On February 9, 2018, Boreal Metals (BMX.V) announced a definitive agreement to purchase the Guldgruvan cobalt project in Sweden, from EMX Royalty (EMX.NYSE).

The Guldgruvan deal is the 2nd cobalt project Boreal has picked up in the last month.

On January 16, 2018 BMX announced the execution of a definitive agreement with EMX Royalty for the acquisition of the Modum Project, surrounding southern Norway’s historic Skuterud Mine which was Europe’s largest and highest grade producer of cobalt though the nineteenth century.

According to the press release, the 2nd acquired property “contains the historic Los Cobalt Mine, one of the better known historic cobalt producers in the region.”

“Cobalt, copper, and nickel were mined on the property in the 1600’s to 1750’s. Guldgruvan, has undergone only limited modern exploration.”

When we first wrote about Boreal, the company was focused on “the discovery of Zinc, Copper, Silver and Gold deposits in four project areas spanning Sweden and Norway.”

Since then, it’s pivoted hard into cobalt, without giving up its precious metals assets.

We think that’s a smart play.

“Guldgruvan complements the previously announced acquisition of Modum, which combined further builds the foundation for Boreal’s strong base metal and cobalt exploration in Scandinavia,” stated Karl Antonius, President and CEO.

Here are the deal points:

- After approval, EMX will transfer its Guldgruvan exploration licenses to Boreal.

- Boreal will issue stock, bringing EMX’s share in Boreal to 5.9%

- EMX will have a 3% Net Smelter Royalty on the Project

- EMX will receive annual payments of USD $20,000, beginning on the second anniversary of the closing, with each payment increasing by USD $5,000 per year until reaching USD$60,000 per year.

Is Scandinavia a good place to mine cobalt?

In a word: yes.

Cobalt is a critical ingredient in lithium-ion batteries.

An investment in cobalt is an investment in the future of Electric Vehicles.

Currently, 65% of global cobalt supply currently comes from the DRC.

But there are child labour problems in the DRC, causing companies like Toyota (TM.NYSE), and Ford (F.NYSE) – to look for alternative supplies of cobalt.

This fall, Volkswagen (VLKAY:OTCPK) tried to secure $59 billion cobalt contract for 150 gigawatt-hours of lithium-ion battery storage – about 30,000 tonnes per year (30% of total 2017 global supply).

VW was unable to find a supplier that could guarantee 5 years of cobalt at a fixed price.

“Norway is the undisputed world leader on electric cars, run almost exclusively off the nation’s copious hydropower resource.”

Nearly a third of all new cars sold in Norway are plug-in models – either fully electric or a hybrid – and experts expect that share to rise to as much as 40% next year.

In the UK electric vehicles have only 2% market penetration, but registrations are growing at a fast pace, up 38% this year so far.

As an example of Scandinavia’s battery-forward policy, Northvolt AB will be building Europe’s biggest battery factory in Sweden.

Northvolt CEO Peter Carlsson believes that the Swedish plant will rival the scale of Tesla’s Nevada desert Gigafactory. Northvolt has stated it intends to purchase cobalt from local sources.

The 2,383 Hectare Guldgruvan cobalt project is accessible year-round, with good infrastructure including paved roads, power, and skilled labour in nearby municipalities.

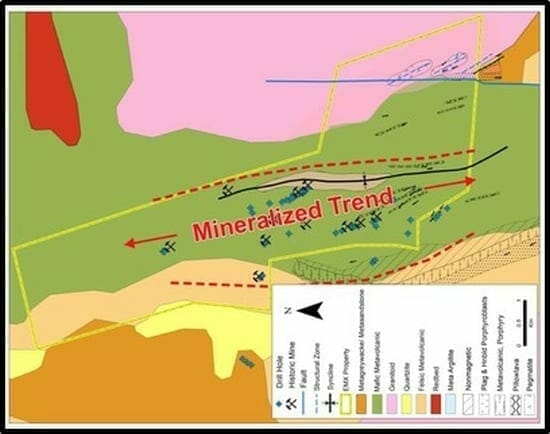

The cobalt-bearing occurrences define a series of parallel north-northwest trending zones of mineralization that extend for at least six kilometers across the claim package.

Boreal Metals’ focus on cobalt in Scandinavia is a good long-term play.

It is also a good short-term stock price catalyst.

BMX is up about 20% to .26 in mid-day trading.

Full Disclosure: Boreal Metals is an Equity Guru marketing client, we also own stock.

Hi Lukas, any update on BKR ?