Welcome to our twice monthly look at short activity in the Canadian market. We get our short data from the fine, fine folks at shortdata.ca. This update is about the aftermath of the weed short at the beginning of the month, the shift to crypto and the big bet on bad news.

Weedpocalypse Thunderdome.

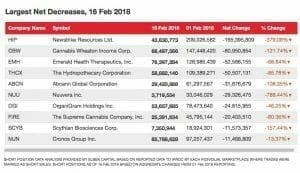

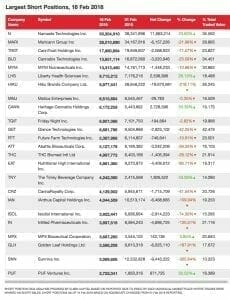

Last time I pointed out how the big winners in the meltdown were the short sellers in the weed sphere. This time the story continues to illustrate the ongoing carnage. Here’s the big boards.

All three exchanges, TSX, TSXV and the CME paint a pretty clear picture from the short activity showing continuing sell offs. All of these companies are seeing continued sell offs, and almost all of them are weed companies and a smattering of mining stocks.

(Like St-Georges Mining. What the hell is up with that thing?)

Mining is always volatile, and is usually in these charts. The weed sector got so badly clobbered last month, the crowded out the cannabis players.

This weeks short data makes it clear the market is returning to normality and the gasbag in weed has deflated somewhat. Good, who thought multi-billion dollar valuations had any basis in reality?

Anyone who was shorting weed and timed it right is now making bank. The big question now is where did that money go? The answer as always can be found in the charts.

The Spec Play – Still life in the ol’ weed girl, and cryptoshorting starts to be a thing again.

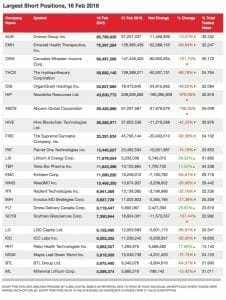

One of the places the short players seem to be going to is Crypto.

The short data for largest position on the TSXV shows a drop in the weed companies (but they are still overrepresented – a sign there’s more deflation to come). Coming up strong are crypto companies like our clients HIVE.

The picture on the CSE is still all about Cannabis.

Here’s what I think – we’re seeing the small bounceback before another big drop. If it’s obvious to me, it’s obvious to the guys who stake their lives on this stuff. So seeing how well everyone is still doing shorting weed, they’re hoovering up fatted calves in preparation for the next axe swing.

The players with a tast for diversification are betting on Crypto reinflating. I’d guess that next month we’ll see more Crypto companies start to appear on the board here. As for HIVE. we believe in their tech and their management, so decide for yourself to pile on the short train, or hold and wait for a squeeze to cash in.

TSX – The Grey Lady is the safe date.

What’s a hot short play on the TSX big board? Welp, the story is totally different. As I noted last time, there’s a lot of money flowing into the classic old-money stocks. This is the short-seller version of hoarding gold.

The idea is that this ball of Crypto/Weed/Trump/RealEstate craziness will blow up real soon. If it does, even these massive companies will take a huge hit. If they don’t they will still just sit there like massive beasts, their stock price nudging up, not wild volatile swings like sexier stuff such as crypto or weed.

So if they bet wrong, they won’t lose the farm and whatever the result, they can wait until they see something they want to pounce on.

What’s next

Short players are always betting things will go badly. It’s a pessimist’s wet dream. The short data says to me there are still weed plays with some juice in ‘em and time to start sniffing around Crypto.

It also says to me the big players are bracing for a BIG shock to the markets and are positioning themselves to make a lot of money from the misery.

Food for thought.

OK, so who is your next potential 10bagger ? I have actually some free cash

I’m not going to give any specific advice – I try to point out where the big sharks are circling, you have to decide which one to remora onto. It looks like a lot of money is still betting on weed having another meltdown – look for companies with high valuations based on ‘potential’. Carpe Diem as always.