This summer, Zinc One (Z.V) closed a deal on two Peruvian zinc assets for a final cash payment of US $1,150,000. Zinc One now controls the Bongará Zinc-Oxide Project and the Charlotte Bongará Zinc-Oxide Project which lie at the end of a 6 km trend of known zinc.

There is an impending shortage of zinc because two of the world’s largest zinc mines have run out of ore (Australia’s Century mine, and the Lisheen mine in Ireland), and China shuttered 26 zinc mines in Hunan province due to serious environmental breaches.

On Monday, the Zinc One’s stock price went boom.

When we see a surge like this, we look first to the news flow to identify the cause.

But Zinc One has not released news this week.

So we called up Zinc One and got some insight

Here are five explanations for Zinc One’s recent share price appreciation:

- The CEO, Jim Walchuck has been on a road show

The CEO Mr Walchuck has recently been giving presentations to institutional investors in Toronto, New York and London.

Not all resource CEO’s are good communicators. Walchuck is. An experienced financier – he also has extensive boots-on-the-ground credentials.

The former Mining Manager for Barrick at the Bulyanhulu Gold Mine in Tanzania, Walchuck built a high-grade underground mine and achieved 2 million man-hours without a lost-time accident.

If Walchuck says he can build a profitable zinc mine, people listen.

- The Bongará Zinc Mine is a proven historical producer.

The Bongará Zinc Mine was mined profitably in 2007 and 2008 by open-pit methods. The mineralization is concentrated along a 2.5 kilometres axis. Zinc One believes that this zinc-oxide mineralization continues into an additional exploration area known as Campo Cielo.

About two kilometers northwest – at the Charlotte Bongará Project – a previous mining company had near- surface drill intercepts that included 29.5% Zn across 15.5 meters, 26.1% Zn across 12.5 meters, 29.7% Zn across 11.5 meters.

- Recent assay results hit a home run.

Recent Surface Channeling Returned Samples of up to 47.7% Zn over 8.1 metres -

Highest grades from sampling program include:

- 73% zinc over 8.1 metres from a dolomite,

- 65% zinc over 19.7 metres from a dolomite breccia, and

- 50% zinc over a 3.8-metre depth from a dolomite breccia.

High-grade zinc grades suggest the Bongarita and Mina Chica areas hold significant potential.

The drill program will delineate the known mineralization at the Bongará Zinc Mine Project.

That’s not good. It’s great.

By comparison, Teck’s (TECK.NYSE) Red Dog Mine in Alaska produces an average head grade of 15% zinc. In 2016 made a gross profit of about $500 million.

“The high-grade zinc grades from this current sampling program are very encouraging,” confirmed Walchuck. “The upcoming drill program should help to better define the footwall of mineralization as well as better determine the magnitude of mineralization left behind by past mining in the Mina Grande area.”

- Peru has got its mining mojo back.

Peru’s Energy and Mines Minister Gonzalo Tamayo stated that Peru is focused on, “the recovery of mining investment in 2018.”

“Peru has been listed as Latin America’s most attractive mining country by Canada-based Fraser Institute – and we want to stay in that position,” stated Tamayo.

According the Peruvian government, [document in Spanish] the $2 billion Michiquillay copper project will be auctioned off on December 20, 2017.

Michiquillay is capable of producing 80,000 tonnes of copper ore a day. It used to belong to Anglo American (AAL.LON), AAL bailed on the project in 2014 amidst a global downturn in copper prices and a campaign to cut capital costs.

- Zinc One is oversold

Despite this week’s stock price surge, Zinc One’s 1-year chart shows a steady, relentless sell-off. The reasons for that can not be found in the news flow.

There have been no significant setbacks, no permitting dramas, no anti-mining demonstrations, no disappointing assay results, no missed milestones.

It is true that Zinc One is waiting to get permission to drill its flagship asset. And waiting is something we – as a society – are not good at. Nobody wants to go to a dinner party and natter about their zinc investment when Bitcoin is doing triple-back flips every day.

- Potential near-term production restart

- Drill-confirmed, exploration potential along 6 km corridor.

- Low risk due to past production

- Mature mining jurisdiction.

- Exceptionally high grade, at surface

- Massive exploration potential.

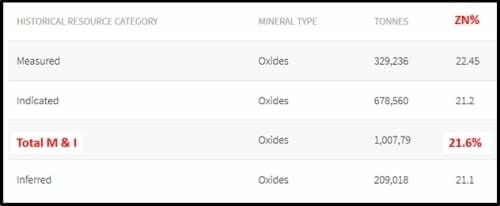

- Anticipated new resource estimate.

- Proven metallurgy

- Accomplished management team.

At a $20 million market cap, there are strong reasons to invest in Zinc One:

Zinc is an anti-corrosive added to iron or steel to prevent rusting. According to a report by the International Lead and Zinc Study Group (ILZSG) 2017 global demand for refined zinc rose 3.6% with mine output decreasing 1.2% – creating a 4.8% gap.

We believe Zinc One has the potential to fill some of that gap.

FULL DISCLOSURE: Zinc One is an Equity Guru marketing client. We also own stock.

Surprised you would get involved with something that Ameduri is pumping