Facebook (FB:NASDAQ) buys Oculus. Sony (SNE:NYSE) launches PSVR. Movie chains in Canada and the U.S. are opening VR simulators and arcades. There are a lot of folks putting their chips into the VR pot. I smell opportunity, so let’s look at what’s happening lately.

You can read my views on the state of VR in 2017, or take a look at a pretty good Nasdaq piece for a quick high-level overview of the major moves in this market.

All caught up? Great. Bottom line is: big players are pushing for a consumer breakthrough, but the demand and the tech might not be there yet. Then again I am dying waiting for Skyrim VR, which could be a game changer.

My personal opinion is to look for the manufacturers, rather than the pushers. Electronics and headset manufacturers or value-added peripheral producers. That’s where the real value is right now.

There’s a Canadian company with both qualities. D-BOX Technologies Inc. (DBO:T) You’ve likely seen their logo or experienced their rumbly seats if you sprung for the extra pricey movie tickets.

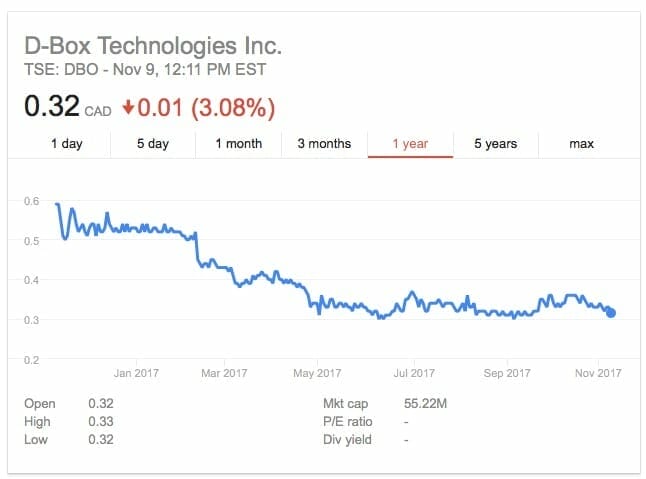

The stock is another plodder. There was a spike of interest a while back. All that’s left now is vast entities scooping up and reinvesting back and forth. Not super sexy.

All that aside, D-BOX could be in the best case, an undervalued stock with potential for big profits as the VR market matures. In the worst case, it has a valuable brand and portfolio of IP which could be worth some bucks for a buyout.

Either way it’s a good example of a company on the periphery of VR who can use their existing business to feed into the trend with partners, to OEMs, or consumers. D-BOX is interesting to me because it has multiple streams, consumer and B2B.

Presuming they don’t have too much on their plate. the technological synergy with their product lines could result in better peripherals for home VR use, and continuing to help bigger players push the VR concept in general.

To get into why, I’d like to zoom in on VR and the movies. As I was noodling around researching VR trends I stumbled on this press release from Cineplex (CGX:T) announcing a partnership with D-BOX to open a VR experience at a theatre in Ottawa.

The statements in the release are the usual fluff, enthusiastic without committing to anything for the future. One would presume if this goes well, they will expand to more areas around the country. If you read the NASDAQ article linked above, you will note IMAX and AMC are partnering on similar projects.

I started digging into D-BOX, just to see what they were up to. The paperwork and communications look fine. I didn’t smell anything out of the ordinary or papered over.

They recently added Robert Couple, a former theatre executive to the board in August. They also have a contract for the first motion control seats in South Africa, announced in October.

Their tech is based on a processor converting soundtracks into motion and vibration. Thanks to directional 5.1 sound, you get an accurate map of sensation. Their engineering has to stand up to horny teenagers in theatres around the world. They use off=the-shelf parts and the tech is easily adapted home use too.

D-BOX already sells top-end consumer grade add-ons for racing simulators. (I saw one rig selling for $36 retail). These are already well regarded, and are well positioned to extend into the expanding high-end VR peripheral market.

Although D-BOX is clearly committed to its movie theatre business internationally, a VR expansion is a natural move. If this VR experience works in Ottawa, it could be a money farm with the model being replicated in theatres across the world.

Of course, C-suite bungling could cock it all up. The could be spinning too many plates, or bet on the wrong partnership, or overextend.. etc.

Coming back to my first point, in terms of criteria for what to look for in a VR investment, D-BOX is the sort of company with the right mix of manufacturing and IP. Even if they crash and burn, their tech and brand are valuable in and of themselves and could be targets of a buyout.

If any insiders can explain the stock’s weak performance, edify me, sound off in the comments.

FULL DISCLOSURE: I own a PSVR rig, but no stock in any of the companies above, nor are they clients.