Carillion (CLLN.L) former CEO, Richard Howson is the subject of “Friday’s Big Fail”.

Carillion is a UK construction and management company that dates back to the 1800s.

Notable projects include the Royal Opera House, Channel Tunnel, the Tate Modern, Oman’s parliament in the Middle East, The Intercontinental Hotel in Dubai and Covent Garden (1830).

This company is older than Larry King with better genes than Alexander Ovechkin.

Yet somehow Carillion was destroyed in 5 short years under the stewardship of a young-ish Englishman (now 49) named Richard Howson.

Howson, who left in disgrace as CLLN shares tanked, received a $1 million bonus for wrecking the venerable construction empire.

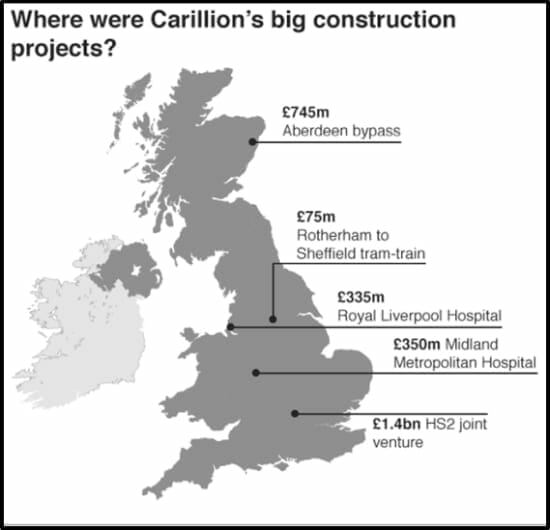

The collapse of Carillion has thrown 450 construction projects into chaos.

Of course, famous old companies, like Kodak, Radio Shack, Tower Records do go bankrupt – but they are usually victims of disruptive technology or aggressive big-cap competitors.

Carillion had a more mundane problem:

Too much debt ($2.5 billion)

Not enough revenue.

Despite a pathetic series of leadership blunders, Howson was paid $2 million in 2016 – including a $1 million performance bonus. He is still being paid $90,000 a month.

Howson is currently hiding in his sprawling UK mansion.

“Carillion will need to explain why they gave Mr. Howson a bonus,” stated the UK Prime Minister’s Office, “We do not expect to see people benefit from this failure.”

Zafar Khan, the former CFO, is also still receiving his $700,000 salary.

Meanwhile, Carillion has entered into liquidation, putting thousands of jobs in Britain and abroad at risk.

Howson – who was presumably once a beautiful naked baby loved by his mother – did not understand budgets.

There were major cost overruns on government construction projects like the $1.2 billion Aberdeen bypass, the $570 million Royal Liverpool University Hospital and the $595 million Birmingham Metropolitan Hospital.

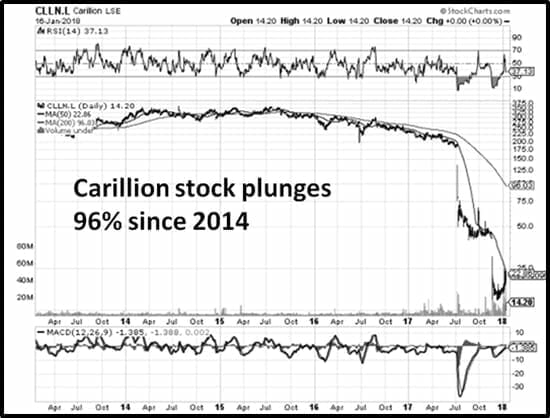

Hedge funds caught onto the financial mismanagement earlier than retail investors and have been off-loading shares for the last two years.

Carillion pensioners have been warned to expect a significant reduction in their retirement incomes when the bankruptcy court forces Carillion’s pension obligations into the Pension Protection Fund.

So far, the UK Government has refused to help the floundering construction company, beyond paying the cost of receivership, and re-tendering contracts.

“Carillion went from crisis to crisis,” admitted UK MP Jon Trickett, “The government must answer questions about why it continued to award the Carillion contracts while the company was lining the pockets of the big bosses who have now endangered our hospitals, schools and transport infrastructure.”

According the Financial Post, “The demise of the 200-year-old business poses a headache for Theresa May’s government”

Employing 43,000 people around the world, including 20,000 in Britain, Carillion has been fighting for survival since July when it revealed it was losing cash on several projects and had written down the value of its contract book by 845 million pounds.

Carillion employs over 6,000 people in Canada where it has an annual revenue of approximately $1 billion. Among other service contracts it maintains 40,000 kilometres of highways in Ontario and Alberta.

With banks refusing to accept the group’s latest attempt to restructure, May’s senior ministers met around the clock in recent days, under pressure from the opposition Labour Party and unions not to use taxpayer money to prop up the failing company.

Richard Howson has yet to make any public statement or apology about his disastrous tenure at the helm of Carillion.

The silence is so deafening, you’d almost think he’d slunk off, plunged a knife into his belly, and pulled out his own entrails in the style of a disgraced Japanese CEO.

But no.

Two weeks after being ousted from the Carillion – a photo emerged on social media of Howson grinning like the Cheshire Cat at the Hôtel le Kandahar in Switzerland where he owns a six-bedroom chalet with an outdoor hot tub.

The Business Dictionary states that Leadership requires: “establishing a clear vision, sharing that vision with others, providing the information, knowledge and methods to realize the vision, and coordinating and balancing the conflicting interests of all members and stakeholders.”

Furthermore: A leader steps up in times of crisis, and is able to think and act creatively in difficult situations.

In 2018, incompetent leaders are part of the zeitgeist.

The U.S. has a President who The Yale Department of Psychiatry has diagnosed as, “a liar, a narcissist, paranoid, delusional and prone to grandiose thinking.”

Back in the business world, “the most dramatic difference is between the compensation of CEOs and the compensation of typical workers is that from 1978 to 2015 CEO compensation grew 941% while the compensation of a typical worker grew just 10 %.”

According to a study in the Harvard Business Review:

The truth for the 36 companies we studied, seems to be that higher-ambition CEOs assume personal responsibility when things are bad and they give collective credit when things are good.

Howson did neither.

That’s why he’s the subject of Friday’s Big Fail.