President Trump just tweeted a self congratulatory note that the Dow breached 23,000 for the first time. A week ago, he tweeted that US stock exchanges gained $5 trillion in value since Election Day.

Meanwhile gold has been pouting in the corner.

Is gold over?

We don’t think so – and here’s why: The U.S. national debt grew by about $480 billion since Trump took office. That’s another $3,000 debt burden for every US tax payer.

The country is insolvent. When the US financial system collapses – there will be an almighty stampede into gold.

Historically, the biggest returns have come from junior explorers or miners, building resources in mining-friendly jurisdictions with low labour costs.

Burkina Faso (pop. 17.5 million) is one of the poorest, yet safest countries in West Africa.

Endeavour Mining (EDV.T) – a $2.5 billion market cap gold miner – is building a mine in Burkina Faso, with projected annual production of 190,000 ounces at an All-In Sustaining Cost of US$709/oz.

Nexus Gold (NXS.V) is also operating in Burkina Faso, but has market cap of only $9.3 million.

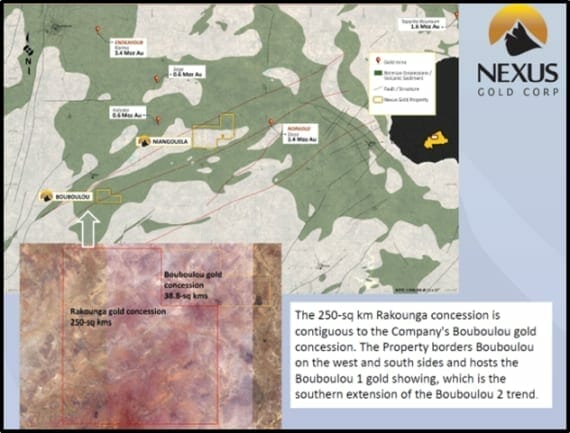

Nexus has two properties in Burkina Faso.

The Niangouela concession has been drilled. Highlights including 26.69 g/t gold over 4.85m (including 1m of 132 g/t gold), and 4.00 g/t gold over 6.2m (including 1m of 20 g/t gold).

The Bouboulou gold concession” is a 38-sq km advanced exploration target with multiple confirmed zones of gold mineralization. On July 11, 2017 Nexus announced that it is expanding its footprint 650% to include the Rakounga Gold Property which adjoins the Bouboulou gold concession.

On October 17, 2017, Nexus announced gold samples of 19.95 grams per tonne, and 14.90 grams per tonne from New Zones Identified at Rakounga Gold Concession.

Nexus’ property is dotted with “artisanal” (Mom & Pop) mines that look like this.

Since these hand-dug shafts are established micro-gold businesses, it makes sense to sniff around there first.

Four rock samples collected from the Porphyry artisanal mine areas returned elevated gold values of 19.95 grams per tonne gold, 2.57 grams per tonne gold, and 1.17 grams per tonne gold respectively.

About one kilometer south of the Porphyry area, eight samples were collected from another location. GGA-05 and GGA-07 samples returned gold values of 14.90 grams per tonne gold, and 2.57 grams per tonne gold, respectively.

Nexus senior geologist Warren Robb stated that: “These three orpaillages [artisanal mine areas] appear to be occurring along the same trend as the Rawema-Pelatanga trend on the neighbouring Bouboulou property to the Northeast.”

“With the early sampling work already producing nice grades…we’re certainly excited to find out more about Rakounga,” stated NXS President & CEO, Pete Berdusco, “It’s a large land package with significant artisanal activity on it, so it checks some important boxes for us…ultimately, we’re looking to establish a relationship between the mineralized zones on both properties.”

Meanwhile assay results from a diamond drilling program at Bouboulou and Niangouela were reported in an October 5, 2017 press release:

- nine of 10 holes from maiden drill program at Bouboulou intersected gold

- 41 g/t Au over 8.15m, including 23 g/t Au over 1m at Bouboulou

- 21 g/t Au over 3.05m, including 15.5 g/t Au over 1m at Bouboulou

- 04 g/t Au over 23m, including 4.1 g/t over 1m at Bouboulou

- 23 g/t Au over 9m, 1.1 g/t Au over 4m at Niangouela

The gold mineralization is open to depth and along strike at all the Bouboulou targets.

“This latest round of drilling really helped us get a better understanding of the project dynamics,” stated Robb about the Niangouela zones. “And I look forward to chasing and hopefully extending those 100-plus gram assays from earlier this year to depth.”

It’s hard to wrap your head around it, but the ultimate profitability of a gold project in Burkina Faso is, to some degree, dependent on policy coming out of Washington, DC.

“The country – we took it over and owed over 20 trillion…and yet, we picked up 5.2 trillion just in the stock market…maybe in a sense we’re reducing debt” – President Trump.

Should it concern us that Trump hasn’t grasped the difference between national debt and equity valuations?

The system is full of checks and balances. Maybe it doesn’t matter.

But every US tax payer now owes about $140,000.

Something’s gotta give.

If you’ve got the balls to make a contrarian bet, take a look at Nexus Gold. The company is doing everything right.

Full Disclosure: Nexus Gold is an Equity Guru marking client. We also own stock.