There are legitimate reasons to tell a delinquent off-spring, “I dislike you”. But it’s still something you should never do.

We have the same opinion about company insiders off-loading high volumes of a micro-cap stock. It’s crappy behavior. Shareholders (like children) expect stronger leadership.

ABcann Global (ABCN.V) is involved in the production of pharmaceutical-grade cannabis products.

On January 18th, 2018, company director and founder Ken Clement sold 148,000 shares of ABCN stock at $2.16. There was some bitching on the bullboards. But maybe he needed the money. $300,000 will usually settle a few bills.

Then on March 11, 2018 Clement sold 300,000 shares at $2.19 and another 500,000 shares at $2.03. He cashed a cheque for $1,672,000. The bitching got louder.

Five days later ABcann issued a press release, announcing that “Ken Clement, ABcann’s founder and director, has resigned from the Board of Directors”.

Apparently, this insider selling wasn’t a new subplot. On May 12, 2017 Equity Guru’s CEO Chris Parry summarized ABcann’s fascinating early innings:

“ABcann has endured its founders absolutely blasting out 41c stock at the open, destroying the market handily.”

Are the “weak hands” now flushed out? We hope so.

A few days ago, GMP a leading weed sector financier – including Canopy Growth (WEED.TO) – published an market update on ABcann.

“Expansion is well underway. ABcann currently operates a 30,000 sq. ft. facility in Napanee, Ontario, with an output of 1,400kg. The company also holds a 320,000 sq. ft. greenhouse, is expected to have its first harvest in 2018, and is constructing a 150,000 sq. ft. hybrid facility, expected to have its first harvest in 2019.

The company has a robust product pipeline. ABcann has approved an “ambitious product pipeline” for development through 2019. In chronological order, this consists of oils caps and sprays; transdermal, sublingual tabs, and essential oils; and inhaled, softgels, combo products, edibles, and beverages.

After commencing the sale of its cannabis in Canada in February of 2016, ABcann has explored international growth and has now established a foothold in Canada, Germany, Israel, and Australia. In January of 2018, ABcann was granted an Australian Import License.”

Yup – that just about covers it.

Oh – wait.

There’s one more thing.

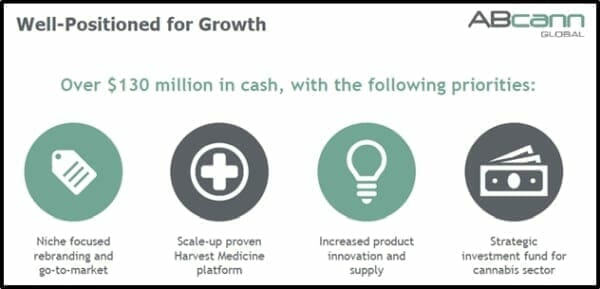

ABcann has $130 million in cash.

On March 06, 2018, ABCN published a business update announcing that it now has “$130 million in cash to accelerate the growth of our business”.

As we wrote on March 7, 2018, “In a frontier industry buzzing with mergers and acquisition – the value of the cash is given a premium based on the belief that the company will make astute investments on behalf of the shareholders.”

“Over the past five months we have enhanced our leadership team, strengthened our balance sheet, improved operational effectiveness and executed a strategic acquisition,” stated Barry Fishman, Abcann CEO.

A disciplined capital allocation process is in place, with the following four priorities:

- Expanding to 500,000 square feet to produce over 30,000 kilograms of capacity

- Focusing on branding and product innovation in the medical and adult-use sectors

- Expanding Harvest Medicine platform to multiple new locations in 2018; and

- Developing strategic partnerships in the industry to broaden our reach and scale

ABcann harvests a lot of very good cannabis – using proprietary techniques to maximize quality and consistency.

ABcann plans to expand its cultivation capacity domestically, as well as in international markets, such as Germany, Australia and Israel.

The single biggest catalyst for company valuation is the 2018 expansion of the high-tech Vanluven facility to 30,000 square feet.

The Company is also pursuing opportunities in select international markets, such as Germany, Australia and Israel.

But let’s get back to that $130 million.

As a shareholder, you need to know if ABcann is a good shopper.

On March 19, 2018, ABcann announced that is has invested $4 million in Choom while agreeing to supply Choom™ with premium cannabis products, subject to regulatory approval.

According to the press release, “Choom was inspired by a group of buddies in Honolulu during the 1970’s who loved to smoke weed—or as the locals called it, Choom.”

Choom is bringing the spirit of Hawaii to Canada. Channeling the spirit of Hawaii in the Okanagan, high-grade handcrafted strains by Choom™ are all about cultivating good times and good friends.

We’re planting our flag in the rapidly growing legal cannabis industry in Canada with our own brand of high-grade handcrafted herb.

This deal is all about ABcann getting into the branding game and investing in downstream buyers.

“With our strategic investment in Choom, we are signaling a strong move into the recreational market,” stated Barry Fishman, CEO of ABcann. “ABcann intends to pursue other accretive opportunities to diversify our industry presence. We look forward to working with and assisting the Choom team with the supply of our premium grown products.”

“On behalf of the Board, we thank Ken for his vision in starting the company,” stated Paul Lucas, ABcann’s Chair, “We wish Ken well in his future endeavors.”

“On behalf of the Board, we thank Ken for his vision in starting the company,” stated Paul Lucas, ABcann’s Chair, “We wish Ken well in his future endeavors.”

The shareholders of ABcann also wish Ken well – and wish to present him with a signed copy of Ellyn Baches’ book, “The Art of Saying Goodbye” – about “friendship, love, and commitment”.

Full Disclosure: ABcann is an Equity Guru marketing client, we also own stock.