The CEO of Ceylon Graphite (CYL.V), Bharat Parashar, recently made two astonishing statements:

- Ceylon Graphite will never have a 43-101 resource estimate.

- Ceylon Graphite could build 120 mines.

For a typical mineral extraction company, this is like saying, “I don’t have a driver’s licence – I’m not planning on getting one – but I’ll probably win the Indy 500 a dozen times.”

Ceylon Graphite has built a different kind of mousetrap.

To understand Parashar’s methodology – you need to know a little about the history and the geology of Sri Lanka.

A hundred years ago there were more than 200 mines in Sri Lanka and the country exported 33,000 metric tons of graphite – meeting 40% of the world’s demand.

How did they do it?

The Sri Lankan miners dug in the mud.

When they hit rock – they stopped.

This technique left some valuable minerals in the ground.

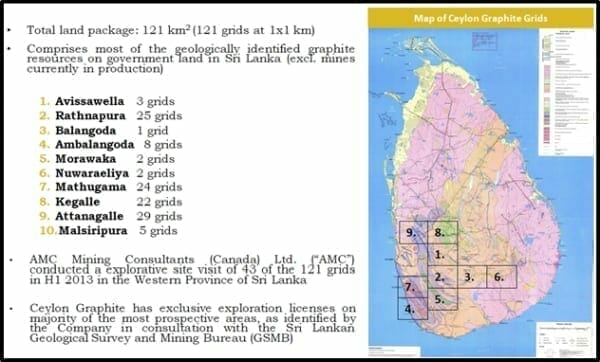

In November, 2017 Chris Parry stated that Ceylon has “the rights to most of Sri Lanka’s known government-held graphite resources, excluding mines already in production”

“They own a pair of drilling rigs, so they can drill all day, every day, at minimal outlay. And they have exploration licenses on 49 of the most productive areas in that package. To dig any graphite out will be extremely cheap when compared to North American sources, and the government would love as much activity going on there as possible.”

Ceylon controls hundreds of graphite mud shafts, which it is drilling to discover how far the graphite veins continue into the rock.

We’ve seen mines with a capex of $650 million described as “cheap”.

Bharat Parashar figures he can go into production for about $1 million per mine.

Obviously, these small mines aren’t going to be kicking out 80,000 tonnes of ore a day.

It’s a volume game: lots of mines, lots of profit.

Parashar estimates his cash costs at $200/tonne; large flake graphite sells between $1,250 and $5,000 per tonne.

The key point for investors is that Ceylon’s graphite seems to be a freakishly high grade, close to the surface, and already permitted for production.

Currently, Sri Lanka has just three outdated graphite mines, producing high-grade graphite using old technology.

On February 06, 2018 Ceylon Graphite announced “significant advancements of its mining operations at its K1 site.”

“The upgraded and refurbished shaft has now reached a depth of over 130 ft and will continue to the current bottom of the shaft.”

De-watering of the main shaft has been completed.

At K1, there are now two tunnels on either side of the main shaft, which have been cut through hard rock.

Each tunnel connects to a winze (a shaft that starts underground and goes further underground till it terminates).

These winzes can be used to transport mine workers or as ventilation passages or to run pipes and electric lines.

Recent drilling has intersected a graphite vein in the bedrock and has also hit a tunnel or cave at a depth of over 300ft.

Ceylon Graphite management will drill a few more holes before making a decision to green-light production.

“With work now underway for exploration and mining at multiple sites we are confident in our ability to become a near-term graphite producer of some of the world’s purest naturally occurring graphite”.

In addition to achievements at K1 site, CYL also has completed preparatory geological work at Katuwana (“K2”) in preparation for the refurbishment of the existing grid shafts and drilling.

Ceylon Graphite has made a decision to begin mining at its Palliyadda after drilling hole revealing graphite veins of more than 40 centimeters.

Subsurface graphite testing has indicated carbon content(Cg) of over 98% from at Palliyadda. These grids, one in Katuwana and the other in Malsiripura both have vein graphite visible on the surface.

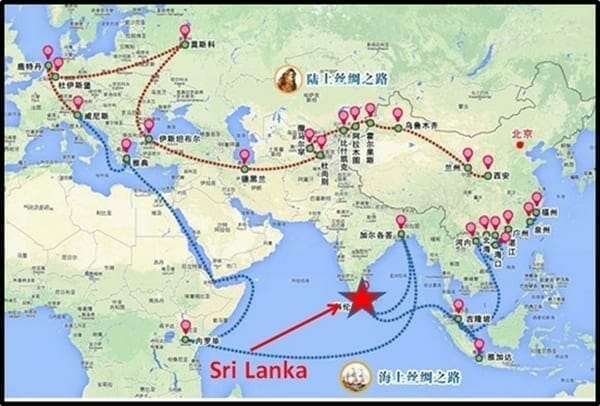

“Sri Lanka has recently signed a $1.1 billion deal with China to develop the southern deep-sea port of Hambantota – playing a key role in China’s “One Belt, One Road” initiative, which links China to Europe and Africa.”

Sri Lankan Graphite has a purity similar to ultra-expensive Synthetic Graphite ($20,000/tonne)

Building a little galaxy of high-grade mines is a harder concept to sell to the street – than one sexy mega-mine.

But this low-capex quick-to-production project is worth looking it.

As we mentioned in a previous article, the President and CEO Bharat Parashar is a heavyweight: 36 years of deal-making in South Asia – raising over $8 billion through debt and equity transactions.

A recent report by Allied Market Research predicts that the global graphite market will increase 44% in the next 7 years from $13 billion to $18.8 billion.

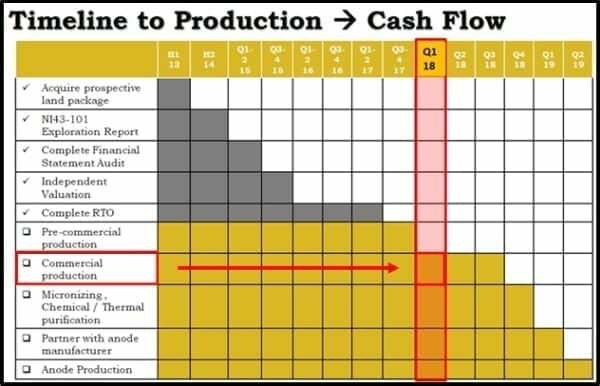

Typically, this is what a junior resource company’s path to production looks like: trenching, airborne survey, drill, resource calculation, bankable feasibility study, permits, merchant banking, construction.

Ceylon Graphite has built a simpler pathway to production.

CYL is trading at .17 with a market cap of $9.3 million.

Full Disclosure: CYL is an Equity Guru marketing client, and we own stock.