So a rough day today for Crypto and Cannabis investors. While cynics and naysayers call everything under the sun a Ponzi scheme, this month an actual crypto based Ponzi scheme blew up in everyone’s faces. Pity the poor Bitconnect investor, they died to teach us all a lesson.

I’ve said many times, these markets require cojones of steel to operate in. Without a healthy dose of sangfroid the ups and downs can make you prematurely grey. Even at that, be warned, my sweet summer child, there are worse beasties out there than volatile stocks.

The overabdunance of cash, lack of regulation and hyped investors has brought out the sharks. Whether it’s land in Florida, Irish Sweepstakes tickets, Junk Bonds, housing derivatives – any kind of stampede in the markets brings out the scammers.

Bitconnect’s spectacular, incandescent meltdown this month is a good lesson on the dangers of letting greed and hype get the better of common sense.

Thanks to the grinder who’s been covering this for a while and has a great archive of this stuff.

Enter Bitconnect

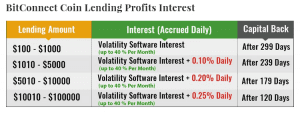

Bitconnect is (was) a site that offered investors guaranteed returns of up to 480% in the crypto space. They had a magical trading bot that would make trades with HAL-9000 level awesomeness with A.I. and Neural stuff, and unicorn blood.

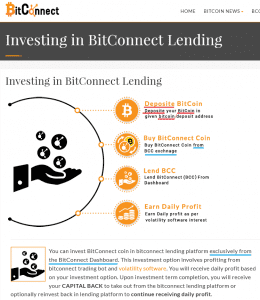

Here’s what they were promising:

Does all this sound too good to be true? Well it is!

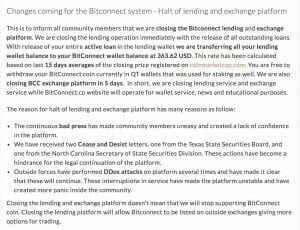

On January 16, 2018, Bitconnect announced it was shutting down due to ongoing bad press. You know the ones noting how the whole thing didn’t add up. Or the ones pointing out the classic Ponzi-scheme structure of the business.

With Rose Coloured Glasses, Red Flags just look like flags.

Oh maybe this time it’s true. Blockchain is crazy and magical and if I close my eyes and hope, I’ll get rich.

-Composite Bitconnect Investor

Here’s how it worked. You are putting your money and faith in their magic trading robot:

- You sign up and pay into the scheme with BTC. They don’t take their own BCC currency in payment. (DANGER WILL ROBINSON)

- Your funds buy Bitconnect Coin (BCC). Everyone’s purchases drive up the value of the coin, especially for the owners, who have control of the whole thing. You are now backing a virtual loan in BCC. Just like the bank!

- They assure you will get back your value in cash in 4-10 months or so, plus they’ll pay you in daily interest. when these great loans mature or whatever, you will receive cash based on the value of the BCC you lent out. (hope the value of BCC keeps rising like crazy! Spoiler: It doesn’t)

- You’ve just pumped their proprietary cryptocurrency and given them your bitcoin, in exchange for a drip drip drip of interest payments and the promise of future riches

- The next steps are only if you are one of the owners of Bitconnect:

Watch as BCC, which increases in price by 7000%+ due to the artificial activity of all the users buying it and giving it back to them, but almost never selling any.- Hoard all the Bitcoin but giggle because at this point it’s worth a lot less than the total amount of BCC you control.

- Sell off your stake, Disappear with all of the money.

If you are not one of the owners, watch your funds go ‘poof’

Red flag 1:

They promise the moon, lock you into an ecosystem and control your money. You pay them in bitcoin, not their actual currency. They do the magic stuff and you get your profits back — in bitcoin and dollars. Meanwhile you’ve been propping up their proprietary currency and platform. At the end of the day, they have your BTC and you have a promise they will cash in the BCC and send you your profits once your loan terms are up.

Red flag 2:

A consistent pattern of typos, errors and shoddy design in their investor materials. I’ve chided our clients and other players about this before. If you are serious about courting investors, the details matter. If you let misspellings, typos etc into your public facing materials, how much attention to detail are you missing in your business.

The other reason you see this sort of hamfisted work is when the people behind it can’t be arsed to care, because A: They use cut-rate talent to keep thing going long enough to make off with the cash or B: it’s a marketing ploy to look homey. (not a very good strategy for an investment prospect.

Red Flag 3:

They spent a ton on promotional materials and constantly flogged referral networks. Any investment with the same outreach practices as Amway or Avon is not likely to be operating on the up and up. (I suppose you could hold Crypto parties, serve ‘blockchain’ rice squares)

Check out this youtube promo:

https://www.youtube.com/watch?v=hXRhIXp4idM

That’s a lot of dough in production values. Looks attractive doesn’t it?

Any of this stuff would make me run screaming into the hills, but a lot of people fell for it, because greed.

Oh and did I mention no one knows who really runs the damned thing?

Crashy crashy.

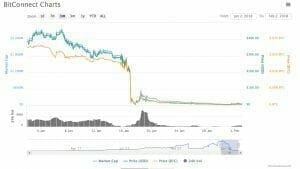

So what happened here? As I said, the price started to drop, the founders cleared out, shut down and investors watched their coins drop from $300 to $8 in one day. FUN!

It all happened for the same reason all schemes like this fail, from Chuck Ponzi’s original, all the way to Bernie Madoff.

Once the stream of suckers dries up, and the bills can’t be covered, time to close the doors and flee to sell monorails to North Haverbrook.

The market took it’s usual dip, BCC took a drubbing the stream of suck- um, investors dried up, the founders cashed out and shut down. No more magic trading-robot, no more BCC.

With a total supply of 9.9b coins these are pretty much useless. A 2.4Billion market cap is now worth $80million. A lot of wealth just went poof.

People still have the actual coins in their wallet. but I can go out and buy weimar republic marks, doesn’t mean i can spend them in the Berlin airport.

The company’s statement is below.

Jim is dumb. don’t be like Jim.

With the site in flames, investors losing out. the company still intends to go forward with its Bitconnect X ICO.

I’d call them crazy, who would even look at that – but BCC is up today. There’s a sucker born every minute.

This story is about ignoring your gut. Just because everyone else is making money doesn’t change the laws of common sense. If it seems too good to be true it really probably is.

Caveat Emptor should be your watchword, especially in the wild west blockchain and crypto market.