grade underground operations can be fairly low profile affairs. The ground disturbance is minimal. The amount of rock moved around is tolerable. The smaller ecological footprint likely won’t ruffle as many (local) feathers.

The Daylight project has four historical mines that were in operation during the mid-1990’s. The miners were chasing underground high-grade veins. The rock ran between 2 g/t and 37 g/t Au. It appears that this is exactly what Prize management is after also. Here, permitting and developing a high-grade underground mining operation should be a fairly smooth, streamlined affair.

Recent Exploration:

The company launched two modest drill programs in H2 of 2017 at their Daylight and Toughnut projects. Results were received on Jan 22nd 2018 (Daylight assays) and on Feb 20th 2018 (Toughnut assays).There was no real ‘discovery hole’ in the above releases (in this author’s opinion). Results might best be characterized as a technical success – narrow high-grade intervals were encountered at various depths.

Future Kena-Daylight Exploration Plans:

The company has no shortage of targets to follow-up on at their Kena-Daylight Gold Project. It would appear that the company’s focus will be on four large gold-bearing targets on their Daylight claims. Details pending.

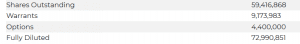

A look at the price tag – Prize’s Cap Structure:

Reasonable, for the amount of copper (and gold) it may ultimately hold:

Final Thoughts:

The company’s main focus is their Manto Negro copper project in NE Mexico. The visuals on this one make it easy to wrap one’s mind around. Below, another example of the Manto Negro’s striking visuals….

I suspect that newsflow out of Manto Negro will be fairly steady from this point on. The evolution of this project should be fairly swift, if Exec Chairman Somji’s optimistic timeline is to be met. We stand to watch.

End

~ ~ Dirk Diggler

Postscript: to peruse at your leisure, a list of Mining terms.

FULL DISCLOSURE: Prize Mining is an Equity.Guru marketing client. The author does not own shares in Prize Mining.