Looks like it might be a grim Easter for Angel Seafood Holdings Ltd (AS1.ASX) shareholders after a lackluster IPO has seen the price tank 30% within the space of two weeks, the $0.20 shares last changing hands for just $0.14 each.

One imagines the seafood platters will be few and far between come April 1st.

On the bright side – as the offer was heavily oversubscribed retail would have been scaled back. The paper losses at this point could have been greater. That’s the problem with trading – when you’re right you’ve never got enough and when you’re wrong always too many.

Angel Seafood Holdings Ltd are in the business of cultivating Pacific oysters (Crassostrea gigas for the scientifically inclined) which, while native to the Pacific coast of Asia, have become an introduced species to many parts of the globe.

The company secretary has been kept busy with announcements they are not paying pumpers (yet! – Jack Dorsey what have you done?) and soothing concerns over a recent POMS outbreak (Pacific Oyster Mortality Syndrome) which lead the company to request a trading halt in its securites.

Investing in aquaculture is not for the faint of heart.

When the prospectus was released, it stated [Section 11 – (h)] “Disease Risk: There is a risk that the Company suffers a disease outbreak that impacts on the health and wellbeing of its oyster stocks. This includes a disease such as Pacific Oyster Mortality Syndrome (POMS) which affects mainly juvenile (<12 months old) Pacific oysters. To date, POMS has not occurred in South Australia and the South Australian Government and the Company has measures in place to mitigate the risk of any such disease."

“To date, POMS has not occurred in South Australia”. Good timing on that front, surely.

On the 1st March, 2018 that statement was no longer true. As they say, timing is everything.

POMS is a nasty pathogen which can decimate an oyster lease and takes no prisoners.

“

Pacific Oyster Mortality Syndrome (POMS) is a disease which affects Pacific Oysters (Crassostrea gigas) and is caused by a virus called OsHV-1 micro variant. It causes rapid death and high mortality rates in farmed Pacific Oysters (up to 100% within days of being detected) and can spread quickly if introduced.

Source: http://bit.ly/2FtndZf

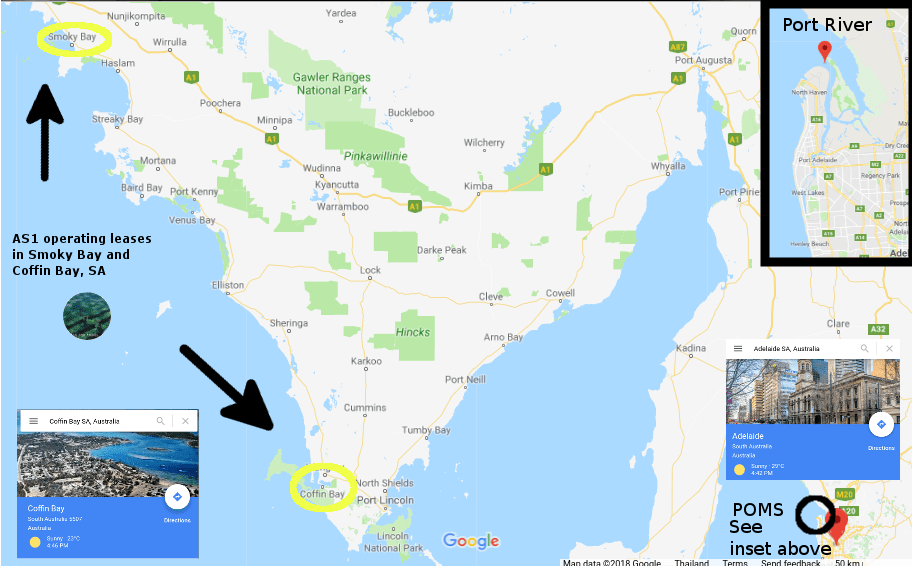

A map would be handy to understand the threat a little better. We’ve taken the liberty of throwing one together for you.

As the company rightly says “Angel’s growing areas are a significant distance (300km) from the Port River”.

Agree.

However, POMS being detected in SA waters represents a material change in the risk profile of the stock for AS1 shareholders.

The company is now reliant on the biosecurity measures implemented by Primary Industries and Regions SA (PIRSA) to stop any further spread of the disease.

AS1 lists and closes at a 20% discount.

Slow clap.

Who managed the IPO of AS1 you ask? That’d be the boys over at EverBlu. We’ve harped on about them enough recently, so it’s a case of same actors different play.

To be fair they have stitched together a decent research report which highlights various aquaculture plays within the space. Worth a look if you’re interested, but there’s a reason you won’t find any posts here at Equity Guru detailing the fortunes to be made in investing in sea monsters – it’s not like shooting fish in a barrel, we can assure you.

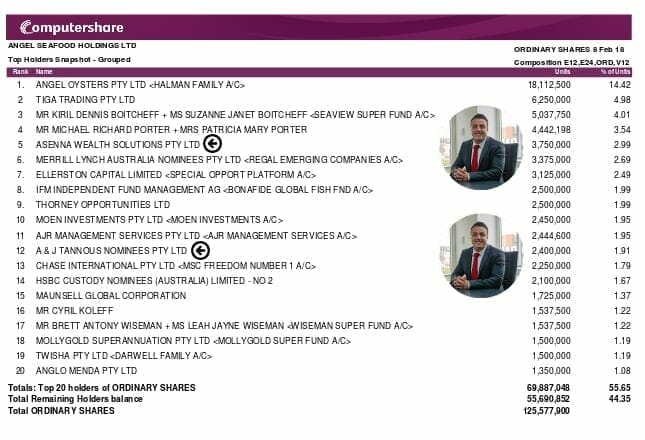

Here are the Top 20 shareholders upon listing. See any familiar names?

After hitting the boards at 11:00 am AEDT on Wednesday 21 February 2018, AS1 came under relentless selling pressure, with the shares closing the day at $0.16. Not quite the opening many had hoped for.

Had retail gone mad and decided to dump their newly acquired shares? Hardly.

More likely, the feeding frenzy was caused by early-stage investors who were busy taking profits.

Not everyone’s selling though – Director Michael R. Porter picked up 185,000 shares at $0.135 a share on March 8, 2018.

Will that stop the price decline in its tracks? Let’s see what Monday’s trade brings, shall we.

Where are all the customers’ yachts?

I’ve unashamedly stolen that headline from the name of a book written in 1940, and subtitled “A Good Hard Look At Wall Street”.

Call me a cynic but IMO the primary purpose of an IPO is to allow early-stage investors to exit with fat stacks. It’s all about the FU money.

One good thing about being around the markets for longer than a visit from your mother-in-law is having made all the classic mistakes.

Investing in an IPO and expecting money to flood into your coffers is one such mistake. Let me unlock the chamber of horrors and see if I can’t find a tale to tell. Ah yes, here’s a fun one.

Kick off your shoes, put your feet up, grab a glass of wine and settle into your favorite easy chair.

Ready? Let’s begin.

The Goh Files – Punters crap-out twice

It was the year 2000 and somehow we’d survived the Y2K bug. Brad and Jen were still together, Brittney did it again (Oops!) and we all had Nokia 3110’s. They were good times!

“

Funds raised will be used to further Sanford’s position as one of Australia’s leading online and broking financial services companies.

Sanford Prospectus (Lodged July 2000)

On the investing front, I was with a mob called Sanford Securities, the brainchild of Steven Goh who had somehow worked out how to hook a bunch of Microsoft Windows servers up to the stock market.

In doing so, he created Australia’s first online stockbroker. A profitable endeavor – for some.

Sanford decided to raise 9 million in an IPO later that year, flogging 6 million shares for a buck and a half each. Sanford Ltd would own 100% of Sanford Securities, the brokerage outfit.

I took a decent lick, maybe stumping up around 10K. Tried to find the contract note, but failed. Sorry folks (*who still has email dating back to the year 2000? I do LOL*)

For me, it was a monster position, given I was working an IT graveyard shift at the time which wasn’t paying top dollar.

It felt like a pretty safe bet (how wrong I was – in fact, you’re more likely to lose money on something which feels like a ‘sure thing’).

The shares debuted at a premium, but I didn’t take the stag profit. Should have. As it turned out, after paying a dollar fifty for shares, retail had one chance to profit – cashing ’em in on the first day. Failing that, shareholders who took up the IPO (your scribe included), were Hans Gruber-ed to varying degrees as the shares would never see the offer price again in their short lifetime.

Within a matter of months they had lost ⅔ of their value.

Within a year of listing, they were found languishing around the $0.20 level.

Within three years of the IPO, the company would be de-listed after being compulsorily acquired by IWL Limited. Remaining shareholders received $0.19 for their SFD securities.

I was not one of them, having bailed somewhere around the one dollar mark IIRC. I held, for a while, until my loss grew so great that I had no choice other than to abandon ship.

It turned out to be the right move.

Remember the line from the prospectus: “Funds raised will be used to further Sanford’s position as one of Australia’s leading online and broking financial services companies.”

FLW.

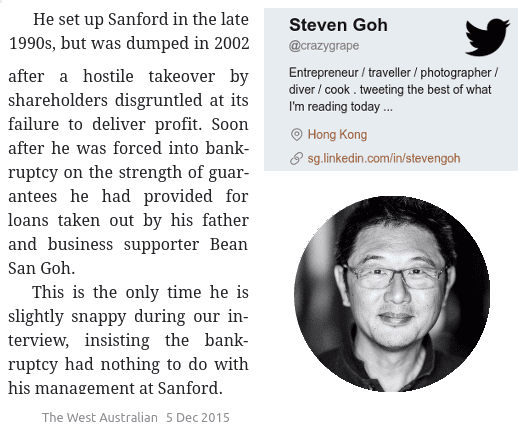

And Goh? What became of him, you ask?

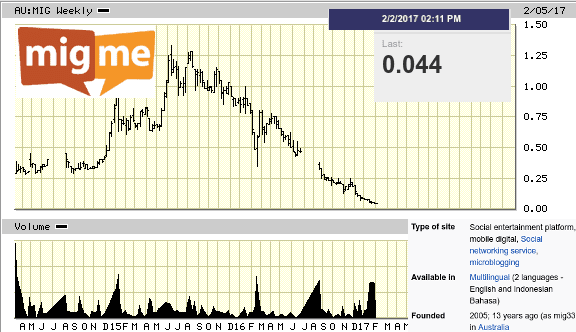

He went on to start Migme (MIG.ASX). Anyone who can explain exactly what the company did wins a prize.

MIG appeared on the ASX in 2014 via an RTO of Latin Gold Ltd and the shares were last seen fetching a measly 4.4 cents each before the reaper was summoned. (It seems a stay of execution was granted – why the bloody thing hasn’t been de-listed is anyone’s guess. ASX?)

MIG just clocked up a year of suspension on the ASX and the chat on Hotcopper is something big is about to be announced. Assuming, that is, the messages from user crazygrape123 are indeed emanating from Goh himself (it bears a resemblance to his Twitter handle).

Still holding that dog? Don’t hold your breath.

In any case, if Gohs’ got time for cooking, diving and photography while holed up in Honkers than it’s a pretty safe bet he’s got the FU money sorted.

He was a bold man that first ate an oyster.

Whenever I’m in Sydney I love nothing more than catching the ferry to Watsons Bay and spending a leisurely few hours at Doyles (tell me it’s still there, please!)

Whenever I’m in Sydney I love nothing more than catching the ferry to Watsons Bay and spending a leisurely few hours at Doyles (tell me it’s still there, please!)

A couple of bottles of NZ Sauvignon Blanc (don’t judge me), some cooked king prawns and the whiting fillets thanks.

No oysters? Nah, not my thing, I must confess. In fact, I only worked up the courage to try one a few years back while passing through Singapore. Meh.

The old man loved ’em though, couldn’t get enough.

As a mark of solidarity with retail AS1 shareholders who may be suffering, I’ve updated my gravatar to show the fateful moment the mollusk nears my mouth.

I hope for their sake the price action changes course soon.

‘

Your ASX commentator,

–// Craig Amos

FULL DISCLOSURE: Angel Seafood Holdings Ltd are not an Equity Guru marketing client. The author held securities in SFD.ASX but never any in either MIG.ASX nor AS1.ASX

Footnotes:

1. A shout out to Investsmart who still have the SFD chart on-line. The prospect of building a Windows box just to restore my Metastock charting app wasn’t an exciting one. (but I would have done it!)