If one thing has been certain on the markets in 2017, it’s that you couldn’t go wrong moving with the pack. Watch the merry go round.

Earlier in the year, nobody could get enough of cobalt stocks. If a cobalt explorer sneezed, flaming paper shot out their nose, and the nose of every other cobalt explorer within 400 miles. When that cooled (meaning, share prices stopped rocketing but began to level off), weed got hot.

Scratch that: Weed emitted the heat of a thousand exploding suns. In summer.

When weed cooled (not dipped, but just stopped flying for a bit), crypto/blockchain exploded. After raising money at $0.025 and $0.30, HIVE Blockchain (HIVE.V) went public at $0.90, and quickly shot to over $6 before common sense prevailed. The blockchain sector followed, and also cooled on HIVE’s example (right as the short sellers were looking to feast). But it didn’t die – it just cooled for a bit.

Now crypto is taking a short breather to catch up with all that new market cap (which is good), so folks with pockets full of stock profits are looking for the next double/triple/whateverple, and it’s cobalt and lithium that are looking delish once more.

Normally, chasing random sector heat is a bad trading policy. You see it a lot when weed giants like Aphria (APH.T) and Aurora (ACB.T) rocket upwards for a week, which drags up your mid-majors like Supreme Pharmaceuticals (FIRE.V) and Abcann Globals (ABCN.V), which then starts to bring up your lower rung (in terms of market cap) ancillary plays like Namaste (N.C) and True Leaf (MJ.C), before the tide ultimately sucks in the bottom rung guys with no real business yet or with troubled charts in the past, like Matica (MMJ.C) and Canabo (CMM.C) and Vodis (VP.C) and Golden Leaf (GLH.C).

To be clear, any weed CEO taking credit for his or her share price acceleration right now is a douche. The market is parking capital where the rest of the market will chase it, and that’s happening across the board. If your weed play hasn’t gone up, holy shnikies, what have they been doing with their time? Post news, do a deal, stock goes up – it’s that simple.

With that in mind, the trick becomes getting good at figuring out where money is starting to move before everyone else figures it out.

If you take HIVE or Aurora as examples, the signs were:

1. Big people putting big money into them

2. Consolidation of assets

3. End user demand

4. Companies without news getting big trading volume

The Cobalt, Ontario region is my canary in the cobalt mine. Check it.

The fun began when First Cobalt (FCC.V) and Cobaltech (CSK.V) decided life would be better as a couple, shortly before deciding maybe a threesome would be even better when Cobalt One unicorned its way into their bed.

A double in three weeks?

That helped put attention on other players around the same location. Enter Castle Silver (CSR.V), which has cobalt/silver digs aplenty.

Maybe you want more? How about Lico Energy Metals (LIC.V) for a two week double?

How about the small end of the market? Cobalt Power Group (CPO.V), which we’ve been telling you about since it was a $0.07 stock.

To be sure, none of these companies is putting out gamechanging news. That two-to-three week timeline where everything in Cobalt, Ontario has gone through a double is indicative of fat ‘area play’ money, which is indicative of folks with very large pockets betting that the Cobaltech/First Cobalt/Cobalt One merger won’t be the last.

And that sort of money is usually followed by early adopters who notice the chart spikes and start jumping in, which preempts the ‘market pack’, which right now is moving around literally hundreds of millions on dollars every day in weed but sneaking a peek over its shoulder now and then in case they have to jump sectors.

The crypto/blockchain space needed a rest. It had simply gone too far, too fast, and though there are still daily spikes on random companies in that space, most of that is the end of the feeding frenzy desperately looking for a sign that it’s about to resume. They’re the last guys out and they’re not aware they’re supposed to be turning out the lights.

The pack will, eventually, return to crypto in a big way. But with lazy journos pumping out ‘it’s too good to be true’ stories that focus almost solely on the biggest name in the space while tossing about ‘pump and dump’ terminology – same as they did with lithium (and Lithium-X), same as they did with weed – it’s probably for the best for blockchain to just chill for a moment.

Last week I was getting calls from blockchain execs asking why they weren’t getting daily doubles anymore. This week I’m getting calls from them asking why they’re not getting 10% jumps. Next week they’ll be asking why their stock prices are where they were this week.

As I said to one particularly eager to rise CEO yesterday, “Relax man, you want this. If you triple tomorrow, you’ll get a sell-off the following day and your chart will look terrible until the end of time. Step, plateau, step, plateau: That’s what investors want to see, not spike, drop, spike drop.”

Now let’s be clear: Equity.Guru has many client companies in the weed space and in the blockchain space (and the cobalt space), and ll of those clients would love for me to tell you that they, and only they, will lead the markets forward and you should buy their stock right now.

But you shouldn’t. You should watch.

Look for those market indicators and respond accordingly. If cobalt is in the early stages of its next bubble (and that would make sense – cobalt demand has never been higher and the only place to get it reliably is with a kid dangling on the end of a rope being lowered into a hole in The Congo), then taking a daily interest in those plays makes sense.

It also makes sense to check out lithium deals, as they go hand in hand with cobalt in making lithium ion battery cathodes.

E3 Metals (E3.V) just released a resource estimate showing a legit lode of lithium in old oil wells in Alberta, and the stock has boomed.

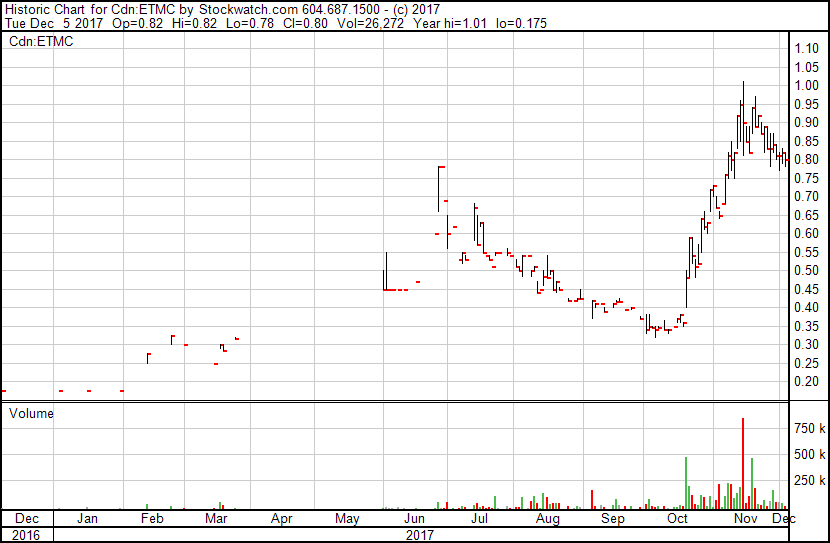

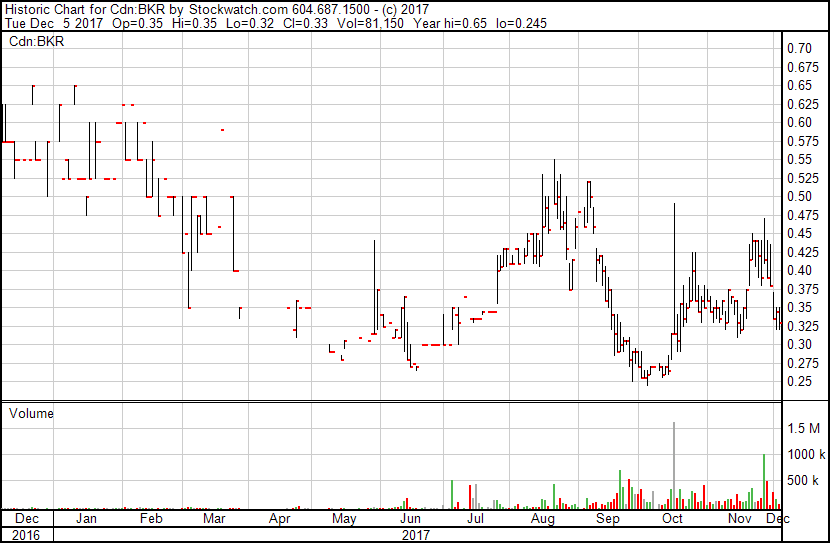

Here’s QMC Quantum Minerals (QMC.V), which we told you about at $0.07 or so, as they dig about looking for spodumene in Manitoba. (FULL DISCLOSURE: I took my profits at $1.25, but am headed back in with warrants)

Also worth watching: Graphite. While cathode demand is increasing, you also need anodes on a lithium ion battery which means you need graphite, which is another thing we source across the planet for some reason. We’ve been following three graphite companies for a while that are near term opportunities. One is Graphite One (GPH.V), which has had a long ‘resting period’ before coming out of slumber, like, today.

Another is Mason Graphite (LLG.C), which already has a fat lump of market cap as it nears production.

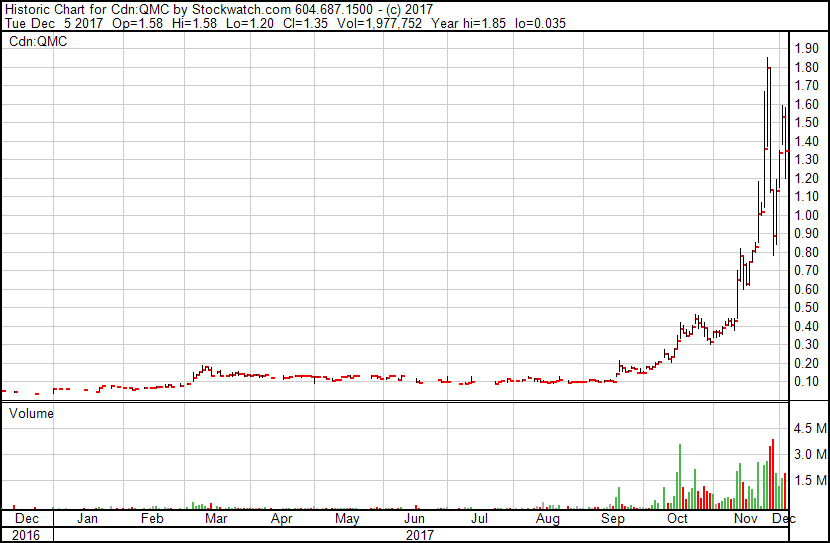

And third, we like Berkwood Resources (BKR.V), which the market hasn’t yet recognized (indeed, it had to go through a lot of paper churn a month back, despite good news, and has been trying to move up for a while now), but we think is due.

Think graphite is too far afield to ride off the cobalt rise?

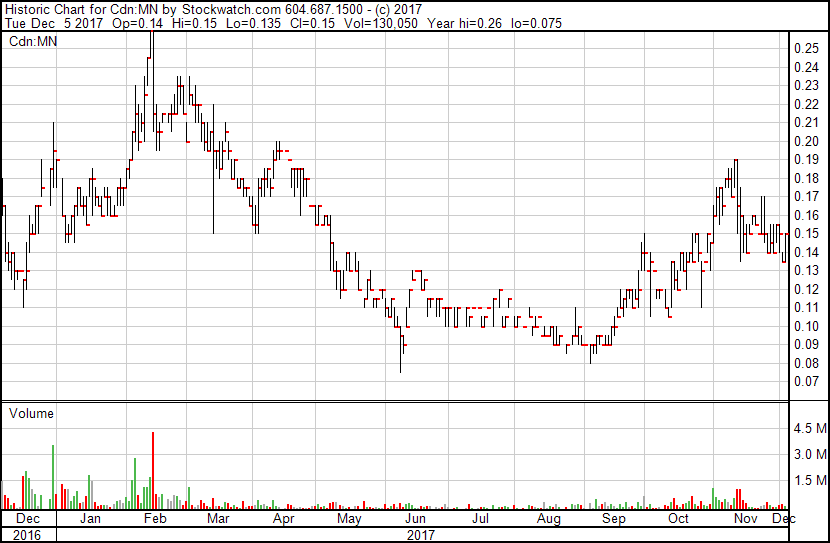

Here’s Manganese X (MN.C), having a bit of a renaissance, despite no news.

Another thing enjoying sunshine at last? Vanadium!

If we go even further tangentially, and look at side industries that will benefit greatly from a cobalt run, look no further than Nano One Materials (NNO.C), which has all sorts of tech and patents that extend lithium ion battery life, allow for formulations that can reduce cobalt requirements (and other metals), and have shown their tech to make stronger, longer lasting, faster charging batteries in their completed pilot plant.

We’ve talked up Nano One for nearly two years now and it’s always proven itself a winner.

Their latest news:

RECENT INNOVATION BY NANO ONE IMPROVES BATTERY LIFE

Nano One Materials Corp. has developed technology that stabilizes lithium metal oxides for use in advanced lithium-ion batteries and has filed a patent related to this stabilization technique.

This innovation alleviates degradation mechanisms that cause energy stored in lithium-ion batteries to fade with each charge cycle. The improvements are most dramatic at higher operating temperatures, such as those seen in electric vehicles and could significantly increase the durability and the number of times that a battery can be recharged over its lifetime.

Geez. That’s not small news. Neither is this:

Nano One Provides Update on the Piloting of Nickel Rich Cathode Materials

Dan Blondal, CEO of Nano One Materials, today announced that Nano One has successfully piloted nickel rich cathode materials for high density energy storage applications such as next generation lithium ion batteries for electric vehicles.

“These pilot tests were conducted at approximately 100 times normal lab scale,” explained Mr. Blondal.

If weed is going to crush it again early next year with recreational use around the corner in Canada, it makes sense to watch that sector hard.

And if blockchain is legitimately going to rewrite how the financial sector does business, and crypto currencies are going to continue rocketing, then you’d be a fool not to look for the sign that the second wave is coming.

But, remember those sector signs we talked about above, that show when things are about to get hot?

1. Big people putting big money into them (FCC/CSK/Cobalt One merger)

2. Consolidation of assets (CPO just grabbed more land, others are doing likewise)

3. End user demand (lithium ion batteries are not going away)

4. Companies without news getting big trading volume (every Cobalt, Ontario explorer right now)

With the above in mind, and with a lot of that weed/crypto money looming, looking for the next run, we think cobalt is just starting its big run.

— Chris Parry

FULL DISCLOSURE: First Cobalt, Cobaltech, Castle Silver, Cobalt Power Group, Berkwood Resources, Abcann Global, Nano One Materials, Manganese X, and Golden Leaf Holdings are Equity.Guru marketing clients. The author holds stock in many of these, as well as Hive Blockchain, Supreme Pharmaceuticals, and has warrants in QMC Quantum Minerals. Lico Energy Metals is a former Equity.Guru client and may be again in the future. Equity.Guru has been in discussions with E3 Energy Metals for a future arrangement.

As reported by newswire.ca ‘Castle Silver Resources Inc. (TSX.V: CSR, OTC: TAKRF, FRANKFURT: 4T9B) (the “Company” or “CSR”) is pleased to announce the name change to Canada Cobalt Works Inc. which will more accurately reflect the direction of the Company. The TSX Venture Exchange has confirmed that shares will commence trading effective, Friday, February 23, 2018 under the new ticker symbol “CCW”. The tickers for OTC: TAKRF and Frankfurt: 4T9B are the same and will not be changed at this time.’