News out of the US today has the OTC announcing it will be marking companies it sees as being overly promotional – that is, subject to promotion campaigns without proper disclosure – with a ‘megaphone’ emoji of sorts, to clue in investors that materials about the firms in question may not be trustworthy.

No Equity.Guru clients were named in the announcement.

Companies hit with the mark include:

- Abattis Bioceuticals Corp.

- Affinor Growers Inc.

- Block One Capital Inc.

- Global Blockchain Technologies Corp.

- International Battery Metals Ltd.

- Jericho Oil Corp.

- Lexington Biosciences Inc.

- Matica Enterprises Inc.

- New Age Farm Inc.

- Petroteq Energy Inc.

- StartMonday Technology Corp.

- Tower One Wireless Corp.

- WestKam Gold Corp.

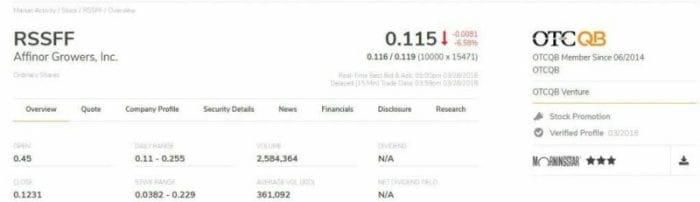

The mark can be seen on the company page of Affinor Growers (AFI.C) on the OTC website:

It should be noted that the OTC is not claiming these companies are the only ones who might qualify for such a warning, nor that the companies are necessarily part, or have paid for, the promotions in question. There are 56 companies that have been marked in this way in total, to date.

The mark indicates that promotional material without proper disclosures has been noticed, but that may be at the behest of individual investors that are not company insiders.

Contacted for comment about the situation, only Affinor Growers CEO Nick Brusatore responded to a Bloomberg journalist about the situation, saying he wasn’t concerned about the mark because Affinor was “promoting something and telling the truth.”

That might be missing the point. The OTC isn’t judging the truth levels of the paid promotions in question, but rather noting that the disclosures required on such material don’t follow the rules, which doesn’t help investors make informed decisions.

We at Equity.Guru do follow such rules, marking any stories we put out that involve paid clients or companies we’ve invested in appropriately. In addition, we have a long record of writing negative pieces -when warranted- about client companies failing to achieve what they promised.

Examples of recent Equity.Guru stories in this vein can be found about ExeBlock (XBLK.V), Lifestyle Delivery Systems (LDS.C), and Berkwood Resources (BKR.V). The headline on a recent XBLK story was ‘Exeblock (XBLK.C) needs to get its shit together, and now’s the time to make it happen’.

“Anonymous, paid stock promotion should have no place in the public markets,” said R. Cromwell Coulson, President and Chief Executive Officer, OTC Markets Group in a statement released today. “We are taking responsibility to provide transparency to investors and encourage public companies to disclose and correct misinformation that can harm the efficient market pricing process. We continue to work with regulators to advocate for the modernization of promotion regulations, including requiring additional disclosure around paid stock promotion and identifying the people associated with these campaigns.”

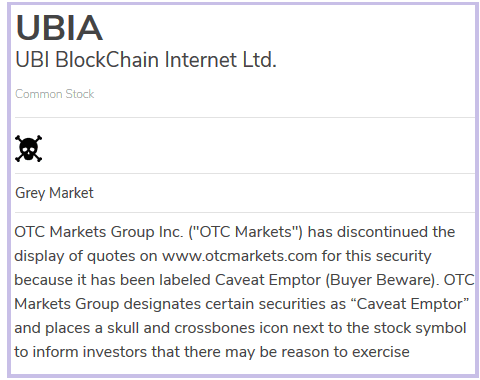

This move by the OTC is actually a positive step for companies caught in its drift net, as the exchange had previously been placing a skull and crossbones image next to companies it considered overly promotional. In contrast, the megaphone may be seen by some investors as evidence that the companies in question are aggressively marketing themselves to investors, which could be considered a positive thing.

The OTC says the megaphone will stay next to a ticker symbol on their exchange until 15 days have passed since the last promotion was posted.

The OTC has released a notice that outlines what it considers to be improper behaviour, stating:

Common characteristics of misleading and manipulative promotion:

• Fail to clearly identify the sponsor of the promotion, and/or the promotion is sponsored or paid for by anonymous, unidentifiable 3rd parties

• Typically focus on a company’s stock rather than its underlying business

• Use highly speculative language. Materials often rely on grandiose numbers and figures related to the target company’s industry, business model, financial results, or business developments

• Tout performance or profit potential of an issuer’s security with unsupported or exaggerated statements about the stock price or its anticipated trajectory

• Make unreasonable claims pertaining to an issuer’s operations

• Suggest a promise of a specific future performance of the stock or profit to investors

• Provide little or no factual information about the company, omit material information

• Urge the investor to take action immediately as not to miss out on a great opportunity

• Fail to provide details or disclosures about the risk associated with the issuers securityAnonymous paid promotion is often associated with unregulated parties or “financiers” that have acquired securities in private market transactions and wish to generate demand so they can sell their shares in the public markets at inflated prices.

The desire for such a warning is not shared by the TSX Venture Exchange, according to Bloomberg. While the Venture has similar rules in terms of disclosure, and listed companies need to have news releases approved by regulators before release, Managing Director Brady Fletcher told Bloomberg, “TSX Venture Exchange has clear policies regarding investor relations activities but we have no intention of penalizing our listed entrepreneurs for arm’s length, third-party content.”

— Chris Parry

haven’t been any articles on berkwood in a while from you Chris. Also i noticed you guys no longer hold any stock. Lost faith? Your input would be appreciated as I always enjoyed your write ups on them and you seemed to be very confident in there prospects and now that the price has suppressed I’m looking at a speculative buy but noticed you guys haven’t done anymore write ups in a while even though there project seems to continue to be moved along pretty successfully even thought the sp doesn’t reflect that

Hey Justin,

Yeah, we dipped out. I like the long term prospects but the market has been brutal for it and we had to decide whether it made more sense to hang or use the funds elsewhere. We went with the latter.

Sometimes good plays are held underwater by early investors bleeding it out. There’s something to be said for taking their stock off them cheap if they want to give it to you that way, but ideally you want to be on the back end of that sell off, rather than the front. We were a bit too frontish.

Thanks for the quick reply Chris its appreciated and yes I’ve been watching it dip progressively even as they continue to move that project along which seems massively undervalued compared to other graphite juniors who don’t have half the potential BKR has yet they are trading much higher. Seems a lot like the East West story where the project has so much promise but the stock keeps bleeding because of impatience and now its starting to sit at levels where the risk is beginning to really lower based on what it seems they have in potential value. I estimate that Lac Gueret property could already be sold for atleast the current market cap of BKR. Is your coverage on BKR over now I’m assuming?

We’ll keep an eye out.

Thanks for sharing the post. The way you narrated the post is good and understanding. After reading the post I learned a lot of new things. Please let me know for the upcoming posts.

Rohit, since there was a 19-month delay between the publication of the article, and your brief comment, the most efficient way for you to “know about upcoming posts” might be to return to the website and click on some of the articles at the top of the page. How strange, your screen name is only two letters away from spelling “robot”?