A lot of exploration stories are complicated.

This one isn’t.

Zinc is a metal used to stop iron or steel from rusting.

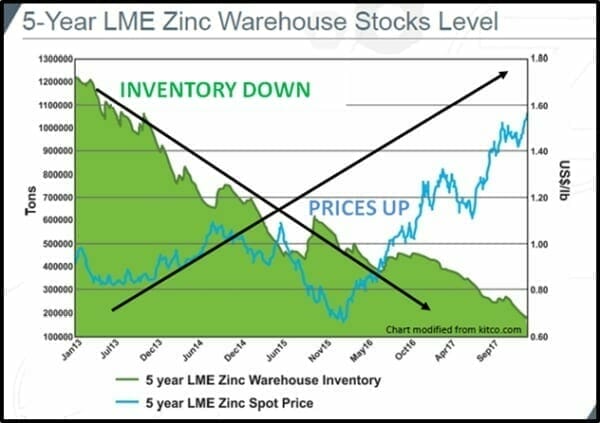

There is an impending shortage of zinc.

That is happening because two of the world’s largest zinc mines have run out of ore (Australia’s Century mine, and the Lisheen mine in Ireland), and China is shutting down it’s polluting mines.

According to Mining.com, Chinese year-to-date zinc production is down 1.3% to 5.65 million tonnes.

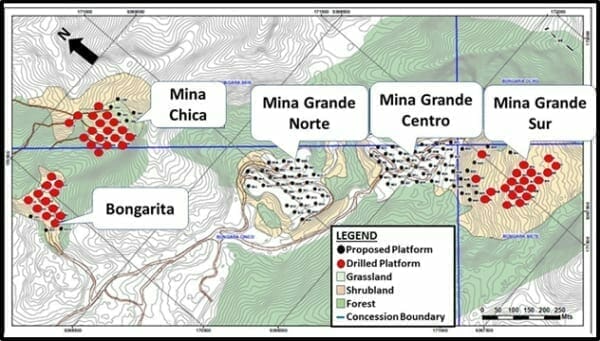

Zinc One (Z.V) controls the Bongará Zinc-Oxide Project and the Charlotte Bongará Zinc-Oxide Project in Peru – which lie at the end of a 6-kilometer trend of known zinc.

The company is drilling aggressively and hitting thick high-grade zones of zinc.

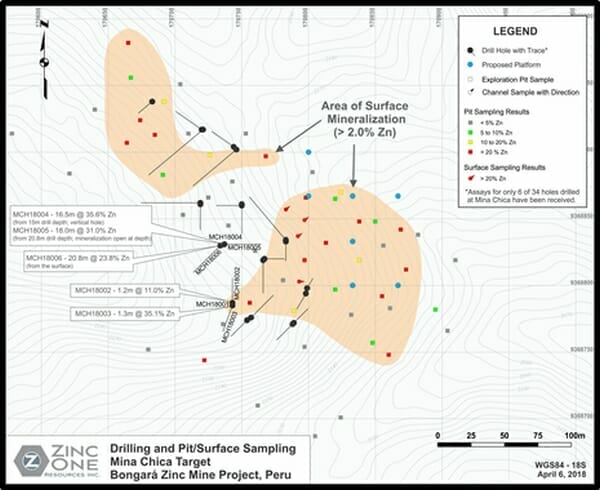

April 9, 2018, Zinc One announced that drill results have confirmed a new high-grade zinc zone at Mina Chica, one of several areas being targeted in the current drill program in Peru.

These drill results penetrated 16.5 metres with 36.5% zinc.

Zinc One anticipates that its new understanding of the high-grade Mina Chica mineralized zone will have a positive impact on the resource estimate at the Bongará Zinc Mine, which is anticipated to be released in Q2 2018.

Mina Chica is only one of three known zones of high-grade near-surface zinc oxide mineralization along a 1.6 kilometre mineralized trend that is being drill tested.

These assays have expanded our expectations with respect to the true vertical thickness,” stated Jim Walchuck, President and CEO of Zinc One, “and thus the potential amount of the mineralization at Mina Chica.”

On March 29, 2018, Zinc One announced drill results from the Mina Grande Sur and Bongarita zones.

Significant Intercepts:

Mina Grande Sur

-

- MGS18001 – 5.5 metres of 26.1% zinc, starting at 3.0 metres drill depth

- MGS18003 – 4 metres of 32.5% zinc, starting at surface

- MGS18003 – 15 metres of 21.5% zinc, starting at 15.0 metres drill depth

- MGS18004 – 9.1 metres of 43.6% zinc, starting at surface

- MGS18006 – 14.1 metres of 32.8% zinc, starting at surface

Bongarita

-

- BO18005 – 11.5 metres of 16.0% zinc, starting at surface

- BO18005 – 5.7 metres of 29.2% zinc, starting at 5.8 metres drill depth

- BO18007 – 7.0 metres of 25.3% zinc, starting at surface

Before the drill results starting coming in, we gave you 9 strong reasons to invest in Zinc One.

- Potential near-term production restart

- Drill-confirmed, exploration potential along 6 km corridor.

- Low risk due to past production

- Mature mining jurisdiction.

- Exceptionally high grade, at surface

- Massive exploration potential.

- Anticipated new resource estimate.

- Proven metallurgy

- Accomplished management team.

Those reasons just got a lot stronger.

To put these drill results in perspective, Teck’s (TECK.NYSE) Red Dog Mine in Alaska produces an average head grade of 15% zinc. In 2017 Teck’s mine made a gross profit of about $970 million.

In last year Zinc One stock price fell from .70 to .26. The current market cap is $14.9 million.

The reason for the slide?

“Investor sentiment”.

At Vancouver cocktail parties people talk about real estate, weed and blockchain.

But those same people sure as hell don’t want their cars to rust.

Zinc is the 4th most widely consumed metal in the world.

We think this company is radically undervalued.

Full Disclosure: Zinc One is an Equity Guru marketing client, and we own stock.