According to Betches.com a website for “self-aware women,” weed smokers are prone to crippling indecision.

“Making decisions when high is a different fucking animal. There is just so much to take into account: What am I in the mood for? Which food will be the least unpleasant to vomit in an hour? We get that Sophie’s Choice was probably a tough decision…but seriously, they should have just had her take a few bong rips and force her to choose between Family Guy and South Park. Good fucking luck.”

Like a zoned-out surfer, the TSX is dithering about a very important issue.

Will it allow Canadian weed companies to operate in the US?

Leading Cannabis expert Andrea Hill – also a securities lawyer at SkyLaw – shone light on this issue about a month ago.

“Some have felt like the TSX’s published policy was not so clear,” wrote Hill, “Rather than requiring all listed issuers to comply with all laws, rules and regulations application to its business or undertaking, the way the TSX Venture Exchange’s (TSXV) Listing Agreement does, the TSX Company Manual requires issuers to conduct their business “with integrity and in the best interests of the issuer’s security holders.”

Hill points out the TSX language is muddy and leaves plenty of room for interpretation.

Of course, the TSX’s paralysis has created an opportunity for other security exchanges, like the CSE.

“With just over 300 listed issuers, the CSE is host to a staggering 49 companies involved in the cannabis industry, including about a dozen issuers with US cannabis activities.”

On November 24, 2017- three weeks after Hill’s illuminating article – A Canadian Press Release, stated that, after much consideration, the TSX is “leaving the door open to clearing trades of issuers with marijuana-related activities in the U.S., where pot remains illegal under federal law, for certain exchanges.”

TMX spokesman Shane Quinn said Friday that discussions with the CSA and exchanges on how to handle these trades were taking longer than initially hoped, and it was important to provide an update to the market.

“That’s something we wanted to clarify,” he said. “That the solution will be founded on each exchange’s role in applying the listing requirements, and that is in line with the Canadian Securities Administrators (CSA) announcement.”

The CSA is the umbrella organization of Canada’s provincial and territorial securities regulators. Its objective is to “improve, coordinate and harmonize regulation of the Canadian capital markets.”

Historically, the organisation gets jittery when there’s a whiff of pot in the air.

Back in 2014, the CSA issued this breathless warning:

“Investors should be aware that companies cannot legally conduct a medical marijuana business without a license from Health Canada, and that there is likely significant time and cost required to obtain such a license.”

Fair enough.

But we’re still waiting for the CSA consumer-advisory warning about the chances of precious metal explorer becoming a miner.

It would be instructive to know what back-room conversations take place between the CSA and their American counterparts.

“I’ve never felt that we should legalize marijuana,” stated U.S. Attorney General Jeff Sessions, “It doesn’t strike me that the country would be better if it’s being sold on every street corner.”

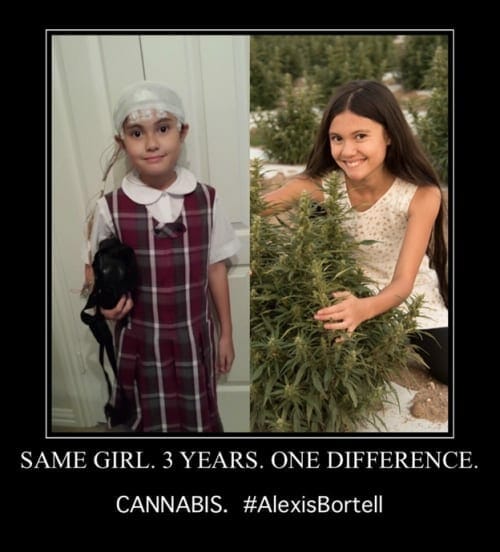

Sessions is getting pushback. Like from this 12-year-old epileptic girl who is suing the Attorney General for right to ingest THC to reduce her seizures.

Maybe the CSA, like David Bowie, is “Afraid of Americans”.

[“I’m afraid of Americans/I’m afraid of the world/I’m afraid I can’t help it”]

“The CSE has repeatedly expressed support for issuers with U.S. cannabis assets and as expected, TMX has confirmed it will base any rules regarding the clearing of these issuers on the rules of individual exchanges,” stated Marc Lustig, CannaRoyalty CEO.

CannaRoyalty (CRZ.C) Corp is a $134 million company building a diversified portfolio of cannabis assets including research, consumer brands, and intellectual property.

We follow a number of weed companies that trade on the CSE, including DOJA Cannabis: DOJA.C, Tinley Beverage Company: TNY.C, Quadron Cannatech: QCC.C, Lifestyle Delivery Systems: LDS.C, Golden Leaf Holdings: GLH.C and Invictus MD Strategies: IMH.C

We are very pleased with them as a group; a lot of our readers have made money investing in this frontier industry.

“We continue to believe the status quo that has existed for the last 12 months — where U.S. operators trade on the CSE, and most Canadian operators on the TSX or TSX Venture — will continue indefinitely,” stated Beacon Securities analyst Vahan Ajamian.

So while TSX pirouettes in a smoky room, companies are being built, and fortunes made, on alternative exchanges.

Full Disclosure: DOJA, Tinley, Quadron, Lifestyle Delivery Systems, Golden Leaf, and Invictus are Equity Guru clients. We also own stock in these companies.