At a BBQ last summer we met a 67-year-old architect who had recently won a $1.4 million judgement against an ex-business partner. The case had taken 10 years to wind through the courts.

Some people – like Donald Trump – enjoy litigation as a heroic theatre of conflict. For most of us, it is unpleasant, stressful and emotionally draining.

That’s probably why there are relatively few lawsuits launched against – or by – stakeholders in the Canadian public markets.

Yes, Tim Hortons franchisees just launched a class action lawsuit against its parent company for jacking up the price of sprinkles.

But considering the TSX and TSX.V have a market capitalisation of $21 billion, and there are more lawyers sloshing around than cowboys in Texas – it is a remarkably non-litigious environment.

According to a 2016 report by Nera Economic Consulting:

“Although six Canadian securities class actions were resolved during 2016, only two of these were resolved by way of a settlement, the lowest number since 2011…Over the last six years (2011 through 2016), a total of 44 securities class actions have been filed in Canada involving Toronto Stock Exchange.”

The report claims that over the same six-year period, lawsuits have been brought against nine TSX Venture Exchange (TSX-V) companies. That’s about 1.2 cases per year. The annual litigation risk is 0.07%.

In other words, Canadian public companies and their shareholders don’t generally sue each other – unless one party is very pissed off.

Which brings us to Ximen Mining (XIM.V) that controls The Gold Drop Project and Brett Gold Project in British Columbia, Canada.

Ximen Mining is being sued in the Supreme Court of British Columbia by a group of “dissident shareholders” lead by Robert Slaughter.

The lawsuit claims that Ximen and five of its board members illegally prevented the injured parties from converting $800,000 debt into 15.8 million voting shares.

The details of the case are – to be frank – a little dry.

There was a meeting. According to Mr. Slaughter, the timing of the meeting was sneaky. Mr. Slaughter tried to hijack the meeting. He was unsuccessful.

Let’s be clear, we’re not fighting over Apple (APPL.NASDAQ) stock here.

Ximen is a 3.5 cent gold stock with a market cap of $3 million.

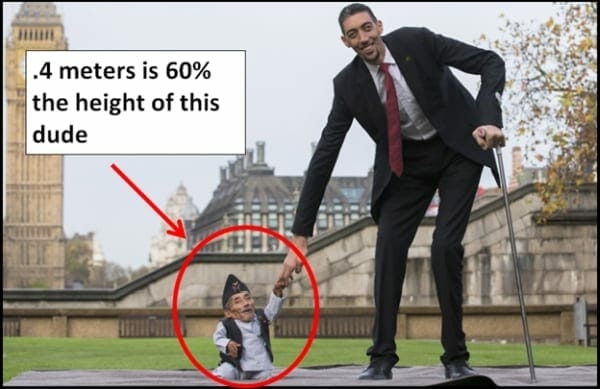

In 2016, Ximen diamond-drilled the Brett Gold Property and found 6.04 grams per tonne of gold over 0.40 metres.

From an investor’s point of view, that’s like being served two crumbs of angel cake.

Delicious – no doubt – but would it kill you to cough up a full slice?

Christopher R. Anderson is the President, CEO and Director of Ximen. According to his official bio Mr. Anderson has, “successfully navigated the waters of one of the toughest bear markets in mining history”.

That’s good.

To a point.

(So has our cat).

Mr. Anderson and Ximen have stated that they will “defend the allegations set out in the petition vigorously.”

In a March, 2017 press release Ximen addressed “inflammatory and misleading statements,” by Slaughter’s group.

“Slaughter is portraying himself as a single concerned shareholder. However, he is in fact the spokesperson for a group of shareholders representing over 20% of the outstanding Ximen shares who have been acting, and are continuing to act, jointly and in concert to gain control of Ximen’s board using ambush tactics.”

Meanwhile, Anderson other directors continue to accumulate Ximen stock.

The lawsuit by Slaughter’s group seeks a court order requiring Ximen to buy the remaining shares held by the group before firing the directors of Ximen.

He said, she said.

Here’s what we know.

In the stock markets, it is vitally important to communicate clearly.

The CEO of a micro-cap company is the bus driver, the foreman, the nurse, the cheerleader and the spokesperson.

There is anecdotal evidence that some of Ximen’s wounds are self-inflicted.

As we often do, we started our research by downloading the Corporate Presentation.

Correction – we tried to download it.

It turned out, we had to ask for it.

Is the PowerPoint only for accredited investors?

Creating a firewall between the message and the people who want to hear it – is a recipe for dissent.

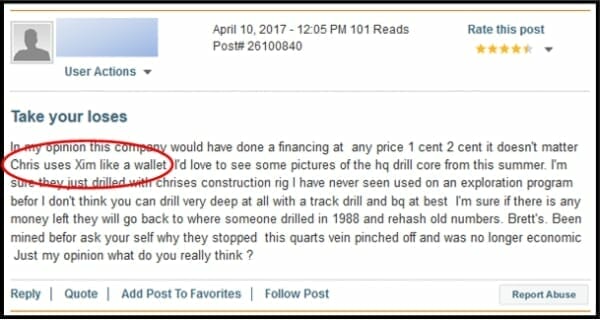

When the CEO stops talking to people, investors get anxious and grumpy which can lead them to make ungenerous – and possibly untrue – accusations on Stockhouse like, “Chris uses Xim like a wallet”.

When blunt accusations have no effect, the shareholders sometimes turn to sarcasm:

It’ll be interesting to see how this scrap between Slaughter and XIM plays out.

At the summer BBQ we suggested to the architect he must be feeling pretty good after cashing a cheque for $1.4 million.

He shook his head vehemently.

“It’s a bullshit victory,” he said, “I lost 10 years of my life. This lawsuit robbed me of my happiness and my health.”

He took a slug of his whiskey and looked up at the cloudless blue sky.

“Always settle,” he said, “Always settle”.

Full Disclosure: We don’t own shares of Ximen mining. We’re not suing anyone. And we’re not being sued.