The gold story is so simple.

Hard asset, limited supply, the Chinese love it, the Indians love it, when investors get nervous about equities (or war) – they flee to gold.

I woke up today in Yi Chang China, clicked on my precious metals stock app – and this is what I saw:

On a day when China retaliated against Trump’s $50 billion import tariffs with a $3 billion tariff on U.S. pork and steel pipes – the “fear index” shot up 30% – the Dow fell 724 points – and gold equities still fell.

Being a gold bug in 2018 is joyless.

Of course, many successful investors appeared to be wrong – before they were right.

For instance, hedge fund manager Michael Burry who unearthed the subprime loans anomaly – made his bet too early – lost money for years – before the loan system blew up – resulting in a $2.69 billion windfall.

If you still like gold as a hedge – we strongly recommend you look at gold assets in Africa.

The continent is pregnant with bullion – and mostly ignored by international investors.

African gold explorers are cheap in the same way this young man might’ve had too much plastic surgery.

The cheapness is distracting.

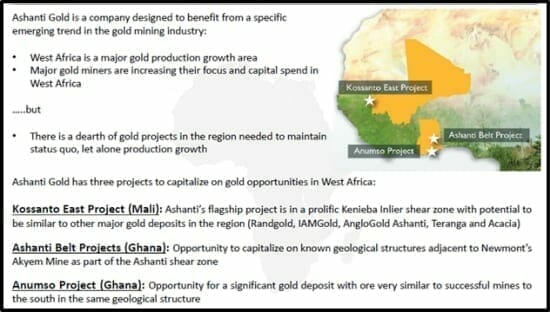

Example#1: Ashanti Gold (AGZ.V) is a West African-focused gold development company run by Tim McCutcheon is a former investment banker with a track record of finding inefficiencies in financial systems – and exploiting them for profit.

“We asked ourselves a basic question: ‘what do we know that others don’t know?’”, stated McCutcheon in an Equity Guru interview, “Because we had been Kinross’s JV exploration partner in Ghana, we had a huge database from that experience. We identified an opportunity to cherry pick the best assets out of the Kinross portfolio”.

Ashanti’s Anumso Gold project in Ghana is close to Newmont’s (NEM.NYSE) Akyem Mine which began production in 2013. For the last five years, the average annual gold production from Akyem is 400,000 ounces with an all-in sustaining cost of about $800 per ounce.

Ashanti’s 29 sq km mining lease covers 5 km of strike length in the Ashanti Gold Belt.

In Mali, a 53-hole, 6,000 meter RC drill program for the Kossanto East project has been completed.

Since 1998, about 40 million ounces of gold has been discovered in this area resulting in the construction of dozens of mines.

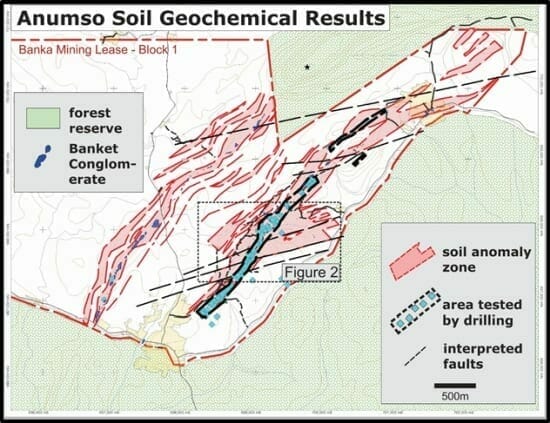

On March 21, 2018 Ashanti announced results from its surface exploration program on the Anumso project.

Results from 486 new soil geochemical samples significantly broaden the target area for gold mineralization.

Extensions of sample lines, along with further testing, reveals a new broadened anomaly area that is approximately 1500m by 500m.

Ashanti is digging and sampling several trenches to assess the results of the soil sampling. Drill testing is expected to occur in Q3, 2018.

On March 05, 2018 AGZ announced results of its on-going exploration program at Kossanto East, Mali.

Sample results define “a new prominent gold zone parallel to and southwest of Gourbassi East, with numerous samples reporting values greater than 0.1 g/t Au in soil, with two samples reporting in excess of 5 g/t.

“These excellent results support the Company’s contention that considerably more gold mineralization is present at and around the Gourbassi East and Gourbassi West targets,” stated the company’s Chief Geologist.

Six months ago, shares of AGZ cost .39.

Ashanti is currently trading at .18 with a market cap of $7.1 million.

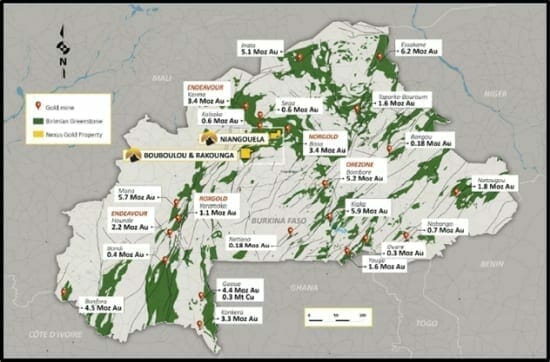

Example#2 Nexus Gold (NXS.V) has 3 gold projects in Burkina Faso:

- The 178-sq km Niangouela gold concession where the company has delineated a 1km quartz vein and shear strike. Eight of the first nine diamond drill holes on the property returned positive gold results, highlighted by a 4.85m intercept of 26.69 g/t.

- The 38.8-sq km Bouboulou gold concession with historical drill results including 40m of 1.54 g/t. The property contains three distinct gold trends, each extending 5000 metres (5km) in length.

- The 250-sq km Rakounga gold concession contiguous to Bouboulou property, contains many artisanal mines.

Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years. The country has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

Some big gold companies are operating profitably in Burkina Faso like Endeavour Mining (EDV.T) – a $2.6 billion gold miner – building the Houndé project with a projected annual production of 190,000 ounces at a cost of about $700 an ounce.

On February 28, 2018, Nexus provided select sampling results from exploration programs on its Niangouela and Bouboulou exploration permits in Burkina Faso

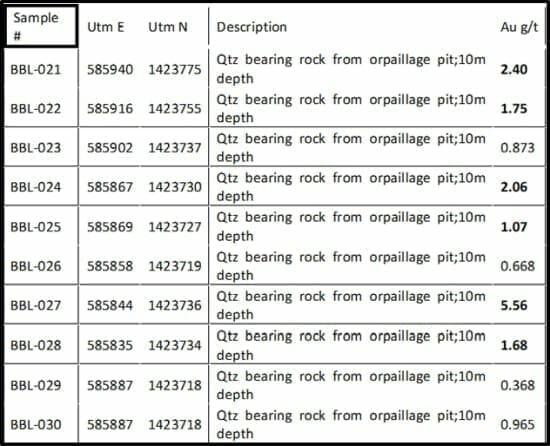

On the Bouboulou permit, NSX geologists have sampled material recovered from new workings at a depth of 10 meters from surface:

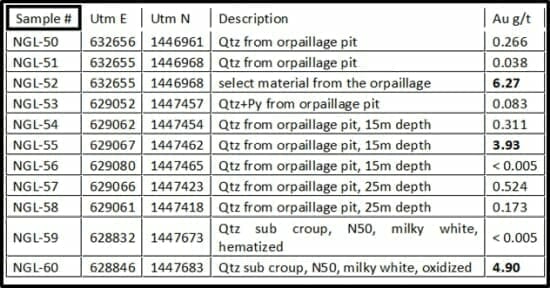

Results from the Niangouela sampling program is tabled below:

“The new zones we’ve uncovered and now sampled define greater areas of mineralization at both concessions,” said Chairman and COO, Alex Klenman. “The Bouboulou trends continue to return gold values along broad trends…The new zone at Niangouela also advances our understanding of that project and suggests that other zones of gold mineralization are present.”

Six months ago, shares of NXS cost .11.

Nexus is currently trading at .035 with a market cap of $5 million.

What’s it gonna take to make gold go up?

Another global depression?

World War III?

How about the collapse of the fiat currency standard?

The Federal Reserve, the United States central bank, has printed more than $2 trillion since the global economic crisis began in 2008. This has more than tripled the size of its balance sheet.

The U.S. Federal deficit was $666 billion in Trump’s first year of his presidency.

At publication date, the U.S. Congress gave final approval to $1.3 trillion spending bill.

The 2018 deficit is projected to be more than $800 billion.

That about $2,200 per U.S. taxpayer.

Something’s gotta give.

The gold bugs may have their day.

Full Disclosure: Ashanti and Nexus are Equity Guru marketing clients, we do own stock, haven’t sold, not going to.

What are your thoughts on the new 1:10 stock consolidation? Desperate last ditch effort?

Also, thank you guys for all the work that you do, I thoughly enjoy reading your articles.

Wynn

Its disappointing, obviously, but unless the share price is up over 5c its really hard to do a financing, which makes it hard to make moves to restore the share price.

I’d view it as evidence they’re still working.